These adults born in the '90s partnered with their parents to buy homes in Ontario

An Ontario woman said it would have been impossible to buy a house without her mother – an anecdote that animates the fact that over 17 per cent of Canadian homeowners born in the ‘90s own their property with their parents, according to a new report.

The Statistics Canada study released last Wednesday shows the extent parental wealth plays in the homeownership outcomes of their adult children as affordability pressures and housing prices have intensified in recent years.

In response to these findings, three Ontario adults born in the ‘90s spoke to CTV News Toronto about their parents' involvement in their homeownership journeys.

- Download our app to get local alerts on your device

- Get the latest local updates right to your inbox

Kirsten Cuffie, 32, and her husband bought a house in Keswick, Ont. with her mother seven months ago.

Having grown up in Toronto, Cuffie knew buying a house in the city was out of the question, but what came as more of a surprise was the hurdles she’d have to leap over to own property in a town an hour north of the city.

Cuffie said she got approved for a $350,000 mortgage. “Even the mortgage broker was like, ‘You won't find anything for that,’” she recalled. She was working full-time as a billing coordinator for an electricity company, but as the self-employed owner of an auto detailer in Newmarket, her husband didn’t have a guaranteed income to contribute.

But then, Cuffie’s mother sold her house in Toronto last summer, and a new idea manifested – what if they bought a house together and co-signed the mortgage?

Cuffie found a two-storey corner lot in Keswick with a big backyard for their dogs, three-bedrooms for their family to grow and a basement they could finish for her mother.

The house was over their budget, at almost $800,000, a price point that Cuffie said would have been impossible without her mother’s help.

Kirsten Cuffie, 32, and her husband bought a house in Keswick, Ont. with her mother seven months ago.

“We paid $50,000. My mom paid $150,000, which is a huge difference,” she said.

Kirsten Cuffie, 32, and her husband bought a house in Keswick, Ont. with her mother seven months ago.

“We paid $50,000. My mom paid $150,000, which is a huge difference,” she said.

“I've actually heard from a lot of my friends that they're in a similar situation … it's not ideal, but this is what people are doing these days, or else people are just going to be stuck.”

At 26, Jamie Foster placed a downpayment on a condo in Bowmanville, Ont., for $86,000. He had saved for years while living at his parent’s house, working full-time since he was 19 years old, at McDonald's and the Beer Store, before moving into accounting. “It was always everything else has to go in the house fund,” he said.

But to pass the stress test, his mortgage broker recommended co-signing with his mother, positioning her as a one per cent owner, despite having no financial involvement in the property. In doing so, the lender looked at their two incomes and decided they would pass the stress test if interest rates rose. “It was kind of like a little cheat in the system,” Foster said.

Mortgage co-signing involves adding a parent’s name to the property title and on the mortgage loan to obtain better conditions through the parents’ financial standing or credit rating, without the intention of cohabiting, according to Statistics Canada.

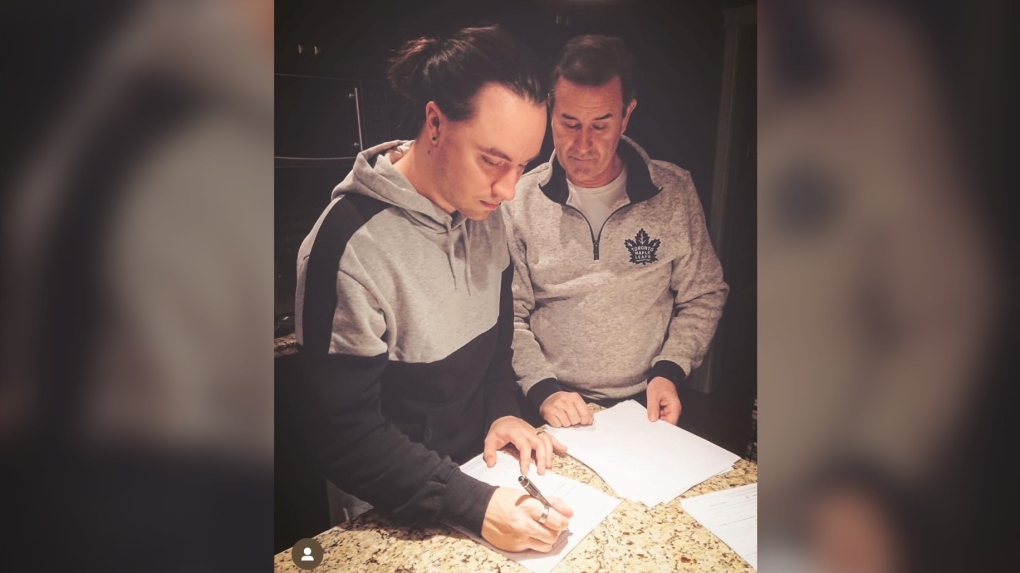

Jamie Foster and his father sign the deal for his condo in Bowmanville, Ont. Noah Endale, a 33-year-old software engineer, said co-signing with his dad allowed him to buy a place in Toronto. “I couldn't get as much as I needed in the city,” he said.

