TORONTO - The Toronto stock market jumped about two per cent Monday to add to last week's strong advance as oils and metals benefited from a falling U.S. dollar and spearheaded a broad-based advance.

The S&P/TSX composite index surged 236.46 points to 11,486.88 after rising about three per cent last week despite employment reports from Canada and the United States on Friday that came in much worse than expected.

But investors consoled themselves that interest rates were unlikely to rise in such a weak economic environment.

And investors also got good news from the weekend gathering of officials from the G20 countries, including Canada, that governments are in no hurry to cut off stimulus measures.

Low interest rates attract investors into the stock market because many have been sitting on cash and realizing little returns from money market funds.

Irwin Michael, portfolio manager at ABC Funds, noted that investors worldwide have about $12.6 trillion in those funds, with Canadian investors holding around $1 billion.

"This money is looking for an entry point into the marketplace, most people being very finicky and very nervous," he said.

"And now the G20...they've basically said we're going to leave things as they are and maybe if anything we'll have to stimulate a little more -- so we know rates are going to remain low."

American currency weakness and higher commodity prices helped take the Canadian dollar up 1.57 cents to 94.57 cents US.

"The Canadian dollar wasn't the top performer today -- I mean the Norwegian krone did better, the Swedish krona did a little bit better, the New Zealand dollar did a little bit better," said David Watt, senior currency analyst at RBC Capital Markets.

"That tells you it's not just the Canadian dollar going off on its lonesome toward strength. So it really does reflect the fact that markets are prepared to take risk."

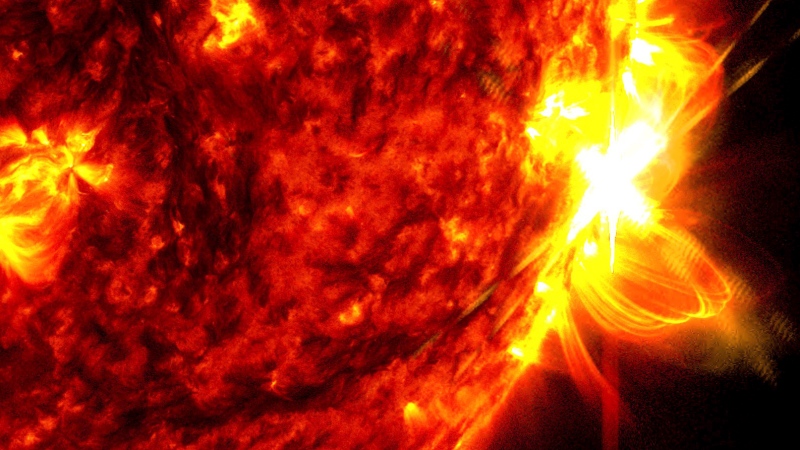

A falling U.S. dollar and worries that hurricane Ida could damage oil installations in the Gulf of Mexico pushed the December crude contract on the New York Mercantile Exchange up $2 to US$79.43 a barrel. The energy sector rose 2.94 per cent, with EnCana Corp. (TSX:ECA) ahead $1.65 to C$62.77 while Suncor Inc. (TSX:SU) advanced $1.95 to $37.35.

Bullion continued to set records, with the December gold contract on the Nymex ahead $5.70 to US$1,101.40 an ounce, pushing the gold sector ahead 2.26 per cent.

"(Central banks) continue to print money and everything is sloshing around, you run the risk of inflation -- not regular, it could be a little more hyper if the monetary base keeps on growing the way it is," added Michael.

"So, by extension, people want to buy gold, they want to buy those industries -- whether it be metals (or) whatever -- that will benefit from inflation."

Goldcorp Inc. (TSX:G) rose $2.01 to $46.49 and Kinross Gold Corp. (TSX:K) improved 48 cents to $20.60.

The base metals sector was up 3.15 per cent as December copper gained 1.5 cents to US$2.97 a pound. Teck Resources (TSX:TCK.B) gained $1.03 to $34.22 and HudBay Minerals (TSX:HBM) rose 74 cents to $16.97.

The financial sector was also stronger, ahead 2.28 per cent. Manulife Financial (TSX:MFC) was up 49 cents to $21.04, while TD Bank (TSX:TD) rose $2.01 to $66.59.

The TSX Venture Exchange was 14.86 points ahead to 1,355.48.

New York markets also advanced as investors took in major acquisition news from the food industry as Kraft Foods made a cash and stock offer worth US$16.46 billion for Cadbury Inc. Cadbury has rejected the offer, saying it "does not come remotely close to reflecting the true value" of the company.

The Dow Jones industrial average jumped 203.52 to 10,226.94 after charging ahead 3.19 per cent last week.

The Nasdaq composite index climbed 41.62 points to 2,154.06 while the S&P 500 index rose 23.77 points to 1,093.07.

In economic news, Canada Mortgage and Housing Corp. said that the seasonally adjusted annual rate of housing starts reached 157,300 units in October, up from 149,300 units in September. CMHC said the multiple starts segment was largely responsible for the increase.

On the earnings front, IT services company CGI Group Inc. (TSX:GIB.A) said quarterly earnings from continuing operations totalled $82.6 million or 27 cents per share, up from a year-ago profit of $75.3 million or 24 cents per share. Revenue for the quarter was $926.1 million, down from $929.2 million a year before. Its shares declined 26 cents to $12.87.

Quadra Mining Ltd. (TSX:QUA) shares slipped 45 cents to $15 as the company reported net income of US$14.7 million or 16 cents per share in the third quarter, down from year-ago profit of US$20.8 million or 31 cents per share. Quarterly revenue totalled $87.2 million, down from $115.96 million last year, impacted by low sales volumes and one-time items.

Elsewhere, shares in Mega Brands Inc. (TSX:MB) soared 22 cents or 45.83 per cent to 70 cents after the company won a $72-million settlement related to its ill-fated acquisition of the Magnetix line of magnetic toys. The line, acquired from Lawrence, Jeffrey and Sydney Rosen's Rose Art business, had to be recalled and redesigned after it was learned that the magnets could come loose and be swallowed by children.

And shares in Bombardier Inc. (TSX:BBD.B), Canada's big aircraft and rail transit equipment maker, lost eight cents to $4.53. The decline came after president and chief executive Pierre Beaudoin said the company will further reduce aircraft production because of "the tough commercial aircraft market."

/>