Many Canadians consider turning to part-time jobs if finances worsen, new survey says

A waitress relieving a credit card is seen in this file image. (Pexels)

A waitress relieving a credit card is seen in this file image. (Pexels)

A new Consumer Debt Report by the Canadian Counselling Society has found that many Canadians are pessimistic about their 2023 finances.

“It is no longer that it's a certain segment feeling the pinch, everyone is feeling the pinch" Anne Arbour, Director of Strategic Partnerships with the Credit Counselling Society, told CTV News Toronto.

82 per cent of Canadians surveyed said spending on essential goods is the main cause of their worsening finances and 63 per cent said they plan to make cutbacks to their expenses, especially on food.

"We all need groceries, we all need gas or bus money and those costs are going up. So it's not as simple as not taking a holiday, it has to do with buying the essentials that we all need," Arbour said.

The survey also found 42 per cent of those asked have experienced an increase in debt in the past year and that 35 per cent would consider getting a part-time job if things get worse.

For companies that deal with debt, this doesn’t come as a surprise – inflation is increasing and many people have not seen their income match those increases.

It’s being called a perfect storm of inflation, rising interest rates and incomes not keeping up, and it’s putting pressure on many families’ finances.

Many debt collection companies took a break from collecting during the pandemic, but have since resumed and now some are seeking repayment of debts, pushing some consumers into a precarious financial situation.

“Creditors are saying the pandemic is over and they want to collect what they are owed and some are being quite aggressive about it," Laurie Campbell, Director of Client Financial Wellness with Bromwich & Smith, a licenced insolvency trustee, said.

Campbell said that bankruptcies and consumer proposals are at their highest level since March 2020.

“We are seeing a steady increase in insolvencies and I predict over the next 6 to 12 months, the increases will continue," she said.

The survey also found, while many people have savings to fall back on if they need extra money, some consumers are forced to use credit cards, borrow from banks and other institutions and even ask friends and family.

Anyone feeling overwhelmed by their financial situation is urged to reach out for help.

"To understand you are not alone and there are resources out there whether it's a not-for-profit credit counselling agency or whether it's your financial institution or a trusted friend," Arbour said.

CTVNews.ca Top Stories

Western University researchers unlock potential 'cure' for ALS

New research out of London, Ont.'s Western University is shedding light on a potential cure for ALS, in which the targeting of the interaction between two proteins can halt or fully reverse the disease's progression.

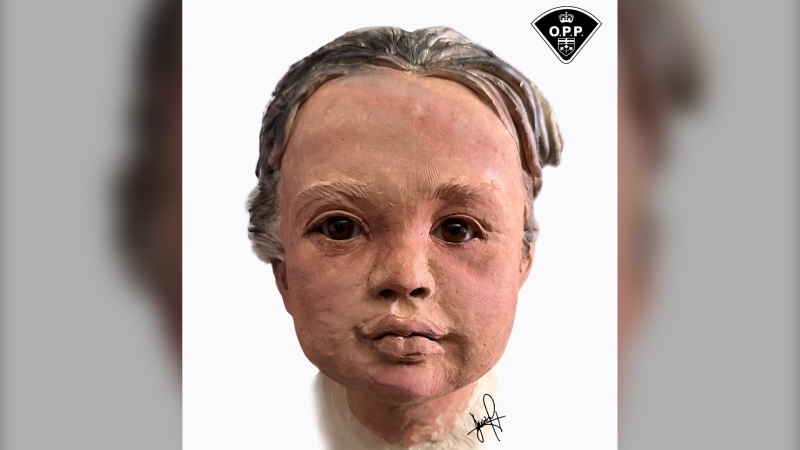

Police release 3D images of young child found in an Ontario river two years ago

Police have released a three-dimensional image of a young child whose remains were discovered in the Grand River in Dunnville, Ont. almost two years ago.

B.C. brings in law on name changes on day that child killer's new identity revealed

The BC NDP have tabled legislation aimed at stopping people who have committed certain heinous acts from changing their names.

Kamala Harris drops F-bomb during White House live-stream

U.S. Vice-President Kamala Harris used a profanity on Monday while offering advice to young Asian Americans, Native Hawaiians and Pacific Islanders about how to break through barriers.

B.C. man fighting for refund after finding someone living at Whistler vacation rental

Edwin Mostered spent thousands of dollars booking a vacation home in Whistler, B.C., for a group skiing trip earlier this year – or so he thought.

Avs forward Valeri Nichushkin suspended at least six months

Colorado Avalanche forward Valeri Nichushkin was suspended for at least six months without pay and placed in Stage 3 of the league's player assistance program.

Collapsed Baltimore bridge span comes down with a boom after crews set off chain of explosives

Crews conducted a controlled demolition Monday to break down the largest remaining span of the collapsed Francis Scott Key Bridge in Baltimore.

Security video caught admitted serial killer disposing of bodies in Winnipeg garbage bins

Security video caught admitted serial killer Jeremy Skibicki on multiple late-night outings, disposing of body parts in nearby garbage bins and dumpsters in the middle of the night.

Mortgage companies could intensify the next recession, U.S. officials warn

U.S. officials worry the next recession could be intensified by a cascading series of failures in the mortgage industry caused by crashing home prices, frozen financial markets and soaring delinquencies.