Ontario man warns people to check bank statements after error nearly costs him $10K

David Heathfield is seen in this undated image. (supplied)

David Heathfield is seen in this undated image. (supplied)

An Ontario man who lost more than $10,000 after a cheque he wrote was cashed twice said he was pushed to the end of his rope trying to fight TD Bank to get the money back.

David Heathfield, who owns a small waste equipment brokerage, said he wrote a cheque for US$8,000 back in January to purchase some new equipment from a dealer in Florida.

- Download our app to get local alerts on your device

- Get the latest local updates right to your inbox

Typically, Heathfield said he waits until the end of the quarter to reconcile his books and make sure there are no banking issues.

He said in late March, at the end of the first quarter, he checked his bank statements and saw no discrepancies.

“I reconciled and everything balanced, because the US$8,000 was there,” Heathfield told CTV News Toronto in an interview.

But at the end of the second quarter in July, Heathfield said he noticed the same US$8,000 cheque, according to his April statement, had been cashed again, leaving him out more than CAD$10,000.

Heathfield said he immediately called TD Bank to try and get his money back, but because of a 30-day deadline to report discrepancies he was told he would be on the hook for the loss.

According to the bottom of Heathfield’s bank statements, which have been viewed by CTV News Toronto, customers are asked to ensure they report in writing any errors or irregularities within 30 days of the document’s issue date.

“If you do not, the statement of account shall be conclusively deemed correct except for any amount credited to the account in error,” the bank statement read.

Heathfield admits he had seen that fine print in the past, but never really paid it too much attention.

He said as months went on, he didn’t give up fighting for his money back.

“I’m at the end of my rope,” he said.

After speaking with Heathfield, CTV News Toronto contacted TD Bank to comment on the situation.

In a statement issued Thursday evening, and following an investigation into the incident, a TD Bank spokesperson said it was working directly with Heathfield to find a resolution.

“We strongly encourage all customers to regularly and carefully review their monthly account statements and immediately report any discrepancies by calling our EasyLine team or visiting their local branch,” the statement read.

That same day, Heathfield said that “out of the blue” he got a call from TD Bank’s head office.

“They have been asked to review my case and are allowing this one-time exception for an error and will be crediting my account the full US$8,000,” he said.

Although Heathfield said he still doesn’t know who cashed the cheque a second time, he said he wanted to share his story to help prevent the same thing happening to someone else.

“I think people need to be aware that, even at the bottom of the statement, any errors or omissions need to be reported within in 30 days. It was always there. I've just never looked at it, but it’s a killer.”

CTVNews.ca Top Stories

Stormy Daniels describes meeting Trump during occasionally graphic testimony in hush money trial

Stormy Daniels took the witness stand Tuesday at Donald Trump's hush money trial, describing for jurors a sexual encounter the porn actor says she had with him in 2006 that resulted in her being paid off to keep silent during the presidential race 10 years later.

Indian envoy warns of 'big red line,' days after charges laid in Nijjar case

India's envoy to Canada insists relations between the two countries are positive overall, despite what he describes as 'a lot of noise.'

Susan Buckner, who played spirited cheerleader Patty Simcox in 'Grease,' dead at 72

Susan Buckner, best known for playing peppy Rydell High School cheerleader Patty Simcox in the 1978 classic movie musical 'Grease,' has died. She was 72.

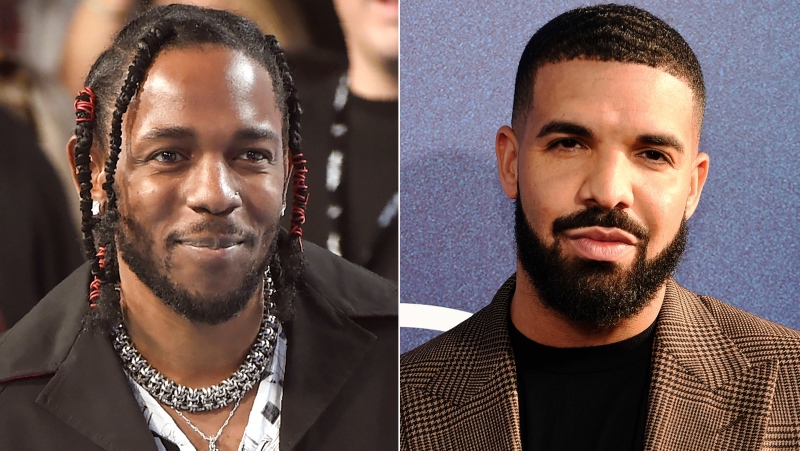

Former homicide detective explains how police will investigate shooting outside Drake's Bridle Path mansion

Footage from dozens of security cameras in the area of Drake’s Bridle Path mansion could be the key to identifying the suspect responsible for shooting and seriously injuring a security guard outside the rapper’s sprawling home early Tuesday morning, a former Toronto homicide detective says.

Jeremy Skibicki has 'uphill battle' to prove he's not criminally responsible in Winnipeg killings: legal analysts

Accused killer Jeremy Skibicki could have a challenging time convincing a judge that he is not criminally responsible for the deaths of four Indigenous women, a legal analyst says.

Alcohol believed to be a factor in boating incident after 2 men die: N.S. RCMP

Two Nova Scotia men are dead after a boat they were travelling in sank in the Annapolis River in Granville Centre, N.S., on Monday.

Northern Ont. woman makes 'eggstraordinary' find

A chicken farmer near Mattawa made an 'eggstraordinary' find Friday morning when she discovered one of her hens laid an egg close to three times the size of an average large chicken egg.

Bye-bye bag fee: Calgary repeals single-use bylaw

A Calgary bylaw requiring businesses to charge a minimum bag fee and only provide single-use items when requested has officially been tossed.

CFL suspends Argos QB Chad Kelly at least nine games following investigation

The CFL suspended Toronto Argonauts quarterback Chad Kelly for at least nine regular-season games Tuesday following its investigation into a lawsuit filed by a former strength-and-conditioning coach against both the player and club.