Detached home prices declined in all but 4 Toronto neighbourhoods last quarter: report

Fuelled by a drop in prices, there was a “short burst of home-buying activity” in the Greater Toronto Area (GTA) during this year’s second quarter, but it was cut short by interest rate hikes and a lack of supply, according to a new report from RE/MAX Canada.

Properties that changed hands most often were detached homes, which were more affordable this year in almost every part of the GTA compared to 2022, the report says.

- Download our app to get local alerts on your device

- Get the latest local updates right to your inbox

“Anxious homebuyers were quick to identify the bottom of the market and jumped in with both feet in the second quarter of the year,” said Christopher Alexander, President of RE/MAX Canada in a press release.

“The short burst of home-buying activity clearly underscored the resilience of the housing market, but the lack of inventory available for sale curtailed any real momentum from building.”

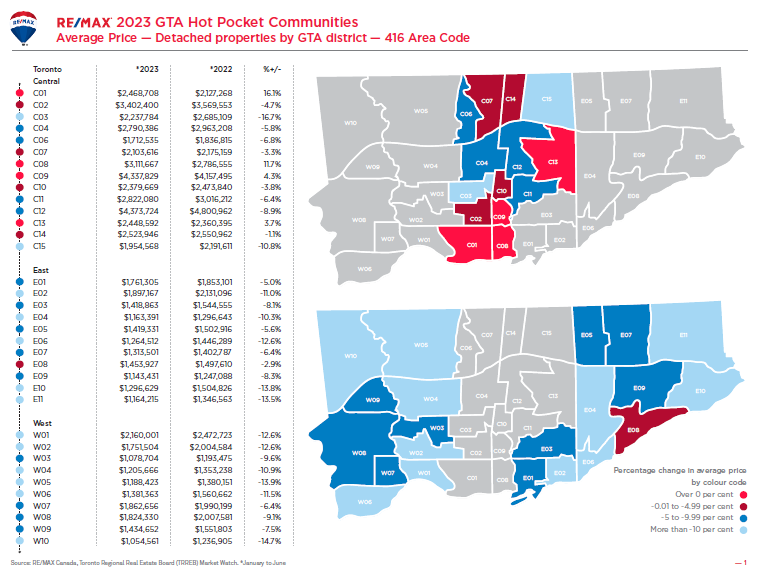

In Toronto, the report found that just four neighbourhoods saw an average increase in detached home values in the first six months of the year compared to the same period last year.

The Palmerston, Little Italy, Trinity-Bellwoods, Dufferin Grove area saw a whopping 16.1 per cent increase, from $2.1 million a year ago to $2.46 million.

Prices in Cabbagetown rose nearly 12 per cent, crossing the $3 million mark, and detached home values in Rosedale, Moore Park and in Banbury-Don Mills, Parkwoods-Donalda saw increases of around four per cent each, according to the report.

Despite the surge earlier in the year, RE/MAX found that far fewer detached homes have been bought and sold this year compared to 2022, with 95 per cent of markets surveyed reporting a downturn in home-buying activity.

Just three GTA neighbourhoods saw an increase in detached home sales year-over-year, the most significant being in the Bayview Village, Don Valley Village, Henry Farm area, which saw an increase of more than 21 per cent.

Sales in Alderwood, Long Branch, New Toronto were up more than nine per cent, while Bathurst Manor, Clanton Park saw a slight increase of around 1.5 per cent, according to the report.

“In many areas, a critical shortage of properties continues to hamper home-buying activity,” the release reads.

“Of the 60 markets in the GTA, nearly half (29/60) reported a decline in new listings in June 2023, compared to June of 2022. The greatest decline was noted in High Park, North Junction, Bloor West Village, where listings were down 58.1 per cent, with just 26 properties available for sale.”

The report found that increased trade-up buying activity fuelled by more affordable prices pushed the overall share of detached home sales to 44.7 per cent in the GTA this year, up slightly from one year ago.

“Today’s purchasers are focusing on value-added properties and communities, given new market realities,” said Elton Ash, Executive Vice President of RE/MAX Canada in the release.

“Listings that offer a short or long-term benefit – be it a basement apartment that allows homeowners to offset their mortgage costs now or homes that hold long-term potential in a future renovation or sale to a builder—are most sought-after. Location, while still an important aspect, has been replaced by value and necessity. A growing number of buyers are willing to travel further afield to get the best bang for their buck.”

An example of this trend, according to RE/MAX, is the significant increase in sales of detached houses in York Region; which saw a 104 per cent increase over home-buying activity in the second quarter.

“Affordability was a major factor given detached properties in the 905 area code are priced significantly less than similar homes located in the 416 area code. Buyers in the 905 are also not subjected to the municipal land transfer tax of two per cent to 2.5 per cent implemented by the City of Toronto,” the release continues.

“As such, the region continues to experience solid demand, as evidenced by the uptick of nearly 18 per cent in overall housing sales in June (compared to year ago levels for the same period).”

All in all, Ash says that the GTA housing market is at a “crossroad.”

With interest rates at a 21-year high, experts expect home-buying activity to remain low for the time being, and the current lack of inventory is one of the few factors keeping the market afloat.

“However, we believe that once stability returns to housing markets across the country, momentum should build again as buyers take advantage of improved affordability levels,” Ash added in the release.

“We expect the tide will turn. It’s only the timing that is still to be determined.”

CTVNews.ca Top Stories

Quebec man, 81, gets prison sentence after admitting to killing wife with Alzheimer's disease

An 81-year-old Quebec man has been sentenced to prison after admitting to killing his wife with Alzheimer's disease.

Canada Post quarterly loss tops $300M as strike hits second week -- and rivals step in

Canada Post saw hundreds of millions of dollars drain out of its coffers last quarter, due largely to its dwindling share of the parcels market, while an ongoing strike continues to batter its bottom line.

'Immoral depravity': Two men convicted in case of frozen migrant family in Manitoba

A jury has found two men guilty on human smuggling charges in a case where a family from India froze to death in Manitoba while trying to walk across the Canada-U.S. border.

Prime Minister Trudeau attends Taylor Swift's Eras Tour in Toronto with family

Prime Minister Justin Trudeau is a Swiftie. His office confirmed to CTV News Toronto that he and members of his family are attending the penultimate show of Taylor Swift's 'The Eras Tour' in Toronto on Friday evening.

Trump supporters review-bomb B.C. floral shop by accident

A small business owner from B.C.'s Fraser Valley is speaking out after being review-bombed by confused supporters of U.S. president-elect Donald Trump this week.

Pat King found guilty of mischief for role in 'Freedom Convoy'

Pat King, one of the most prominent figures of the 2022 'Freedom Convoy' in Ottawa, has been found guilty on five counts including mischief and disobeying a court order.

Nearly 46,000 electric vehicles recalled in Canada over power loss risk

Nearly 46,000 electric vehicles from Kia, Hyundai and Genesis are being recalled in Canada over a potential power loss issue that can increase the risk of a crash.

Trump chooses Bessent to be Treasury secretary and Vought as top budget official

President-elect Donald Trump announced Friday that he'll nominate hedge fund manager Scott Bessent, an advocate for deficit reduction, to serve as his next treasury secretary. Trump also said he would nominate Russel Vought to lead the Office of Management and Budget.

Canada's tax relief plan: Who gets a cheque?

The Canadian government has unveiled its plans for a sweeping GST/HST pause on select items during the holiday period. The day after the announcement, questions remain on how the whole thing will work.