Many Canadians consider turning to part-time jobs if finances worsen, new survey says

A waitress relieving a credit card is seen in this file image. (Pexels)

A waitress relieving a credit card is seen in this file image. (Pexels)

A new Consumer Debt Report by the Canadian Counselling Society has found that many Canadians are pessimistic about their 2023 finances.

“It is no longer that it's a certain segment feeling the pinch, everyone is feeling the pinch" Anne Arbour, Director of Strategic Partnerships with the Credit Counselling Society, told CTV News Toronto.

82 per cent of Canadians surveyed said spending on essential goods is the main cause of their worsening finances and 63 per cent said they plan to make cutbacks to their expenses, especially on food.

"We all need groceries, we all need gas or bus money and those costs are going up. So it's not as simple as not taking a holiday, it has to do with buying the essentials that we all need," Arbour said.

The survey also found 42 per cent of those asked have experienced an increase in debt in the past year and that 35 per cent would consider getting a part-time job if things get worse.

For companies that deal with debt, this doesn’t come as a surprise – inflation is increasing and many people have not seen their income match those increases.

It’s being called a perfect storm of inflation, rising interest rates and incomes not keeping up, and it’s putting pressure on many families’ finances.

Many debt collection companies took a break from collecting during the pandemic, but have since resumed and now some are seeking repayment of debts, pushing some consumers into a precarious financial situation.

“Creditors are saying the pandemic is over and they want to collect what they are owed and some are being quite aggressive about it," Laurie Campbell, Director of Client Financial Wellness with Bromwich & Smith, a licenced insolvency trustee, said.

Campbell said that bankruptcies and consumer proposals are at their highest level since March 2020.

“We are seeing a steady increase in insolvencies and I predict over the next 6 to 12 months, the increases will continue," she said.

The survey also found, while many people have savings to fall back on if they need extra money, some consumers are forced to use credit cards, borrow from banks and other institutions and even ask friends and family.

Anyone feeling overwhelmed by their financial situation is urged to reach out for help.

"To understand you are not alone and there are resources out there whether it's a not-for-profit credit counselling agency or whether it's your financial institution or a trusted friend," Arbour said.

CTVNews.ca Top Stories

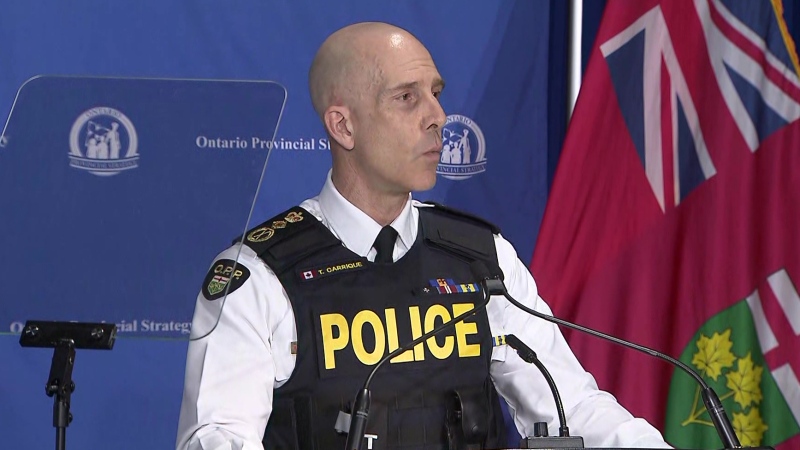

BREAKING Ontario Provincial Police arrest 64 suspects in child sexual exploitation investigation

Ontario Provincial Police say 64 suspects are facing a combined 348 charges in connection with a series of child sexual exploitation investigations that spanned the province.

AstraZeneca says it will withdraw COVID-19 vaccine globally as demand dips

AstraZeneca said on Tuesday it had initiated the worldwide withdrawal of its COVID-19 vaccine due to a 'surplus of available updated vaccines' since the pandemic.

