Toronto is now the closest its been to a 'buyer's market' since January: RBC

The tightening of market conditions that unfolded in the spring is “unwinding rapidly” and Toronto is now the closest it has been to a so-called buyer’s market since last winter, a new report from RBC suggests.

The report, which was released last week, shows that home sales in Toronto were down 8.7 per cent in July compared to the previous month even as listings inched up by 7.8 per cent.

The average benchmark price in Toronto was still up 1.1 per cent month-over-month in July but RBC says that the pace of further price gains are likely to be restrained so long as interest rates remain high.

“The spring tightening in demand-supply conditions is unwinding rapidly in BC and Ontario. Softer sales and increasing new listings returned most markets in these provinces to balance, with Toronto the closest it’s been to a buyer’s market since January,” the report states. “We expect higher interest rates to keep curbing buyers’ enthusiasm for months to come, while possibly forcing the hand of some current owners to sell.”

- Download our app to get local alerts on your device

- Get the latest local updates right to your inbox

RBC says that while price appreciation “remains generally brisk,” changes in market conditions have brought “overall demand-supply conditions in Canada back into balance after tightening surprisingly fast this spring.”

In fact, the bank says that a 24 per cent increase in listings that has occurred nationwide since April has now fully reversed the declines seen earlier this year.

Going forward, the bank anticipates that conditions in the real estate market will be “bumpy” but it is not calling for outright price declines at this time.

“We see this summer’s cooling as evidence the surprisingly strong rebound in the spring wasn’t sustainable. Our view had been—and remains—the recovery will be slow until interest rates are cut,” the report states. “What the spring rebound did, though, is bring forward the bottom of price cycle that we earlier anticipated around the fall. With prices rising sooner, the magnitude of the correction turned out to be smaller than expected. We think the resulting higher trough (in level terms) will restrain the pace of future price gains.”

The average selling price of a Toronto home across all property types peaked at $1,334,062 in February 2022 before dropping to a low of $1,037,542 amid what RBC previously called a “historic” housing correction brought about by the Bank of Canada’s aggressive interest rate hiking cycle.

The average selling price in July was $1,118,374, up about 4.2 per cent from one year prior.

CTVNews.ca Top Stories

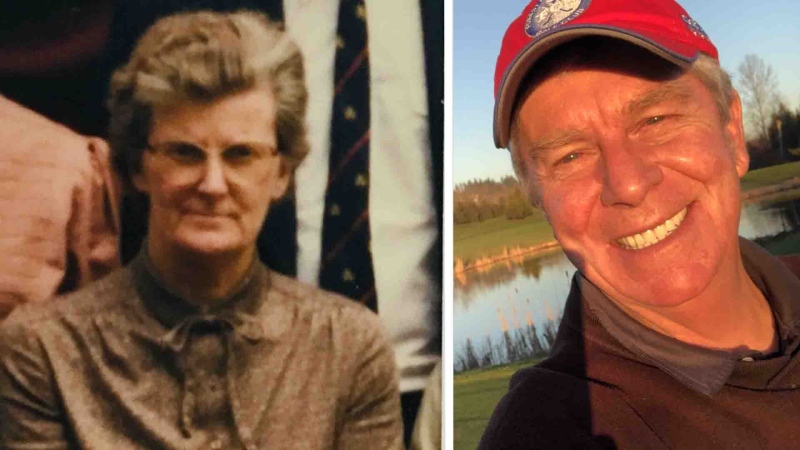

The story of how a B.C. man found his birth mother

After his adopted parents died, Dave Rogers set out to learn more about his birth mother. DNA results and a little help from friendly strangers would put him on a path to a small town in England.

Montreal man on the hook for thousands of dollars after a feature on his Tesla caused an accident

A Montreal man is warning Tesla drivers about using the Smart Summon feature after his vehicle hit another in a parking lot.

Italy's white-collar mafia is making a business killing

Italy's mafia rarely dirties its hands with blood these days. Extortion rackets have gone out of fashion and murders are largely frowned upon by the godfathers.

Spike in 'violent rhetoric' since Oct. 7 attack from 'extremist actors,' CSIS warns

The Israel-Hamas war has led to a spike in 'violent rhetoric' from 'extremist actors' that could prompt some in Canada to turn to violence, the Canadian Security Intelligence Service warns.

Russia announces nuclear weapon drills after angry exchange with senior Western officials

Russia plans to hold drills simulating the use of battlefield nuclear weapons, the Defense Ministry announced Monday, days after the Kremlin reacted angrily to comments by senior Western officials about the war in Ukraine and Moscow warned that tensions with the West are deepening.

Summer forecast: What to expect as El Nino weakens

As Canadians brace themselves for summer temperatures, forecasters say a weakening El Nino cycle doesn’t mean relief from the heat.

Actor Bernard Hill, of 'Titanic' and 'Lord of the Rings,' has died at 79

Actor Bernard Hill, who delivered a rousing cry before leading his people into battle in 'The Lord of the Rings: The Return of the King' and went down with the ship as the captain in 'Titanic,' has died.

Dash cam catches moment suspected drunk driver hits parked car, sends it careening into North Shore flower shop

Police say it’s fortunate no one was injured or killed in a collision at North Vancouver’s Park and Tilford shopping centre Saturday evening that sent one vehicle careening into a flower shop and another into a set of concrete barriers outside a Winners store.

Israeli army tells Palestinians to evacuate parts of Gaza's Rafah ahead of an expected assault

The Israeli army on Monday ordered tens of thousands of Palestinians in Gaza's southern city of Rafah to start evacuating from the area, signalling that a long-promised ground invasion there could be imminent.