How much does $1 million buy you in Canada's housing market?

The purchasing power of buyers with a $1 million budget searching for a home in Canada will widely vary depending on the city they are shopping in with those in Toronto getting less square footage and fewer bedrooms than everywhere aside from Vancouver, according to a new report.

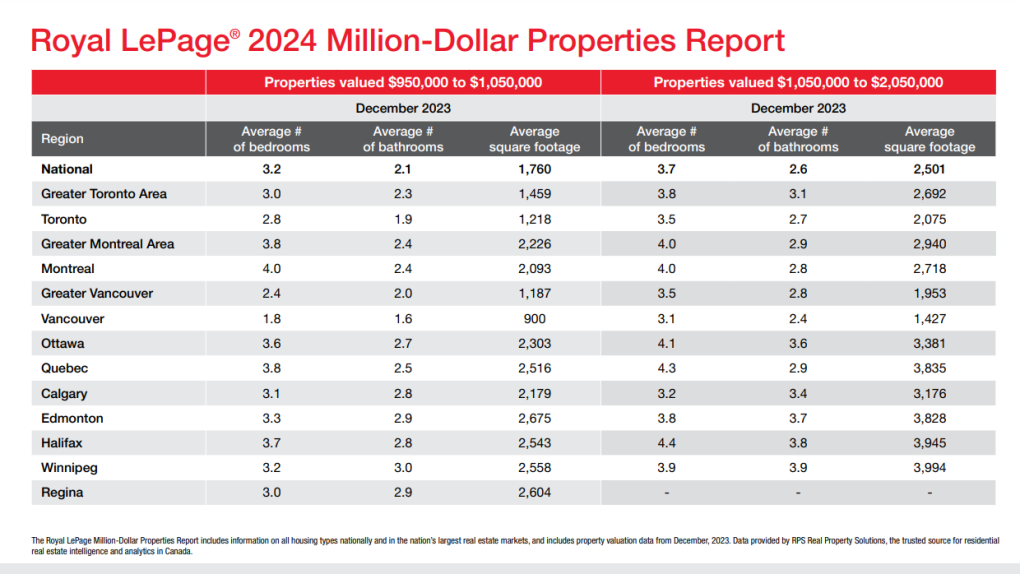

The Royal LePage Million-Dollar Properties Report, released Thursday, found a $1-million property in Canada had 3.2 bedrooms, 2.1 bathrooms and 1,760 square feet of living space on average in December 2023.

However, a $1 million property can range from a luxurious detached home to a two-bedroom condominium, depending on the location.

- Download our app to get local alerts on your device

- Get the latest local updates right to your inbox

“In Calgary, a budget of $1 million is considered the move-up price point for existing homeowners. In Vancouver, the same amount is often the starting point for entry-level buyers," Karen Yolevski, Chief Operating Officer of Royal LePage Real Estate Services Ltd., said.

The average home in the Greater Toronto Area (GTA) valued between $950,000 and $1,050,000 in December 2023 had 3 bedrooms, 2.3 bathrooms and 1,459 square feet of living space – 301 square feet less than the national average.

A home in the City of Toronto at the same price point had 2.8 bedrooms, 1.9 bathrooms and 1,218 square feet of living space – 241 square feet less than the average property in the greater region, and 542 square feet less than the national average.

The average GTA home valued at a higher price point – between $1,950,000 and $2,050,000 – had 3.8 bedrooms, 3.1 bathrooms and 2,692 square feet of living space – 191 square feet more than the national average.

A home within the same price point situated in the City of Toronto had 3.5 bedrooms, 2.7 bathrooms and 2,075 square feet of living space – 717 square feet less than the average property in the greater region, and 526 square feet less than the national average.

Royal LePage 2024 Million-Dollar Properties Report"In the City of Toronto, $1 million is the entry-level price point for most property types. With this budget, a two-bedroom condominium or condo-townhome is realistic. If your budget is closer to the $2-million mark, then you can unlock larger and more updated properties in desirable downtown neighbourhoods,” Toronto broker Shawn Zigelstein explained.

