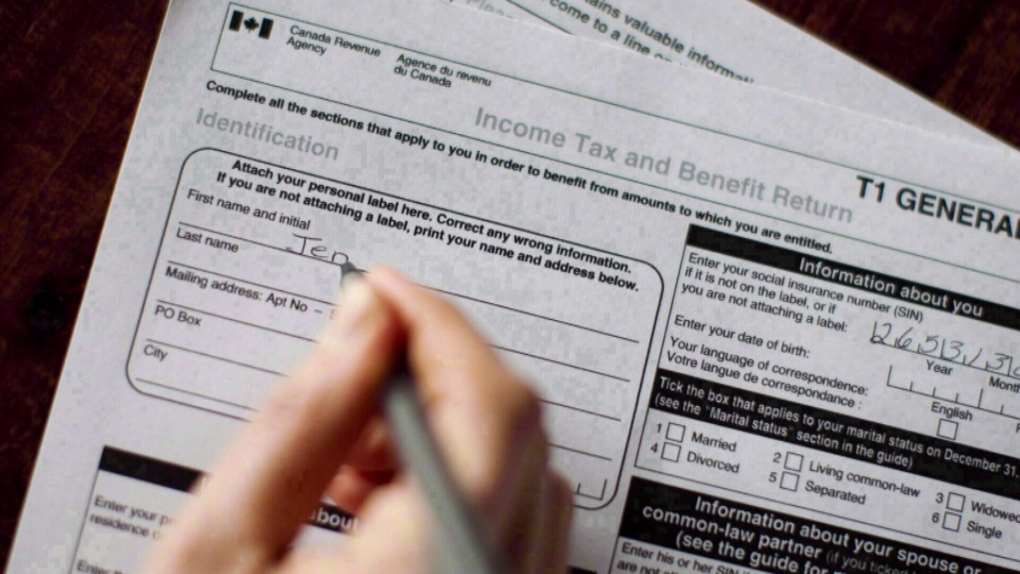

Ontario income credits people need to know about before filing their taxes

While the deadline to file your taxes gets closer, there are some personal tax credits people in Ontario may qualify for.

“Today is the best time to start putting all your papers together, and that way, you’ll be sure you don’t forget anything,” H&R Block tax specialist, Yannick Lemay, told CTV News Toronto.

“Often what we see in practice is that the credits that get forgotten are those that people need to search for slips, they need to search for receipts.”

Lemay brought up Ontario’s Staycation Tax Credit as an example. Through this credit, Ontarians who have stayed in a hotel or rented a cottage in the province can claim 20 per cent of eligible accommodation expenses between Jan. 1 and Dec. 31, 2022.

“We are excluding costs for food, entertainment, gas, and all extra expenses, but anything that goes for accommodation for travel, you can claim,” he said, noting Ontarians who want to apply for this credit should have all of their receipts. “It’s up to $1,000 [for an individual], and it’s a 20 per cent rate credit, so that means Ontarians can get up to $200 back.”

Families and couples can claim up to $2,000 and get a maximum credit of $400.

“Now is the time to get those receipts,” Lemay said. “But there are other credits that have changed, improved, or are new credits, for which you don’t necessarily have to provide an additional receipt.”

Lemay pointed to the Ontario Seniors Care at Home Tax Credit, which can help low to moderate-income seniors with eligible medical expenses.

Seniors who are 70 years and older can write off up to 25 per cent of their medical expenses, and can claim up to $6,000 for a maximum of $1,500 in return.

The credit is refundable and anyone earning up to $65,000 annually can qualify, though the amount of credit is on a sliding scale based on income level.

There is also the Childcare Access and Relief from Expenses (CARE) tax credit, which helps families with a household income of $150,000 or less. Eligible families may be able to claim up to 75 per cent of child care expenses, including child care centres and camps.

While there are personal income tax credits, Lemay says there are also deductions that Ontarians will want to keep in mind.

Anyone who has moved to be closer to work or school might be able to claim their moving expenses, he said.

“Sometimes people think they don’t move far enough to be able to deduct moving expenses, but the criteria is 40 kilometres,” Lemay said.

According to the federal government, if your new home is at least 40 kilometres closer to your new job than your previous home was, you can be eligible for the moving expenses deduction.

Lemay also noted those who have investments outside of their registered accounts – like their Tax Free Savings Account (TFSA) or Registered Retirement Savings Plan (RRSP) – can deduct management fees.

“If you’re paying management fees to your financial institution to manage your money – your investments – those fees are deductible, and they don’t come with a tax slip,” Lemay said. “Sometimes you have to look at the bank statement to find the fees.”

May 1 is the deadline for most Canadians to file their tax returns, with June 15 being the deadline for those who are self-employed.

CTVNews.ca Top Stories

'A beautiful soul': Funeral held for baby boy killed in wrong-way crash on Highway 401

A funeral was held on Wednesday for a three-month-old boy who died after being involved in a wrong-way crash on Highway 401 in Whitby last week.

'Sophisticated' cyberattacks detected on B.C. government networks, premier says

There has been a "sophisticated" cybersecurity breach detected on B.C. government networks, Premier David Eby confirmed Wednesday evening.

Police handcuff man trying to enter Drake's Toronto mansion

Toronto police say a man was taken into custody outside Drake's Bridle Path mansion Wednesday afternoon after he tried to gain access to the residence.

Biden says he will stop sending bombs and artillery shells to Israel if they launch major invasion of Rafah

U.S. President Joe Biden said for the first time Wednesday he would halt shipments of American weapons to Israel, which he acknowledged have been used to kill civilians in Gaza, if Prime Minister Benjamin Netanyahu orders a major invasion of the city of Rafah.

Rookie goalie Arturs Silovs to start for Canucks in Game 1 vs. Oilers

Rookie goalie Arturs Silovs will start in net for the Canucks as Vancouver kicks off a second-round series against the Edmonton Oilers Wednesday night.

Nijjar murder suspect says he had Canadian study permit in immigration firm's video

One of the Indian nationals accused of murdering British Columbia Sikh activist Hardeep Singh Nijjar says in a social media video that he received a Canadian study permit with the help of an Indian immigration consultancy.

Pfizer agrees to settle more than 10K lawsuits over Zantac cancer risk: Bloomberg News

Pfizer has agreed to settle more than 10,000 lawsuits about cancer risks related to the now discontinued heartburn drug Zantac, Bloomberg News reported on Wednesday, citing people familiar with the deal.

Quebec premier defends new museum on Quebecois nation after Indigenous criticism

Quebec Premier Francois Legault is defending his comments about a new history museum after he was accused by a prominent First Nations group of trying to erase their history.

U.S. presidential candidate RFK Jr. had a brain worm, has recovered, campaign says

Independent U.S. presidential candidate Robert F. Kennedy Jr. had a parasite in his brain more than a decade ago, but has fully recovered, his campaign said, after the New York Times reported about the ailment.