Ontario teen who didn't report missing bank card told to repay $16,000 in fraudulent charges

An Ontario teen got his first bank card when he was 14 years old, but said he never bothered to read the fine print in his service agreement.

Now, he is 18 years old and wishes he had, as his bank is saying he is responsible for $16,000 in fraudulent cheques.

Angus, Ont. teen Quinton Thompson said his bank card went missing about a year ago and since he had spent his money from working in the summer months, he said he never bothered to check his bank account for over a month.

"At the end of November 2020 I lost my bank card and then, maybe early December, I reported it lost and I got a new one shipped to my house," Thompson told CTV News Toronto.

But during the time his card was missing, someone had found his bank card and deposited a fake government cheque of $8,026 into his Bank of Montreal account and then proceeded to withdraw the money.

"They withdrew $1,500, $1,500, $1,500, $1,500, $1,500, and $520. So they knew the exact amount to take out each time," said Andrew Cresswell, Thompson’s uncle, who has been helping him deal with the fraud.

When no one noticed the fraudulent activity, the thieves did it again and deposited another fake cheque for $7,997.42 and also withdrew the money over the following days from ATMs.

Over the course of one month, more than $16,000 was taken.

Thompson said the fraud was only discovered another month later when the government returned the cheques to the bank and said they were fakes. He filed a fraud report with the police and the Bank of Montreal’s Ombudsman but it was determined he would be held responsible for the fraud.

Thompson said the ombudsman found he was responsible for the losses because he failed to report his lost bank card in a timely manner and did not check his bank account for one month.

The family was told to repay the money.

"It feels like the bank doesn't care it was fraud, they just care about the money and they will do whatever is necessary to get it back," said Cresswell.

"My great-grandmother agreed to pay the money back that was owed and I made an agreement to pay the money back to her overtime," said Thompson.

CTV News Toronto contacted the Bank of Montreal and they agreed to review his case again.

"There are a number of factors that must be considered in these types of circumstances, and we are pleased we were able to resolve the matter to the family’s satisfaction," a spokesperson with BMO Financial Group said.

"We have strong measures in place to protect our customers, their accounts and their private information. It is important for customers to keep their password confidential and in a safe place at all times, ensure that it is only their fingerprints and facial ID stored on their mobile device, and that they notify us within 24 hours if their debit card, credit card or smartphone used for mobile banking is lost or stolen, or if their password confidentiality has been compromised in any way."

The Bank of Montreal said after reviewing the matter the family would be reimbursed the $16,000 that was fraudulently taken from Thompson’s account.

"My grandmother was so happy she started to cry," said Thompson, who added "This has taken a huge pressure off our shoulders.'

It's a lesson to watch your bank card carefully, safe guard your passwords and monitor your bank accounts often.

If you don't and there is fraud you could be held responsible for it.

CTVNews.ca Top Stories

Western University researchers unlock potential 'cure' for ALS

New research out of London, Ont.'s Western University is shedding light on a potential cure for ALS, in which the targeting of the interaction between two proteins can halt or fully reverse the disease's progression.

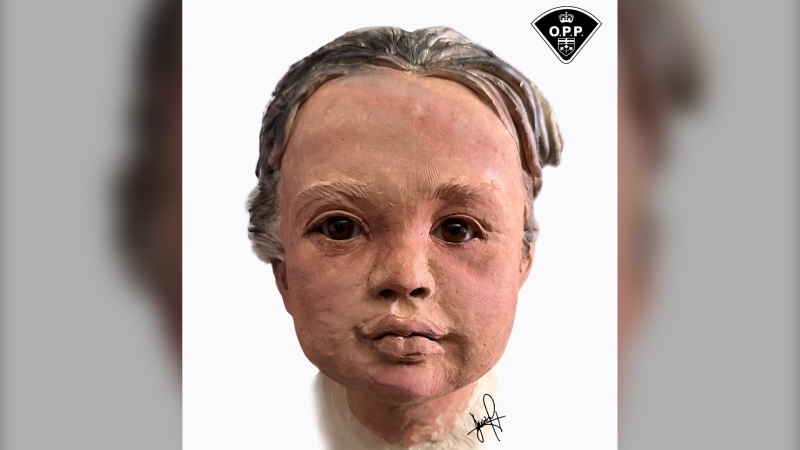

Police release 3D images of young child found in an Ontario river two years ago

Police have released a three-dimensional image of a young child whose remains were discovered in the Grand River in Dunnville, Ont. almost two years ago.

B.C. brings in law on name changes on day that child killer's new identity revealed

The BC NDP have tabled legislation aimed at stopping people who have committed certain heinous acts from changing their names.

Kamala Harris drops F-bomb during White House live-stream

U.S. Vice-President Kamala Harris used a profanity on Monday while offering advice to young Asian Americans, Native Hawaiians and Pacific Islanders about how to break through barriers.

B.C. man fighting for refund after finding someone living at Whistler vacation rental

Edwin Mostered spent thousands of dollars booking a vacation home in Whistler, B.C., for a group skiing trip earlier this year – or so he thought.

Avs forward Valeri Nichushkin suspended at least six months

Colorado Avalanche forward Valeri Nichushkin was suspended for at least six months without pay and placed in Stage 3 of the league's player assistance program.

Collapsed Baltimore bridge span comes down with a boom after crews set off chain of explosives

Crews conducted a controlled demolition Monday to break down the largest remaining span of the collapsed Francis Scott Key Bridge in Baltimore.

Security video caught admitted serial killer disposing of bodies in Winnipeg garbage bins

Security video caught admitted serial killer Jeremy Skibicki on multiple late-night outings, disposing of body parts in nearby garbage bins and dumpsters in the middle of the night.

Mortgage companies could intensify the next recession, U.S. officials warn

U.S. officials worry the next recession could be intensified by a cascading series of failures in the mortgage industry caused by crashing home prices, frozen financial markets and soaring delinquencies.