Some homeowners spend more time planning vacations than reviewing their mortgage, survey finds

As the Bank of Canada is poised to possibly raise interest rates next week, a new survey has found that more than a third of homeowners spend more time planning their vacation than thinking about their mortgage.

“People should understand they are signing up for a long term commitment that is the largest purchase that most families will ever make,” said Huston Loke, Executive Vice President of Market Conduct with the Financial Services Regulatory Authority of Ontario (FSRA).

After years of historic low interest rates many economists believe the Bank of Canada will starting hiking it’s bench mark rate on Jan. 26 by 0.25 per cent, with more interest rate hikes to come later this year.

The FSRA said it’s new survey found that many people don't pay as much attention to their mortgage as they should, and if they did it could save them money.

The FSRA survey found that 38 per cent of those asked spent more time researching their next vacation than their mortgage.

“We know just how important these decisions are for borrowers,” said Loke.

Housing prices are rising, with the average price of a home in the GTA worth more than a million dollars and interest rates appear to be trending upward. The FSRA believes home owners could benefit by doing more research.

“This is part of a consumer being a smart consumer and being well informed and knowing the kind of professional they are dealing with. We encourage consumers to understand the mortgage decisions they are making," said Loke.

When getting a mortgage 67 per cent of homeowners use a bank specialist, while 29 per cent use a mortgage broker and three per cent use a private lender. Two per cent said they use other sources and the number does not add to 100 due to rounding, according to the survey.

FSRA has a code of conduct for mortgage brokers, but says wherever consumers take out a mortgage they should be given a suitable product for their situation.

For example, if someone is in a fixed mortgage, they should be advised there could be expensive penalties if they break the mortgage contract before the term is up.

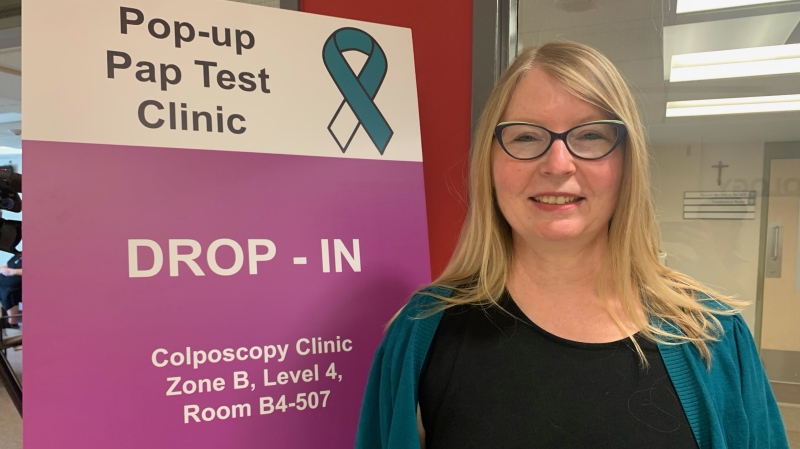

Leah Zlatkin is a mortgage broker with LowestRates.ca and agrees people should spend more time understanding their mortgage agreements.

“The majority of people out there find personal finances and mortgages outside their comfort zone," said Zlatkin.

The survey also found 74 per cent feel more should be done to educate people on mortgages and mortgage brokers.

Whether you deal with a major bank or a broker understanding your mortgage details could potentially save you thousands of dollars a year.

“You need to speak to a professional who can walk you through the nuts and bolts of your situation" said Zlatkin.

If you have a variable mortgage you may want to consider locking into a fixed mortgage product, but there are pros and cons to each of them. It's why if you're not sure you should ask your lender which type would work best for you.

LowestRates.ca provided this example that shows how a 0.25 per cent rate increase could affect mortgage payments.

For the average Canadian home, priced at $720,000 (with a minimum down payment of 10 per cent amortized over 25 years), monthly mortgage payments based on a five-year variable rate of 0.95 per cent, would be $2,502.

According to LowestRates.ca’s mortgage payment calculator, the same mortgage payment with a 25 basis point rate increase, that monthly variable-rate mortgage payment estimate is $2,578, an increase of $76 per month or $912 per year.

By comparison, the same mortgage at today’s best five-year fixed rate on LowestRates.ca of 2.02 per cent, monthly mortgage costs would be $2,835.

CTVNews.ca Top Stories

Asking rent prices up 9.3% across Canada, Ontario sees only decline: report

A new report says the average asking rent for a home in Canada in April was up 9.3 per cent compared with a year ago, while a slight month-over-month increase was also recorded for the first time since January.

What is basic income, and how would it impact me?

Parliamentarians are considering a pair of bills aiming to lift people out of poverty through a basic income program, but some fear these types of systems could result in more taxes for Canadians who are already financially struggling.

'I may have some nightmares:' Man survives being bitten by 2 sharks in Bahamas

A man who was bitten by two sharks in the Bahamas said Thursday he's 'thankful that I'm here' while sharing his story of survival.

Magnitude 4.2 earthquake reported off Vancouver Island's west coast

A 4.2-magnitude earthquake was recorded west of Vancouver Island early Friday morning.

Mexico's president accuses press and volunteer searchers for missing people of 'necrophilia'

The administration of Mexico's president has accused the press and volunteer searchers who look for the bodies of missing people of 'necrophilia,' comments that drew criticism this week.

WATCH Expecting an interest rate cut in June? Don't bet on it after new jobs data

Canada's labour market rebounded in April, adding more than 90,000 jobs, a staggering number of new positions after four consecutive months of little change.

Out-of-control wildfire burning near Fort McMurray

As of 9 a.m. on Friday, the wildfire burning 28 kilometres southwest of the northeastern Alberta city was 25 hectares in size.

Prince William says wife Kate is 'doing well'

Prince William said on Friday his wife Kate was 'doing well' in a rare public comment about the Princess of Wales as she undergoes preventative chemotherapy for cancer.

'Irate male' assaulted Newfoundland officers with block of cheese, police say

Police in Newfoundland say patrol officers were assaulted Thursday by a "very irate male" wielding a block of cheese.