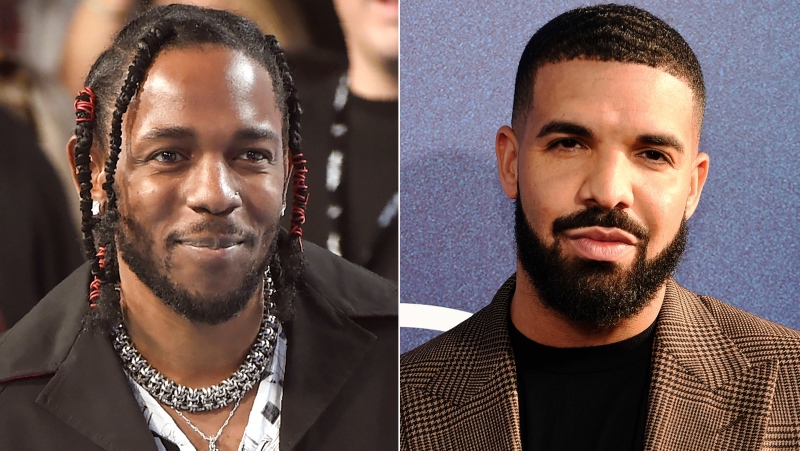

Toronto police seek suspect vehicle after security guard shot outside Drake's mansion

Toronto police are seeking help from the public as they continue to investigate a shooting that seriously injured a security guard outside rapper Drake's mansion.

World's record-breaking hot temperature streak stretches through April

The world just experienced its hottest April on record, extending an 11-month streak in which every month set a temperature record, the European Union's climate change monitoring service said on Wednesday.

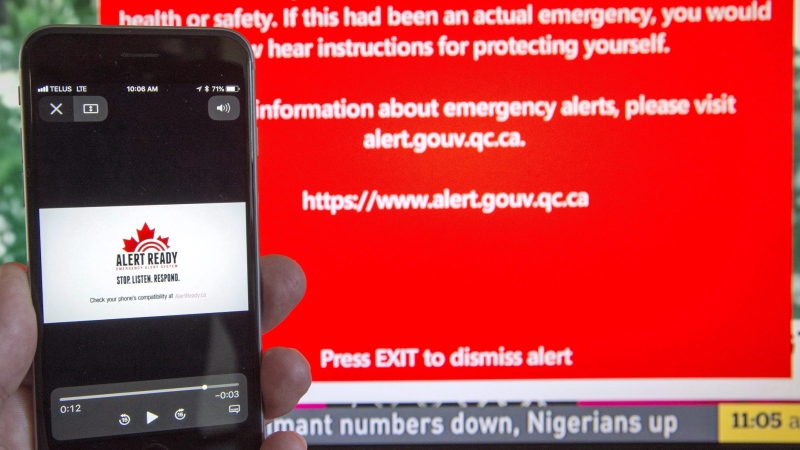

Most of Canada to receive emergency alert test today

The federal government will test its capacity to issue emergency alerts today, with the exception of Ontario, where the test will take place on May 15.

OPINION What King Charles' schedule being too 'full' to accommodate son suggests

Prince Harry, the Duke of Sussex, has made headlines with his recent arrival in the U.K., this time to celebrate all things Invictus. But upon the prince landing in the U.K., we have already had confirmation that King Charles III won't have time to see his youngest son during his brief visit.

Seafood, eat food: Calgary Stampede releases Midway menu

The Calgary Stampede has released its menu of sweet, salty and spicy treats available on the Midway for the Greatest Outdoor Show on Earth.

Boy Scouts of America is rebranding. Here's why they've changed their name

After more than a century, Boy Scouts of America is rebranding as Scouting America, another major shakeup for an organization that once proudly resisted change.

Ontario man devastated to learn $150,000 line of credit isn't insured after wife dies

An Ontario man found out that a line of credit he thought was insured actually isn't after his wife of 50 years died.