Ontario deficit shrinks by $3.3 billion

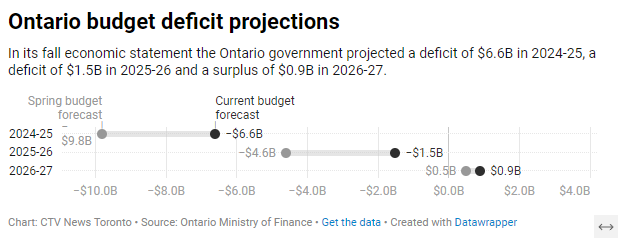

Ontario’s deficit for 2024-25 has shrunk by $3.3 billion since the Ford government released the provincial budget earlier this year and the province says it expects that deficit to flip to a larger-than-expected surplus within the next two years.

“Inflation and our growing economy have brought in unexpected tax revenues,” Finance Minister Peter Bethlenfalvy said in the government’s fall economic statement, titled “Building Ontario For You.”

The deficit for 2024-25 now stands at $6.6 billion, down from the $9.8 billion included in the 2024 budget. The province is now projecting a revised deficit of $1.5 billion for 2025-26 and a small surplus of $900 million in 2026-27.

That extra revenue comes from boosted sales tax revenue due to inflation, as well as changes to capital gains tax rules by the federal government.

Bethlenfalvy said that’s why the government can afford to give each taxpayer a one-time cheque of $200, expected to be mailed out early in 2025.

Those cheques, which the province says are intended to help Ontarians with the high cost of living, will cost $3 billion. The government says it’s not yet clear how much it will cost to administer the program.

“While inflation and interest rates are coming down, the cost of groceries, the cost of gas, the cost of housing, is still impacting a lot of households and families right across Ontario,” Bethlenfalvy said. “I think the relief has to happen now, and that's why I'm giving back $200 for every taxpayer in Ontario.”

Overall, the province is spending slightly more than projected in the budget, with a total spend of $218.3 billion, up from $214.5 billion.

In terms of growth, the province’s real GDP is expected to shrink to 0.9 per cent this year, from 1.4 per cent in 2023. The province is predicting that it will strengthen to 1.7 per cent in 2025 and 2.3 per cent by 2026.

Employment growth is also lower this year at 1.4 per cent, down from 2.4 per cent last year. That number is expected to stay at or below 1.5 per cent in 2025 through 2027.

Notably, the province is lowering its forecast for housing starts this year and through 2027. While the budget had predicted 87,900 new homes this year, that forecast has been revised to 81,300. About 6,000 fewer homes are expected in 2025, for a new projection of 86,500.

Ontario's updated budget projections are shown.

Ontario's updated budget projections are shown.

Other cost of living measures

The update includes a number of other measures intended to reduce the cost of living.

As announced earlier this week, the province is also extending the temporary gas and fuel tax cuts to June 30, 2025. They say that with the latest extension, the move will have saved the average household $380 since it was implemented in July 2022.

Bethlenfalvy said the “One Fare” integration of transit fares across municipalities is saving daily transit users $1,600 a year. The province says that over 90 per cent of transit riders in the Greater Golden Horseshoe region have access to the program.

For Ontarians seeking fertility treatment, the province will be investing an extra $150 million over two years to expand the Ontario Fertility Program. The government says this will triple the number of individuals who are able to receive government-funded IVF.

The province will introduce a new tax credit in 2025 that would cover up to 25 per cent of eligible treatment expenses for Ontario residents.

LCBO and gaming revenue lower

The government expects the LCBO’s net income to be down from previous forecasts for the next two years due to the impact of this year’s strike, the retail expansion of alcohol sales to corner stores, and lower sales projections.

For 2024-25, the LCBO’s net income is expected to be $2.17 billion, about $286 million less than the budget forecast. For 2025-26, it’s expected to be $2.23 billion, about $254 million less than previously expected.

The government expects that income to pick up in 2026-27 as the LCBO transitions to its expanded role as a wholesaler. The increased net income for that year is now projected at $2.65 billion, roughly $96 million more than previously expected.

Implementing the new alcohol marketplace is costing the government $87 million for 2024-25.

By 2027, the LCBO is expected to have 77.1 per cent of Ontario’s alcohol market share, compared to 51.2 per cent this year. That will mostly come from eating up some of The Beer Store’s current 41.1 per cent share, which is expected to shrink to 15 per cent by 2027.

The province has previously disclosed that it will pay The Beer Store up to $225 million to end the deal before it was set to expire.

The government says it is doing a review of taxes, fees and markups on alcohol to create a more competitive market.

