Ontario home insurance rates to rise 5 per cent or more in 2022

Due to the pandemic, inflation and supply chain issues, many things have increased in price and now it looks like home insurance will as well.

“We do anticipate seeing larger than normal increases in 2022," Henry Lof, with the insurance comparison website RatesDotCa, told CTV News Toronto Friday.

Lof said the industry is expecting that home insurance premiums will rise 5 per cent in 2022 and some companies may increase premiums 10 per cent or more.

According to the website, the average cost for home insurance last year in Ontario was $1,342 annually. It expects a jump of $67 to $1,409, but Lof said some companies may implement larger increases.

One of the primary reasons for the hikes is extreme weather issues due to climate change. The tornado that ripped through Barrie, Ontario in July led to insurance losses of $100 million.

The flooding in British Columbia in November was the most severe weather event in the province's history, leading to losses of more than $450 million.

"We do know across Canada in 2021, there were about 2 billion dollars of severe weather claims that were incurred from coast to coast,” Rob de Pruis, with the Insurance Bureau of Canada (IBC), told CTV News Toronto.

It may br frustrating for clients to see their rates go up even if they haven’t had a claim, but the industry says that when there are huge losses they will push up premiums for all customers.

“The underpinning concept of insurance is spreading the losses of the few among the many," Lof said.

IBC said that inflation, supply chain issues and the rising costs to rebuild a home are also putting pressure on premiums.

Many homeowners have also invested in their homes during the pandemic which makes them worth more.

RatesDotCa said rates are rising for multiple reasons — renovations have increased home values, the cost of home replacement has gone up, there has been an increase in the price of building materials and climate change and severe weather is leading to large insurance losses.

Clients are advised to ask if they're eligible for any discounts and to shop around to see if they can find a better deal.

“Across Canada, there are 200 insurance companies selling home, auto and business insurance, so there is quite a bit of competition,” de Pruis said.

Homeowners are also advised to contact their insurer to see if a security system, a good credit rating or bundling home and auto policies can save them money.

One of the most common insurance claims is flooding, so you want to make sure you have the proper flood coverage because, when it comes to water damage, there can be big differences between policies.

Customers are warned to not shop by price alone and to compare policies carefully.

CTVNews.ca Top Stories

Western University researchers unlock potential 'cure' for ALS

New research out of London, Ont.'s Western University is shedding light on a potential cure for ALS, in which the targeting of the interaction between two proteins can halt or fully reverse the disease's progression.

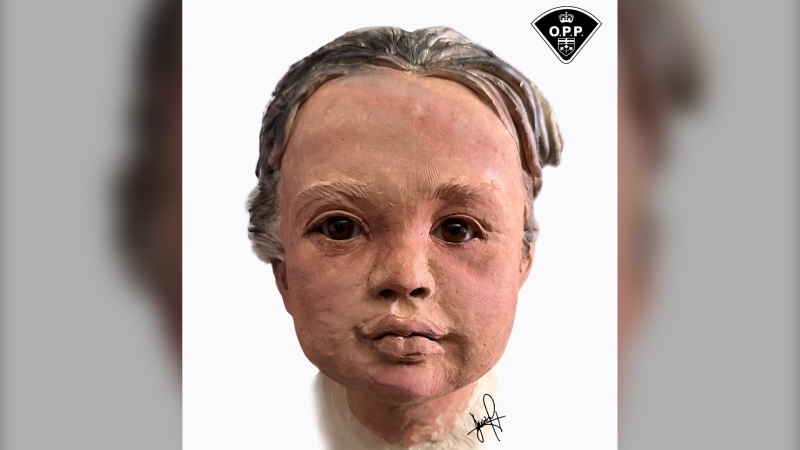

Police release 3D images of young child found in an Ontario river two years ago

Police have released a three-dimensional image of a young child whose remains were discovered in the Grand River in Dunnville, Ont. almost two years ago.

B.C. brings in law on name changes on day that child killer's new identity revealed

The BC NDP have tabled legislation aimed at stopping people who have committed certain heinous acts from changing their names.

Kamala Harris drops F-bomb during White House live-stream

U.S. Vice-President Kamala Harris used a profanity on Monday while offering advice to young Asian Americans, Native Hawaiians and Pacific Islanders about how to break through barriers.

B.C. man fighting for refund after finding someone living at Whistler vacation rental

Edwin Mostered spent thousands of dollars booking a vacation home in Whistler, B.C., for a group skiing trip earlier this year – or so he thought.

Avs forward Valeri Nichushkin suspended at least six months

Colorado Avalanche forward Valeri Nichushkin was suspended for at least six months without pay and placed in Stage 3 of the league's player assistance program.

Collapsed Baltimore bridge span comes down with a boom after crews set off chain of explosives

Crews conducted a controlled demolition Monday to break down the largest remaining span of the collapsed Francis Scott Key Bridge in Baltimore.

Security video caught admitted serial killer disposing of bodies in Winnipeg garbage bins

Security video caught admitted serial killer Jeremy Skibicki on multiple late-night outings, disposing of body parts in nearby garbage bins and dumpsters in the middle of the night.

Mortgage companies could intensify the next recession, U.S. officials warn

U.S. officials worry the next recession could be intensified by a cascading series of failures in the mortgage industry caused by crashing home prices, frozen financial markets and soaring delinquencies.