The most expensive city for car insurance in Ontario revealed

It’s getting more expensive to drive a car in Ontario and rates in at least one city have jumped by nearly 40 per cent since 2021, a new report says.

Rising inflation, an ongoing shortage of vehicles and their parts, as well as an increase in car thefts are behind the hike, according Ratesdotca.

- Download our app to get local alerts on your device

- Get the latest local updates right to your inbox

Those factors, paired with the fact more drivers are hitting the road as the COVID-19 pandemic appears to be in the rear view, show that auto insurance premiums across Ontario have increased by 12 per cent in the last two years.

In December of 2021, that last time Ratesdotca surveyed the province, the average estimated auto insurance premium was $1,555 based on sample quotes for a 35-year-old male driver with a clean driving record who drives a four-door sedan.

Now, the company estimates the average premium to be $1,744.

While that may seem like a lot, it’s cheaper than what auto insurance will cost you in Brampton.

- Car insurance rates: Tips for finding the best coverage

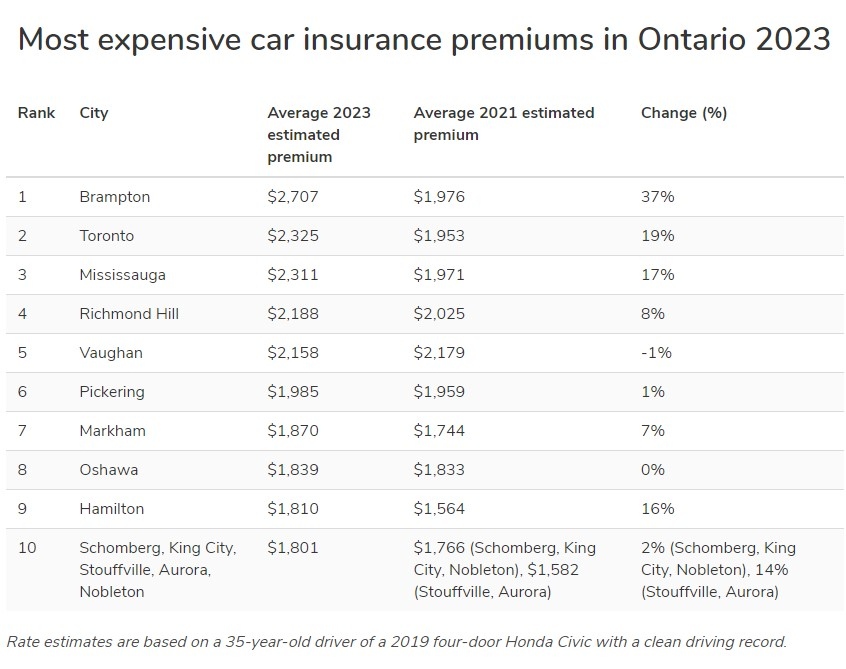

That city tops the report’s top 10 list for most expensive cities in Ontario for auto insurance, where driving will cost you an estimated $2,707. In 2021, rates in Brampton were $1,976.

Drivers in Toronto don’t fare much better. Rates in Ontario’s biggest city are an estimated $2,325 in 2023 – a 19 per cent jump from $1,953.

Mississauga holds the unenviable third spot at $2,311, which marks a 17 per cent hike from $1,971.

A full list of all the Ontario cities covered in the report can be found here.

(Ratesdotca)

(Ratesdotca)

EXPECT A BUMPY RIDE IN 2023: REPORT

Rates are expected to raise even higher, a Ratesdotca insurance expert said, as car coverage companies look to catch up with inflation.

"Just because they were allowed to increase [their rates] doesn't mean it's enough to take care of their losses from the last few years. There's some fine-tuning to come,” Daniel Ivans said in the report.

Late last year, the rising rate of inflation pushed a number of insurers in Ontario to request permission from the provincial regulator to increase rates.

The Financial Services Regulatory Authority (FSRA) has approved 22 increase requests since the beginning of this year, the company said, with the average change per insurer sitting at 6.5 per cent.

Heavy traffic leaves the downtown core in Toronto on Thursday January 14, 2021. THE CANADIAN PRESS/Frank Gunn

Heavy traffic leaves the downtown core in Toronto on Thursday January 14, 2021. THE CANADIAN PRESS/Frank Gunn

CTVNews.ca Top Stories

'Mayday! Mayday! Mayday!': Details emerge in Boeing 737 incident at Montreal airport

New details suggest that there were communication issues between the pilots of a charter flight and the control tower at Montreal's Mirabel airport when a Boeing 737 made an emergency landing on Wednesday.

Trudeau appears unwilling to expand proposed rebate, despite pressure to include seniors

Prime Minister Justin Trudeau does not appear willing to budge on his plan to send a $250 rebate to 'hardworking Canadians,' despite pressure from the opposition to give the money to seniors and people who are not able to work.

Hit man offered $100,000 to kill Montreal crime reporter covering his trial

Political leaders and press freedom groups on Friday were left shell-shocked after Montreal news outlet La Presse revealed that a hit man had offered $100,000 to have one of its crime reporters assassinated.

Cucumbers sold in Ontario, other provinces recalled over possible salmonella contamination

A U.S. company is recalling cucumbers sold in Ontario and other Canadian provinces due to possible salmonella contamination.

Trudeau says no question incoming U.S. president Trump is serious on tariff threat

Prime Minister Justin Trudeau says incoming U.S. president Donald Trump's threats on tariffs should be taken seriously.

In a shock offensive, insurgents breach Syria's largest city for the first time since 2016

Insurgents breached Syria's largest city Friday and clashed with government forces for the first time since 2016, according to a war monitor and fighters, in a surprise attack that sent residents fleeing and added fresh uncertainty to a region reeling from multiple wars.

Canada Bread owner sues Maple Leaf over alleged bread price-fixing

Canada Bread owner Grupo Bimbo is suing Maple Leaf Foods for more than $2 billion, saying it lied about the company's involvement in an alleged bread price-fixing conspiracy.

Musk joins Trump and family for Thanksgiving at Mar-a-Lago

Elon Musk had a seat at the family table for Thanksgiving dinner at Mar-a-Lago, joining President-elect Donald Trump, Melania Trump and their 18-year-old son.

Here's how thick ice needs to be to park a truck on it, according to Sask. Water Security Agency

The Saskatchewan Water Security Agency (WSA) says ice should be at least one foot (30 centimetres) thick before it's safe to drive a car or light truck on a frozen body of water.