These adults born in the '90s partnered with their parents to buy homes in Ontario

An Ontario woman said it would have been impossible to buy a house without her mother – an anecdote that animates the fact that over 17 per cent of Canadian homeowners born in the ‘90s own their property with their parents, according to a new report.

The Statistics Canada study released last Wednesday shows the extent parental wealth plays in the homeownership outcomes of their adult children as affordability pressures and housing prices have intensified in recent years.

In response to these findings, three Ontario adults born in the ‘90s spoke to CTV News Toronto about their parents' involvement in their homeownership journeys.

- Download our app to get local alerts on your device

- Get the latest local updates right to your inbox

Kirsten Cuffie, 32, and her husband bought a house in Keswick, Ont. with her mother seven months ago.

Having grown up in Toronto, Cuffie knew buying a house in the city was out of the question, but what came as more of a surprise was the hurdles she’d have to leap over to own property in a town an hour north of the city.

Cuffie said she got approved for a $350,000 mortgage. “Even the mortgage broker was like, ‘You won't find anything for that,’” she recalled. She was working full-time as a billing coordinator for an electricity company, but as the self-employed owner of an auto detailer in Newmarket, her husband didn’t have a guaranteed income to contribute.

But then, Cuffie’s mother sold her house in Toronto last summer, and a new idea manifested – what if they bought a house together and co-signed the mortgage?

Cuffie found a two-storey corner lot in Keswick with a big backyard for their dogs, three-bedrooms for their family to grow and a basement they could finish for her mother.

The house was over their budget, at almost $800,000, a price point that Cuffie said would have been impossible without her mother’s help.

Kirsten Cuffie, 32, and her husband bought a house in Keswick, Ont. with her mother seven months ago.

“We paid $50,000. My mom paid $150,000, which is a huge difference,” she said.

Kirsten Cuffie, 32, and her husband bought a house in Keswick, Ont. with her mother seven months ago.

“We paid $50,000. My mom paid $150,000, which is a huge difference,” she said.

“I've actually heard from a lot of my friends that they're in a similar situation … it's not ideal, but this is what people are doing these days, or else people are just going to be stuck.”

At 26, Jamie Foster placed a downpayment on a condo in Bowmanville, Ont., for $86,000. He had saved for years while living at his parent’s house, working full-time since he was 19 years old, at McDonald's and the Beer Store, before moving into accounting. “It was always everything else has to go in the house fund,” he said.

But to pass the stress test, his mortgage broker recommended co-signing with his mother, positioning her as a one per cent owner, despite having no financial involvement in the property. In doing so, the lender looked at their two incomes and decided they would pass the stress test if interest rates rose. “It was kind of like a little cheat in the system,” Foster said.

Mortgage co-signing involves adding a parent’s name to the property title and on the mortgage loan to obtain better conditions through the parents’ financial standing or credit rating, without the intention of cohabiting, according to Statistics Canada.

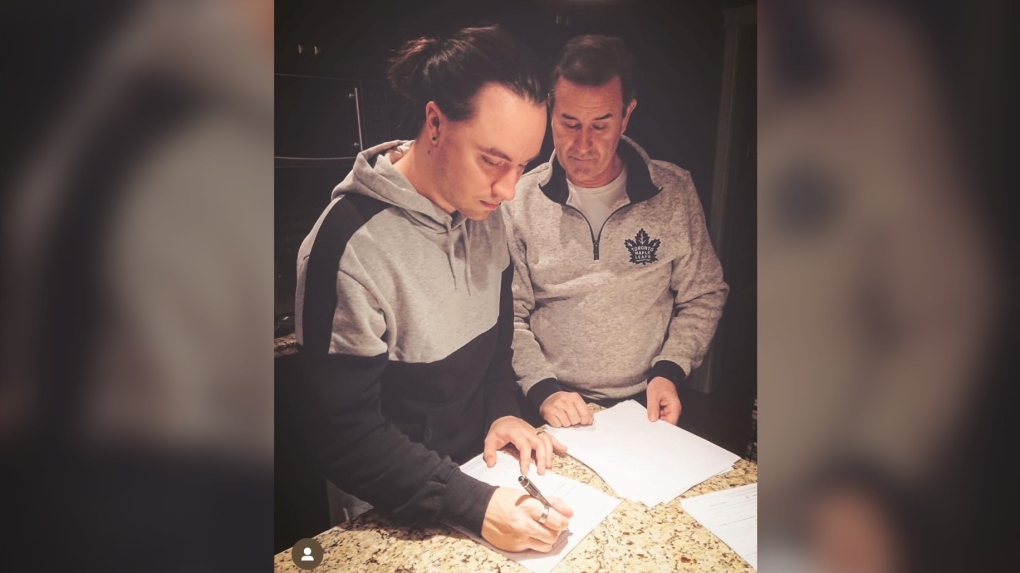

Jamie Foster and his father sign the deal for his condo in Bowmanville, Ont. Noah Endale, a 33-year-old software engineer, said co-signing with his dad allowed him to buy a place in Toronto. “I couldn't get as much as I needed in the city,” he said.