Royal LePage 2024 Million-Dollar Properties Report"In the City of Toronto, $1 million is the entry-level price point for most property types. With this budget, a two-bedroom condominium or condo-townhome is realistic. If your budget is closer to the $2-million mark, then you can unlock larger and more updated properties in desirable downtown neighbourhoods,” Toronto broker Shawn Zigelstein explained.

Zigelstein noted that the number of homes sold over the $1 million threshold in the GTA has increased dramatically over the past six years, putting pressure on the lower end of the market, which faces increased demand.

Vancouver was the only other market that got buyers less bang for their buck than in Toronto.

The average home in Greater Vancouver valued between $950,000 and $1,050,000 in December of 2023 had 2.4 bedrooms, 2.0 bathrooms and 1,187 square feet of living space – 573 square feet less than the national average.

A house in Canada as featured in a Royal LePage report. "If you're shopping for a home in Vancouver's downtown core, $1 million can get you into a two-bedroom condo or a small loft-style townhouse. However, when you expand your search eastward and deep into the Fraser Valley, you can find a starter detached single-family home at this price point," Adil Dinani, a local sales representative, said.

A house in Canada as featured in a Royal LePage report. "If you're shopping for a home in Vancouver's downtown core, $1 million can get you into a two-bedroom condo or a small loft-style townhouse. However, when you expand your search eastward and deep into the Fraser Valley, you can find a starter detached single-family home at this price point," Adil Dinani, a local sales representative, said.

According to a Royal LePage survey conducted by Leger, two thirds of Canadians overall believe that $1 million is a reasonable budget to afford a home that meets their household's needs.

But, Canadians living in the country's most expensive provinces are much less likely to feel that a $1-million budget is enough to buy a home.

Forty-five per cent of British Columbians and 31 per cent of Ontarians say that a $1 million budget is not enough to meet their household’s needs while only 12 per cent in Alberta and 8 per cent in Quebec felt the same way.

CTVNews.ca Top Stories

Chants of 'shame on you' greet guests arriving for the annual White House correspondents' dinner

An election-year roast of U.S. President Joe Biden before journalists, celebrities and politicians at the annual White House correspondents' dinner Saturday.

What is a 'halal mortgage'? Does it make housing more accessible?

The 2024 federal budget announced on April 16 included plans to introduce “halal mortgages” as a way to increase access to home ownership.

Here's where Canadians are living abroad: report

A recent report sheds light on Canadians living abroad--estimated at around four million people in 2016—and the public policies that impact them.

Deadly six-vehicle crash on Highway 400 sparked by road rage incident

One person was killed in a six-vehicle crash on Highway 400 in Innisfil Friday evening.

Opinion I just don't get Taylor Swift

It's one thing to say you like Taylor Swift and her music, but don't blame CNN's AJ Willingham's when she says she just 'doesn't get' the global phenomenon.

Invasive and toxic hammerhead worms make themselves at home in Ontario

Ontario is now home to an invasive and toxic worm species that can grow up to three feet long and can be dangerous to small animals and pets.

Harvey Weinstein hospitalized after return to New York from upstate prison

Harvey Weinstein’s lawyer said Saturday that the onetime movie mogul has been hospitalized for a battery of tests after his return to New York City following an appeals court ruling nullifying his 2020 rape conviction.

'We are declaring our readiness': No decision made yet as Poland declares it's ready to host nuclear weapons

Polish President Andrzej Duda says while no decision has been made around whether Poland will host nuclear weapons as part of an expansion of the NATO alliance’s nuclear sharing program, his country is willing and prepared to do so.

Central Alberta queer groups react to request from Red Deer-South to reinstate Jennifer Johnson to UCP caucus

A number of LGBQT+2s groups in Central Alberta are pushing back against a request from the Red Deer South UCP constituency to reinstate MLA Jennifer Johnson into the UCP caucus.