TORONTO -- A week before the launch of a city budget that councillors are calling an “unprecedented fiscal challenge,” a new Toronto home sales report is offering a glimmer of hope of the land transfer tax that can be reaped from the boom.

The Toronto Regional Real Estate Board reported Wednesday that in spite of the pandemic, more than 95,000 homes were sold in 2020, setting a new record average selling price of $929,699.

Municipal officials are still crunching the numbers on how much land transfer tax the city will intake from those sales, but they will need every penny they can get. The 2021 budget shortfall is forecasted at $1.5-1.7 billion, due largely to massive revenue losses related to the pandemic.

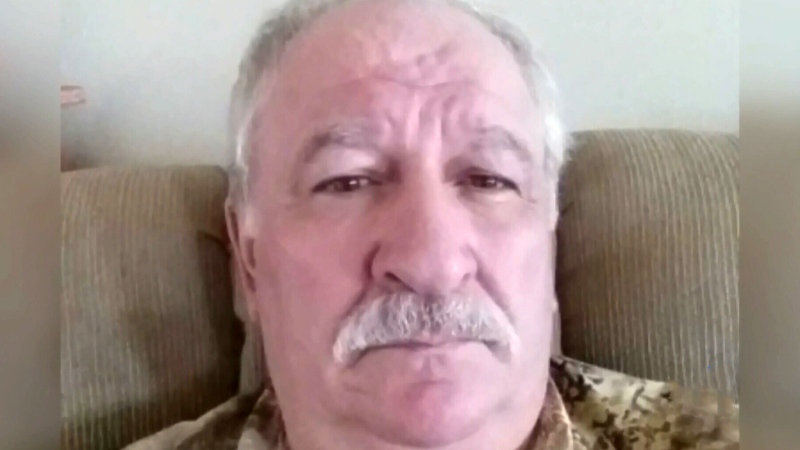

“We’re grateful for the real estate market doing well because it gives us the ability to help with our financial challenges,” Budget Chief Gary Crawford told CTV News Toronto Wednesday.

Crawford said that the forecast for municipal Land Transfer Tax was looking grim during the spring real estate slowdown, but it improved after the market began to rebound in July 2020.

The budget chief said the 2020 land transfer tax total will likely be less than was projected pre-pandemic, but that the shortfall won’t be quite as dire as first thought.

Crawford admitted that the land transfer tax won’t be axed any time soon, despite repeated calls from the Toronto Regional Real Estate Board, which has maintained for years that the tax is unfair and not sustainable.

“What if we had seen a protracted downturn in the housing market because things unfolded differently due to COVID-19?” asked Jason Mercer, Chief Market Analyst. “Then the city would be looking at a much greater budget hole than it is right now.”

The city launches its 2021 tax budget January 14.