Revenue for the Ontario Lottery and Gaming Corporation (OLG) is also projected to be lower, as consumers cut back on unnecessary spending due to higher living costs.

Revenue drops from the OLG and LCBO are partly offset, however, by higher projected income from Ontario Power Generation, the update said. The government said that’s largely due to realized gains projected for the Ontario Nuclear Funds.

No details on Crosstown or Hwy. 401 tunnel

The province says “significant progress” has been made on the much-delayed Eglinton Crosstown LRT project, but there is no opening date in the update.

As previously disclosed by Metrolinx, the government says that “nearly all occupancy permits have been received by The City of Toronto” and the project continues in the testing and commissioning phase.

There were also few details in the update on an idea previously announced to build a tunnel under Highway 401.

Latest numbers ‘a magic show’: Opposition

Reacting to the economic update Wednesday, opposition parties characterized the government’s latest projection as a “magic show” where they set conservative estimates, only to miraculously beat them down the road. They predicted that the government will balance the budget in the spring, only to call an early election afterward.

Opposition Leader Marit Stiles said the government is playing a “shell game.”

“At the end of the day, if that's what we end up with – $200 checks and a balanced budget – this is a gimmick. The people of Ontario are wondering ‘why aren't we getting what we have already paid for?’” Stiles said.

Ontario Liberal Leader Bonnie Crombie sounded a similar note.

“We know very well they're going to announce a balanced budget when they have money – a billion dollars set aside in a contingency reserve that, by the way, could be so better utilized right now,” Crombie said.

“A billion dollars would help us hire 13,000 nurses or 15,000 teachers, which our economy, our children and people who need health care sorely deserve.”

For his part, Bethlenfalvy denied that he intentionally sets conservative estimates so that government can later say they beat them.

“Would I like to beat those numbers? Absolutely. I mean, what finance minister wouldn't want to beat their numbers?” He told reporters. “But I think the statement today reflects a realistic forecast of how we see – based on the economic factors, our revenues and our spending – a realistic outcome for next year.”

Stiles also called the lower forecast for housing starts and lack of further initiatives there “extraordinary” at a time when the province has promised to build 1.5 million new homes by 2031.

“Why is this government so incapable of building the homes that people need desperately,” she said. “The problem is getting bigger by the day.”

Other highlights

- The province is slightly boosting The Ontario Municipal Partnership Fund – the main general assistance grant to municipalities – by $100 million over two years for small, rural and northern municipalities.

- The government will spend around $88 million over three years, starting in 2026, to expand Learn and Stay grants for 1,360 eligible undergraduate students who commit to practising family medicine with a full roster of patients once they graduate The funding will cover all tuition and other direct educational costs like books, supplies and equipment in exchange for a term of service as a physician in any community across Ontario.

CTVNews.ca Top Stories

BREAKING Donald Trump picks former U.S. congressman Pete Hoekstra as ambassador to Canada

U.S. president-elect Donald Trump has nominated former diplomat and U.S. congressman Pete Hoekstra to be the American ambassador to Canada.

Genetic evidence backs up COVID-19 origin theory that pandemic started in seafood market

A group of researchers say they have more evidence to suggest the COVID-19 pandemic started in a Chinese seafood market where it spread from infected animals to humans. The evidence is laid out in a recent study published in Cell, a scientific journal, nearly five years after the first known COVID-19 outbreak.

This is how much money you need to make to buy a house in Canada's largest cities

The average salary needed to buy a home keeps inching down in cities across Canada, according to the latest data.

Canada's space agency invites you to choose the name of its first lunar rover

The Canadian Space Agency (CSA) is inviting Canadians to choose the name of the first Canadian Lunar Rover.

'My two daughters were sleeping': London Ont. family in shock after their home riddled with gunfire

A London father and son say they’re shocked and confused after their home was riddled with bullets while young children were sleeping inside.

Smuggler arrested with 300 tarantulas strapped to his body

Police in Peru have arrested a man caught trying to leave the country with 320 tarantulas, 110 centipedes and nine bullet ants strapped to his body.

Boissonnault out of cabinet to 'focus on clearing the allegations,' Trudeau announces

Prime Minister Justin Trudeau has announced embattled minister Randy Boissonnault is out of cabinet.

Baby dies after being reported missing in midtown Toronto: police

A four-month-old baby is dead after what Toronto police are calling a “suspicious incident” at a Toronto Community Housing building in the city’s midtown area on Wednesday afternoon.

Sask. woman who refused to provide breath sample did not break the law, court finds

A Saskatchewan woman who refused to provide a breath sample after being stopped by police in Regina did not break the law – as the officer's request was deemed not lawful given the circumstances.