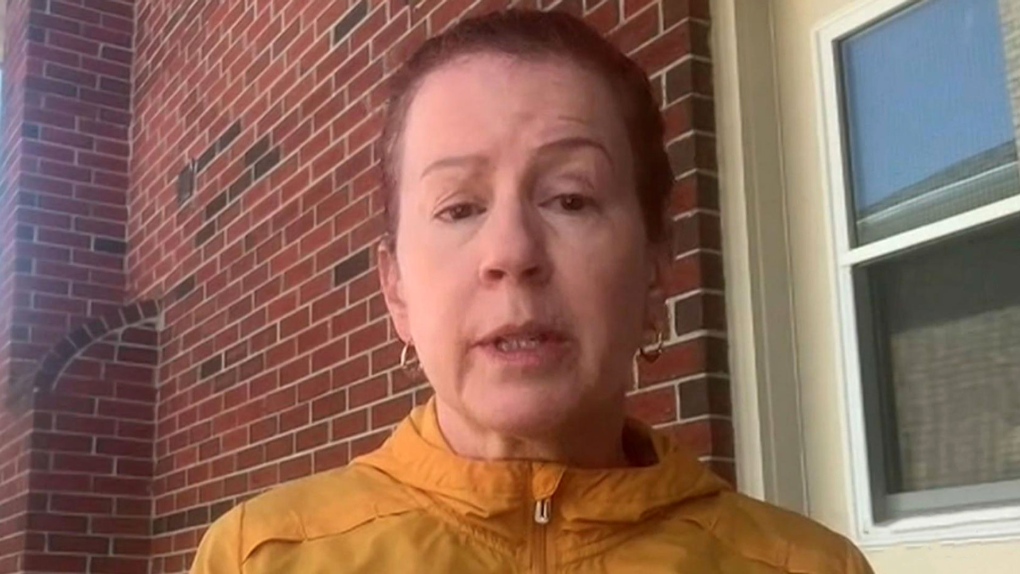

Ontario mother loses $2,500 to text scammer pretending to be daughter

An Ontario mother lost $2,500 to a scammer pretending to be her daughter asking for help in late April.

“I thought it was her. I thought she was in trouble and I needed to help her,” said Erin McInerney of Ajax, who added, “my daughter has an unusual name and it had the correct spelling so I thought for sure it was her."

The text messages claimed McInerney’s daughter’s phone broke and she had a new one with a new phone number which wasn't set up with the bank yet.

That’s when she asked her mother to e-transfer her money that she would borrow from her to pay some bills that were due.

"So she asked me to do that for her and she would reimburse (me). So that's what I did,” said McInerney.

But after McInerney e-transferred $2,500 she didn’t hear back from her daughter. Later that day she decided to call her daughter's original phone number and she answered, said everything was fine and that she knew nothing about the text messages.

That’s when McInerney realized she had been scammed.

“It was $2,500 that I let go to someone that I thought was her and it wasn't," said McInerney.

About 95 per cent of Canadians own a smartphone and scammers know this which is why they are targeting smartphones with scam texts otherwise known as "smishing."

Technology Analyst Carmi Levy said criminals are scouring through social media looking for names, numbers and addresses, anything they can use to customize a fake text message to make it seem more believable.

“We all use text messages and cyber criminals know this and that's why they are after us with the tools we use all the time,” said Levy.

Levy said you should never send money or personal information to anyone based solely on receiving a text message.

“Call the person from where the text message seems to be coming from and ask them, “’did you text me and ask for money?’ If the answer is no, you know it's a scam attempt,” said Levy.

McInerney is with the Royal Bank of Canada (RBC) and requested a refund after the smishing scam, but following an investigation her request was denied.

In a statement to CTV News an RBC spokesperson said, “We realize that any time a client is affected by fraud or scams, it can be a difficult and stressful situation for them. We encourage clients to reach out to us if they have been impacted as we review each instance of potential fraud on a case-by-case basis. We work with our client throughout the process and keep them informed.”

“While we cannot speak to the specifics of this situation for privacy reasons, our decision was based on a careful review. We remind clients to take precautions to ensure they are dealing with a trusted source when transferring or receiving funds.”

“We also provide clients with a variety of information and education on how to protect themselves including, How Cyber Criminals Make Contact. Anyone who believes they are a victim of a scam or fraud, should report it immediately to their financial institution, the police and the Canadian Anti-Fraud Centre.”

McInerney said she is frustrated that she lost money to scammers and wanted to share what happened to her to warn others.

“I feel it's so wrong. I feel so betrayed. They work on you and use your emotions against you. I mean who wouldn't want to help their child?”

Anytime you get a text, call or email from someone asking for money or your personal information it should be a red flag so you should be cautious and never send that type of information unless you're sure it is a trusted source.

CTVNews.ca Top Stories

Calls for change to B.C.'s child protection system after disturbing case of neglect

Is B.C.'s child protection system outdated and in need of a major overhaul? The province's representative for children and youth believes so, and that 'a new model' is needed.

Ont. mother loses $6K during Facebook marketplace transaction

An Ontario woman is sharing her story after she lost $6,000 by clicking a fraudulent link disguised to look like an e-transfer during a Facebook Marketplace transaction.

Rapper Travis Scott arrested for disorderly intoxication, trespassing early Thursday

American rapper Travis Scott, whose legal name is Jacques Bermon Webster, was arrested and booked into Miami-Dade County Jail early Thursday morning, county jail records show.

Train collision in Chile kills at least 2 people and injures 9 others

At least two people were killed and nine others injured Thursday when a train full of passengers collided head-on with another train on a test run just outside the capital of Chile, where fatal railway crashes remain rare.

Senators approve bill to fight foreign interference after voting down amendment

The Senate has passed a government bill intended to help deter, investigate and punish foreign interference.

Gunman in Toronto shooting was not evil, but 'broken' by fraud dispute: wife

The wife of the gunman in Monday's double murder-suicide in North York says she doesn't consider her husband an evil person, but one who was 'broken' by a lengthy fraud dispute that saw their family savings drained.

Heat warnings blanket the east and in Northwest Territories; humidex temperatures push the mid-40s

Heat warnings blanket Canada's eastern corridor Thursday as the year's first major heat wave drags on, and even parts of Northwest Territories are feeling the burn.

Why olive oil is so expensive right now, and the impact it's having on restaurants

Canadian restaurants that rely on what is being called 'liquid gold' as the backbone of their menu are being forced to eat a massive extra cost during a worldwide olive oil shortage.

Can a marriage survive a gender transition? Yes, and even thrive. How these couples make it work

A partner's gender transition does not necessarily mean a death sentence for a marriage. Data is scant, but couples and therapists say that in many cases, a relationship grows and flourishes under the light of new honesty.