Real estate firm increases house price forecast for Greater Toronto Area in 2022

Royal LePage is raising its forecast for 2022, despite some signs suggesting that the real estate market might finally be moderating after a frenzied run up in prices during the COVID-19 pandemic.

The real estate brokerage had initially forecast Canadian home prices to rise by 10.5 per cent in 2022 but it now says that it expects prices to be up 15 per cent by the fourth quarter of 2022, driven by a continued acceleration in the Greater Toronto Area.

The adjustment is being partially attributed to a record breaking first quarter, in which the average price of a Canadian home rose 25.1 per cent year-over-year to $856,900.

In the GTA, the acceleration in prices was even more pronounced, with the average home price increasing by 27.7 per cent year-over-year to $1,269,900.

Speaking with CP24 on Tuesday morning, Royal LePage President and CEO Phil Soper said that while there are signs that there could be some change afoot in the market, with the number of listings “increasingly slightly” in recent months, there is nothing to suggest that a correction is on the horizon.

Royal LePage, in fact, is still forecasting the average price of a home in the Greater Toronto Area to surpass $1.3 million by the end of 2022, which would equate to a 16.5 per cent year-over-year increase.

“It's a complex thing our economy. Some things make prices rise, other things push consumer confidence down and that's the kind of turmoil that Canadians are wrestling with right now,” Soper said. “In general things continue to look positive for housing in the country as more people move to Canada but people are being a little more cautious and certainly the rising interest rates have heightened people's awareness that the economy is in an unusual place.”

Real estate prices have surged during the COVID-19 pandemic and in the first quarter of 2022 the average price of a detached home in four Golden Horsehsoe communities - Barrie, Cambridge, Kitchener-Waterloo and Oshawa – all surpassed $1 million for the first time.

Soper told CP24 that occasional “periods of irrational exuberance” in the real estate market do all “run their course” eventually and there are at least “early indicators” of a change in buyer mentality.

But it remains to be seen whether there will be any relief for first time buyers trying to get into the market, especially with the Bank of Canada now in the midst of a rate hiking cycle that many experts expect will ultimately result in a significant increase in the cost of borrowing.

“Demand for housing in Toronto and the surrounding region remains strong. Despite a slight increase in new listings in recent weeks, competition is still very tight among buyers looking to enter the market ahead of further interest rate hikes,” Royal LePage’s Chief Operating Officer Karen Yolevski said in a press release. “The condo market is particularly competitive, as some former residents are returning to the city due to return-to-office mandates and first-time buyers looking to enter the market at a more affordable price point.”

Royal LePage provided data on house prices in 62 different markets as part of its updated forecast.

Prices in Toronto were up 20.9 per cent year-over-year in the first quarter of 2022, which was actually below the national average.

The following summarizes the average price increase in GTA communities between the first quarter of 2021 and the first quarter of 2022:

- Brampton – 30.5 per cent

- Mississauga – 26.1 per cent

- Hamilton – 32.4 per cent

- Oakville - 28.2 per cent

- Oshawa – 29.4 per cent

- Pickering – 25.4 per cent

- Vaughan - 26.3 per cent

- Whitby – 34.2 per cent

- Richmond Hill – 24.7 per cent

- Markham – 22 per cent

- Ajax - 32.2 per cent

CTVNews.ca Top Stories

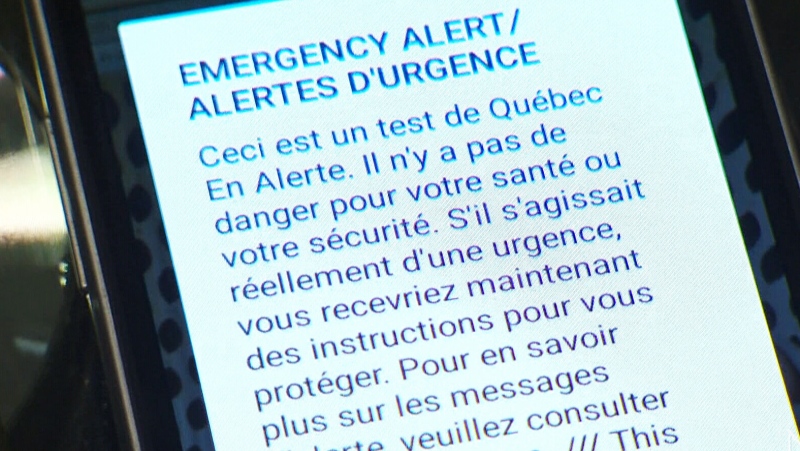

Most of Canada to receive emergency alert test today

The federal government will test its capacity to issue emergency alerts today, with the exception of Ontario, where the test will take place on May 15.

OPINION What King Charles' schedule being too 'full' to accommodate son suggests about relationship with Prince Harry

Prince Harry, the Duke of Sussex, has made headlines with his recent arrival in the U.K., this time to celebrate all things Invictus. But upon the prince landing in the U.K., we have already had confirmation that King Charles III won't have time to see his youngest son during his brief visit.

Ontario man devastated to learn $150,000 line of credit isn't insured after wife dies

An Ontario man found out that a line of credit he thought was insured actually isn't after his wife of 50 years died.

Boy Scouts of America is rebranding. Here's why they're now named Scouting America

After more than a century, Boy Scouts of America is rebranding as Scouting America, another major shakeup for an organization that once proudly resisted change.

New Canadian study could be a lifesaver for thousands suffering from CTE

A first-of-its-kind Canadian research study is working towards a major medical breakthrough for a brain disorder, believed to be caused by repeated head injuries, that can only be detected after death.

Rape, terror and death at sea: How a boat carrying Rohingya children, women and men capsized

In March, Indonesian officials and local fishermen rescued 75 people from the overturned hull of a boat off the coast of Indonesia. Until now, little was known about why the boat capsized.

Stormy Daniels describes meeting Trump during occasionally graphic testimony in hush money trial

With Donald Trump sitting just feet away, Stormy Daniels testified Tuesday at the former president's hush money trial about a sexual encounter the porn actor says they had in 2006 that resulted in her being paid to keep silent during the presidential race 10 years later.

These adults born in the '90s partnered with their parents to buy homes in Ontario

An Ontario woman said it would have been impossible to buy a house without her mother – an anecdote that animates the fact that over 17 per cent of Canadian homeowners born in the ‘90s own their property with their parents, according to a new report.

For their protection, immigrants critical of China and India call for speedy passage of Canada's foreign interference legislation

Canadian immigrants threatened by hostile regimes are urging parliamentarians to quickly pass the 'Countering Foreign Interference Act' so they can feel safe living in their adopted home.