Jamie Foster and his father sign the deal for his condo in Bowmanville, Ont. Noah Endale, a 33-year-old software engineer, said co-signing with his dad allowed him to buy a place in Toronto. “I couldn't get as much as I needed in the city,” he said.

His mortgage pre-approval jumped from the $350,000 range to more than $1 million after he co-signed with his father, and bought a one-bedroom condo in East York in 2022.

“It’s not great that it’s come to this,” Endale acknowledged. “It’s definitely not sustainable. It makes you wonder how this started and how we can get out of this situation.”

Victor Tran, a mortgage broker in Toronto, notes that even if parents are only co-signing to increase their child’s income in the eyes of lenders, they should be aware of the responsibility that comes along with it. If a child misses a payment, for example, it could impact the parent’s credit score, Tran said. “That’s something all co-signers should be aware of.”

Foster said he spoke with his parents about the fact that his mortgage payments would fall on them if his financial standing drastically changed in an unforeseen situation. “But at the same time, they knew me well enough that I was never going to let it get to that degree,” he said.

“If the co-sign didn't happen, I would not be where I am today,” Foster said.

In a month, Foster, now 30, is moving into a $800,000 three-bedroom house in Bowmanville with his partner and dog.

“I kept my mum on title with me as one per cent owner, because we also learned it's cheaper with the mortgage company to carry over a mortgage into a new location,” Foster said.

'It's striking'

Aisha Khalid, Josh Gordon and Michael Mirdamadi, analysts with the Canadian Housing Statistics Program at Statistics Canada, set out to dissect the declining homeownership of young people in Canada and the extent to which the financial situation of their parents plays a role in their chances of buying a home.

“It's striking that about one in six properties owned by individuals born in the 1990s are co-owned with their parents,” Gordon said.

He noted the prominence of this trend in pricier urban markets, such as Toronto and Vancouver, where the children of parents with the most housing wealth tended to own properties that were approximately 30 to 40 per cent more valuable than those whose parents had less housing wealth.

“That indicates that parental housing wealth can play an important role in the homeownership aspirations of young adults,” he said.

When it comes to the impact these trends have on housing affordability in Canada, Mirdamadi said these findings are indicative of “the catalyst or the impetus” of the mounting challenge of entering the housing market.

“Your outcomes, your situation, your homeownership status will come to be more influenced by how your parents are doing, and so people may have concerns around intergenerational inequity as a result of that,” Gordon added.

The analysts aren’t tasked with outlining how their findings should inform policy decisions, but Gordon said, “It raises important questions about the extent to which people have equal opportunities in society. It pertains to those types of questions.”

CTVNews.ca Top Stories

BREAKING NEWS 'A horrible way to start the summer': 3 killed in serious boat crash on lake north of Kingston, Ont.

Three people were killed and five others were injured Saturday night following a boat crash on the Buck Bay area of Bobs Lake, north of Kingston, Ont., the Ontario Provincial Police (OPP) said.

Signs of Alzheimer’s were everywhere. Then his brain improved

Blood biomarkers of telltale signs of early Alzheimer’s disease in the brain of his patient, 55-year-old entrepreneur Simon Nicholls, had all but disappeared in a mere 14 months.

Canadian immigration asks medical worker fleeing Gaza if he treated Hamas fighters

Lawyers are questioning Canada’s approach to screening visa applications for people in Gaza with extended family in Canada after one applicant, a medical worker, was asked whether he had treated members of Hamas.

Diddy admits beating ex-girlfriend Cassie, says he's sorry, calls his actions 'inexcusable'

Sean "Diddy" Combs admitted Sunday that he beat his ex-girlfriend in a hotel hallway in 2016 after CNN released video of the attack, saying in a video apology he was "truly sorry" and his actions were "inexcusable."

Helicopter carrying Iran's president suffers a 'hard landing,' state TV says, and rescue is underway

A helicopter carrying Iranian President Ebrahim Raisi suffered a "hard landing" on Sunday, Iranian state media reported, without elaborating. Some began urging the public to pray for Raisi and the others on board as rescue crews sped through a misty, rural forest where his helicopter was believed to be.

Walmart, Costco refusing to sign grocery code of conduct 'untenable': industry minister

Industry Minister Francois-Philippe Champagne says it's 'untenable' for 'smaller players' like Walmart and Costco to delay signing on to the government- and industry-led grocery code of conduct, now that industry giant Loblaw has agreed to do so.

Ottawa driver who appeared to be racing another vehicle on Highway 416 facing charges

The Ontario Provincial Police (OPP) says an Ottawa driver is facing charges after being caught going 187 km/h on Highway 416.

VIDEO Born without front legs, this dog has been inspiring the world for 3 years: Dresden farm owner

A sanctuary dedicated to animals with disabilities is celebrating the third birthday of one of its most popular residents.

Residents evacuated after threats made to residence in Fall River, N.S.

Nova Scotia RCMP are warning the public to avoid the area around Canterbury Lane in Fall River after a threat was made at a residence.