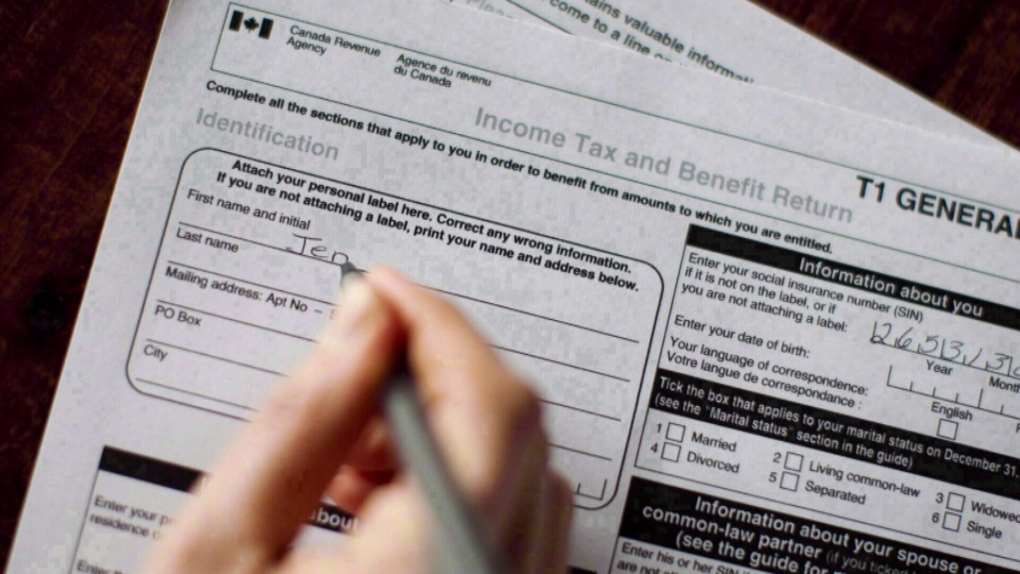

Ontario income credits people need to know about before filing their taxes

While the deadline to file your taxes gets closer, there are some personal tax credits people in Ontario may qualify for.

“Today is the best time to start putting all your papers together, and that way, you’ll be sure you don’t forget anything,” H&R Block tax specialist, Yannick Lemay, told CTV News Toronto.

“Often what we see in practice is that the credits that get forgotten are those that people need to search for slips, they need to search for receipts.”

Lemay brought up Ontario’s Staycation Tax Credit as an example. Through this credit, Ontarians who have stayed in a hotel or rented a cottage in the province can claim 20 per cent of eligible accommodation expenses between Jan. 1 and Dec. 31, 2022.

“We are excluding costs for food, entertainment, gas, and all extra expenses, but anything that goes for accommodation for travel, you can claim,” he said, noting Ontarians who want to apply for this credit should have all of their receipts. “It’s up to $1,000 [for an individual], and it’s a 20 per cent rate credit, so that means Ontarians can get up to $200 back.”

Families and couples can claim up to $2,000 and get a maximum credit of $400.

“Now is the time to get those receipts,” Lemay said. “But there are other credits that have changed, improved, or are new credits, for which you don’t necessarily have to provide an additional receipt.”

Lemay pointed to the Ontario Seniors Care at Home Tax Credit, which can help low to moderate-income seniors with eligible medical expenses.

Seniors who are 70 years and older can write off up to 25 per cent of their medical expenses, and can claim up to $6,000 for a maximum of $1,500 in return.

The credit is refundable and anyone earning up to $65,000 annually can qualify, though the amount of credit is on a sliding scale based on income level.

There is also the Childcare Access and Relief from Expenses (CARE) tax credit, which helps families with a household income of $150,000 or less. Eligible families may be able to claim up to 75 per cent of child care expenses, including child care centres and camps.

While there are personal income tax credits, Lemay says there are also deductions that Ontarians will want to keep in mind.

Anyone who has moved to be closer to work or school might be able to claim their moving expenses, he said.

“Sometimes people think they don’t move far enough to be able to deduct moving expenses, but the criteria is 40 kilometres,” Lemay said.

According to the federal government, if your new home is at least 40 kilometres closer to your new job than your previous home was, you can be eligible for the moving expenses deduction.

Lemay also noted those who have investments outside of their registered accounts – like their Tax Free Savings Account (TFSA) or Registered Retirement Savings Plan (RRSP) – can deduct management fees.

“If you’re paying management fees to your financial institution to manage your money – your investments – those fees are deductible, and they don’t come with a tax slip,” Lemay said. “Sometimes you have to look at the bank statement to find the fees.”

May 1 is the deadline for most Canadians to file their tax returns, with June 15 being the deadline for those who are self-employed.

CTVNews.ca Top Stories

'State or state-sponsored actor' believed to be behind B.C. government hacks

The head of British Columbia’s civil service has revealed that a “state or state-sponsored actor” is behind multiple cyber-security incidents against provincial government networks.

Here's how much more Canadian landlords are asking for now, according to a just-released report

A new report says the average asking rent for a home in Canada in April was up 9.3 per cent compared with a year ago, while a slight month-over-month increase was also recorded for the first time since January.

Rare severe solar storm Friday could bring spectacular aurora light show across Canada

A rare and severe solar storm is expected to bring spectacular displays of the northern lights, also known as aurora borealis, across much of Canada and parts of the United States on Friday night.

Swarm of 20,000 bees gather around woman’s car west of Toronto

A swarm of roughly 20,000 bees gathered around a woman’s car in the parking lot of Burlington Centre.

What is basic income, and how would it impact me?

Parliamentarians are considering a pair of bills aiming to lift people out of poverty through a basic income program, but some fear these types of systems could result in more taxes for Canadians who are already financially struggling.

Canada abstains from Palestinian UN membership vote but supports two-state solution

Canada was one of 25 countries that abstained from a United Nations vote on Palestinian membership that passed with overwhelming support on Friday.

'I may have some nightmares:' Man survives being bitten by 2 sharks in Bahamas

A man who was bitten by two sharks in the Bahamas said Thursday he's 'thankful that I'm here' while sharing his story of survival.

Out-of-control wildfire burning near Fort McMurray

As of 9 a.m. on Friday, the wildfire burning 28 kilometres southwest of the northeastern Alberta city was 25 hectares in size.

Mexico's president accuses press and volunteer searchers for missing people of 'necrophilia'

The administration of Mexico's president has accused the press and volunteer searchers who look for the bodies of missing people of 'necrophilia,' comments that drew criticism this week.