Jamie Foster and his father sign the deal for his condo in Bowmanville, Ont. Noah Endale, a 33-year-old software engineer, said co-signing with his dad allowed him to buy a place in Toronto. “I couldn't get as much as I needed in the city,” he said.

His mortgage pre-approval jumped from the $350,000 range to more than $1 million after he co-signed with his father, and bought a one-bedroom condo in East York in 2022.

“It’s not great that it’s come to this,” Endale acknowledged. “It’s definitely not sustainable. It makes you wonder how this started and how we can get out of this situation.”

Victor Tran, a mortgage broker in Toronto, notes that even if parents are only co-signing to increase their child’s income in the eyes of lenders, they should be aware of the responsibility that comes along with it. If a child misses a payment, for example, it could impact the parent’s credit score, Tran said. “That’s something all co-signers should be aware of.”

Foster said he spoke with his parents about the fact that his mortgage payments would fall on them if his financial standing drastically changed in an unforeseen situation. “But at the same time, they knew me well enough that I was never going to let it get to that degree,” he said.

“If the co-sign didn't happen, I would not be where I am today,” Foster said.

In a month, Foster, now 30, is moving into a $800,000 three-bedroom house in Bowmanville with his partner and dog.

“I kept my mum on title with me as one per cent owner, because we also learned it's cheaper with the mortgage company to carry over a mortgage into a new location,” Foster said.

'It's striking'

Aisha Khalid, Josh Gordon and Michael Mirdamadi, analysts with the Canadian Housing Statistics Program at Statistics Canada, set out to dissect the declining homeownership of young people in Canada and the extent to which the financial situation of their parents plays a role in their chances of buying a home.

“It's striking that about one in six properties owned by individuals born in the 1990s are co-owned with their parents,” Gordon said.

He noted the prominence of this trend in pricier urban markets, such as Toronto and Vancouver, where the children of parents with the most housing wealth tended to own properties that were approximately 30 to 40 per cent more valuable than those whose parents had less housing wealth.

“That indicates that parental housing wealth can play an important role in the homeownership aspirations of young adults,” he said.

When it comes to the impact these trends have on housing affordability in Canada, Mirdamadi said these findings are indicative of “the catalyst or the impetus” of the mounting challenge of entering the housing market.

“Your outcomes, your situation, your homeownership status will come to be more influenced by how your parents are doing, and so people may have concerns around intergenerational inequity as a result of that,” Gordon added.

The analysts aren’t tasked with outlining how their findings should inform policy decisions, but Gordon said, “It raises important questions about the extent to which people have equal opportunities in society. It pertains to those types of questions.”

CTVNews.ca Top Stories

Trump again calls to buy Greenland after eyeing Canada and the Panama Canal

First it was Canada, then the Panama Canal. Now, Donald Trump again wants Greenland.

King Charles ends royal warrants for Ben & Jerry's owner Unilever and Cadbury chocolatiers

King Charles III has ended royal warrants for Cadbury and Unilever, which owns brands including Marmite and Ben & Jerry’s, in a blow to the household names.

LIVE UPDATES Parts of Ontario under snowfall warning Monday as holiday travellers hit the road

Holiday travellers and commuters could be in for a messy drive on Monday morning as a significant round of snowfall moves into the region. Here are live updates on the situation in Toronto.

Statistics Canada reports real GDP grew 0.3 per cent in October

Statistics Canada says the economy grew 0.3 per cent in October, helped by strength in the mining, quarrying, and oil and gas extraction sector, following a 0.2 per cent increase in September.

U.S. House Ethics report finds evidence Matt Gaetz paid thousands for sex and drugs including paying a 17-year-old for sex in 2017

The U.S. House Ethics Committee found evidence that former Rep. Matt Gaetz paid tens of thousands of dollars to women for sex or drugs on at least 20 occasions, including paying a 17-year-old girl for sex in 2017, according to a final draft of the panel's report on the Florida Republican, obtained by CNN.

The rent-a-friend industry is booming among Canada's Chinese diaspora

Dozens of people are offering rent-a-friend services on Xiaohongshu, a social media platform also known as Little Red Book or China's Instagram, in cities including Vancouver, Calgary and Toronto.

Dozens of luxury condos and hotels in Florida are sinking, study finds

Dozens of luxury condos, hotels and other buildings in southeast Florida are sinking at a surprising rate, researchers reported in a recent study.

Nordstrom agrees to US$6.25B buyout deal from founding family

Nordstrom said on Monday it would be acquired by its founding family and Mexican retailer El Puerto de Liverpool in an all-cash deal valuing the department store chain at about US$6.25 billion.

Biden gives life in prison to 37 of 40 federal death row inmates before Trump can resume executions

U.S. President Joe Biden announced on Monday that he is commuting the sentences of 37 of the 40 people on federal death row, converting their punishments to life imprisonment just weeks before president-elect Donald Trump, an outspoken proponent of expanding capital punishment, takes office.