Ontario millennials need to save for over 20 years for down payment on a home: report

A real estate sign is displayed in front of a house in the Riverdale area of Toronto on Wednesday, September 29, 2021. THE CANADIAN PRESS/Evan Buhle

A real estate sign is displayed in front of a house in the Riverdale area of Toronto on Wednesday, September 29, 2021. THE CANADIAN PRESS/Evan Buhle

A new report shows house prices need to drop by more than $500,000 for millennials to be able to afford a home in Ontario.

Generation Squeeze, a charitable organization fighting for generational fairness in the country, recently released a 56-page reported called “Straddling the Gap 2022,” which looks at the disparity between home prices and earnings across the country.

The study analyzes what Canada’s “primary goal” should be for home prices by looking at the gap between earnings and average home prices from 1976 until 2021, which was the last year available to procure data from the Canadian Real Estate Association (CREA).

After analyzing CREA’s data and comparing it to Statistics Canada’s data for annual income, the report concludes prices should stall “for many years ahead – or even continue to fall moderately.”

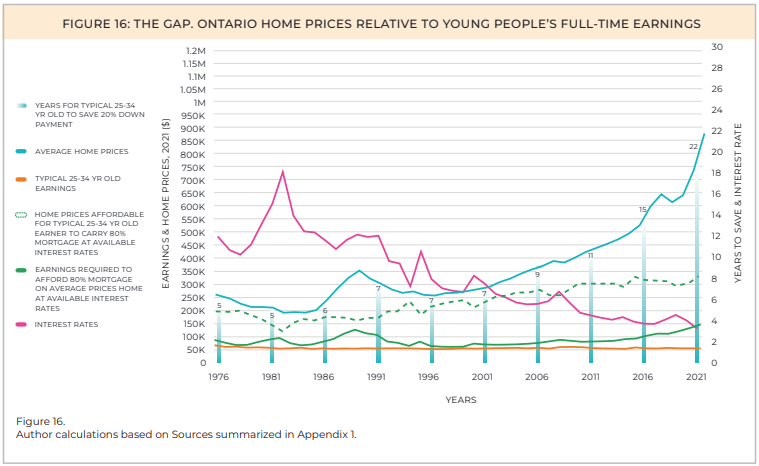

“The number of years of work required to save [for] a 20 [per cent] down payment on average priced homes has grown in alarming ways in many regions,” the report reads.

Across Ontario, average home prices were just shy of $900,000 last year.

Meanwhile, average income of Ontarians between the ages of 25 and 34 years has stayed nearly the same for decades, lingering at an average of roughly $50,000 a year. According to the latest data from StatsCan, the yearly income was $50,800 in 2020.

In order for millennials to buy a home in the province, the report says average home prices need to drop by $530,000, more than 60 per cent of the market value last year, for them to afford a mortgage that covers 80 per cent of the value.

Or, Ontario millennials will need to be earning $137,000 a year, which is roughly $85,000 more than what they are currently making on average.

A graph of Ontario's home prices relative to 25-to-34-year-olds full-time earnings. (Generation Squeeze)

A graph of Ontario's home prices relative to 25-to-34-year-olds full-time earnings. (Generation Squeeze)

“It takes 22 years of full-time work for the typical young person to save a 20 [per cent] down payment on an average priced home,” the report reads, which they say is 17 years longer than when “today’s aging population” were their age. The report did not clarify what age groups fall under this definition.

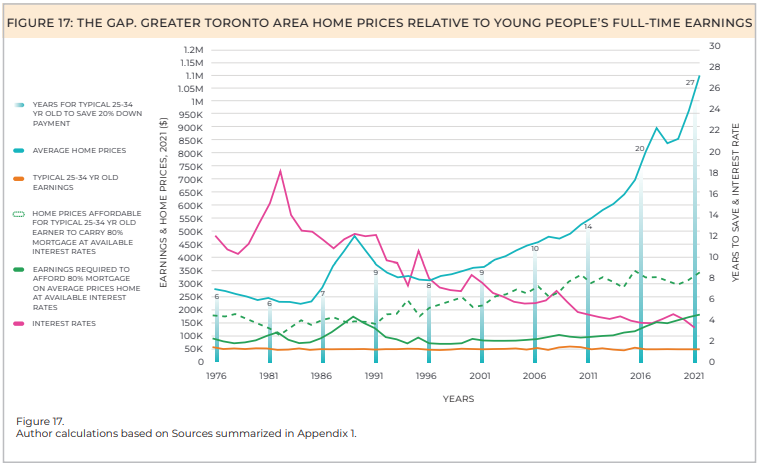

The lack of affordability in the Greater Toronto Area (GTA) is even steeper.

Those who have their sights set on owning a home in the GTA will have to save for an average of 27 years to make the same downpayment on an average-priced home. That is 10 years longer compared to the average amount of time across Canada.

Average annual incomes have remained at around $50,000 in the region, with StatsCan revealing 25 to 34-year-olds in the GTA raked in an average of $51,600 in 2020.

Meanwhile, average home prices in the region have soared to $1.1 million.

According to the report, these prices will have to fall by more than $750,000 for this age group to afford a mortgage that covers 80 per cent of the home’s value at current interest rates.

A graph of the GTA's home prices relative to 25-to-34-year-olds full-time earnings. (Generation Squeeze)

A graph of the GTA's home prices relative to 25-to-34-year-olds full-time earnings. (Generation Squeeze)

“Or typical full-time earnings would need to increase to $172,000/year – more than triple current levels,” the report notes.

Rent is also steep for those who cannot afford to buy, as the report notes it costs $20,148 a year for a two-bedroom apartment in the GTA in 2021.

With how much millennials make a year on average, rent takes up about 40 per cent of their income.

House prices in the GTA, however, are expected to drop slightly next year.

According to Re/Max Canada’s housing market outlook for 2023, prices are expected to fall by nearly 12 per cent to an average of just over $1 million.

CTVNews.ca Top Stories

W5 Investigates A 'ticking time bomb': Inside Syria's toughest prison holding accused high-ranking ISIS members

In the last of a three-part investigation, W5's Avery Haines was given rare access to a Syrian prison, where thousands of accused high-ranking ISIS members are being held.

'Mayday!': New details emerge after Boeing plane makes emergency landing at Mirabel airport

New details suggest that there were communication issues between the pilots of a charter flight and the control tower at Montreal's Mirabel airport when a Boeing 737 made an emergency landing on Wednesday.

Federal government posts $13B deficit in first half of the fiscal year

The Finance Department says the federal deficit was $13 billion between April and September.

Canadian news publishers suing ChatGPT developer OpenAI

A coalition of Canadian news publishers is suing OpenAI for using news content to train its ChatGPT generative artificial intelligence system.

Weather warnings for snow, wind issued in several parts of Canada

Winter is less than a month away, but parts of Canada are already projected to see winter-like weather.

BREAKING Supreme Court affirms constitutionality of B.C. law on opioid health costs recovery

Canada's top court has affirmed the constitutionality of a law that would allow British Columbia to pursue a class-action lawsuit against opioid providers on behalf of other provinces, the territories and the federal government.

Cucumbers sold in Ontario, other provinces recalled over possible salmonella contamination

A U.S. company is recalling cucumbers sold in Ontario and other Canadian provinces due to possible salmonella contamination.

Nick Cannon says he's seeking help for narcissistic personality disorder

Nick Cannon has spoken out about his recent diagnosis of narcissistic personality disorder, saying 'I need help.'

Real GDP per capita declines for 6th consecutive quarter, household savings rise

Statistics Canada says the economy grew at an annualized pace of one per cent during the third quarter, in line with economists' expectations.