'I feel horrible': Ontario man denied theft coverage owes $55,000 for stolen truck

An Ontario man said he was shocked when his truck was stolen not once but twice, and the second time it was taken he was surprised to discover he was no longer covered for theft.

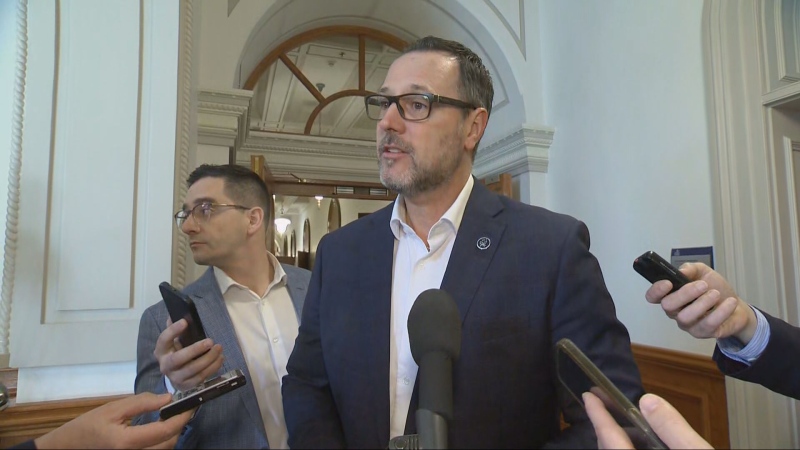

"I feel horrible. Had I known that the insurance company had canceled the comprehensive coverage I would have gone to another company," said Roger Sodhi of Toronto.

- Download our app to get local alerts on your device

- Get the latest local updates right to your inbox

Sodhi said when his 2021 Ram 1500 truck was stolen in February of 2022 police found the pick-up badly damaged in Montreal and his insurance company agreed to tow it back and repair the damages that happened during the theft.

Then, the same truck was stolen again in September.

"It got stolen again a second time. I guess they really wanted it bad, it must be in high demand these Rams” said Sodhi.

The second time Sodhi's truck was stolen his insurance company advised him he was no longer covered for theft as collision and comprehensive coverage had been dropped when his policy renewed in April after the truck had been stolen the first time.

Sodhi is with Desjardins Insurance which said it assured him he was informed by letter and on the phone that changes had been made to his policy.

"The insurance company apparently sent a notice to me that they had canceled it (comprehensive coverage) but I never got anything," said Sodhi.

Sodhi said he still has a loan on the truck and owes the bank $54,350.

“It’s painful to be paying for something you don't even have," said Sodhi.

CTV News Toronto reached out to Desjardins Insurance about Sodhi’s case and a spokesperson said, “Due to privacy reasons, we can’t discuss details of an insured’s policy. However, I can confirm that in a registered letter dated April 7, 2022, the client was informed of the decision and reason to remove certain coverages from his policy at renewal. Unfortunately, since the claim for vehicle theft was made months after on September 28, 2022, no coverage was applicable.”

The Insurance Bureau of Canada (IBC) said that insurance companies can modify coverages and make changes to a client’s policy but they must make sure the customer is made aware of the changes.

“Insurance companies have to give written notice to a policy holder when they make these type of changes," said Anne Marie Thomas, Director, Consumer and Industry Relations with IBC.

Thomas said it’s important to always pay close attention to any correspondence received from your insurance company, especially if it comes in the form of a registered letter.

“If a letter comes registered that means the insurance company is wanting to make sure that you get the information and they want proof you have received it," said Thomas.

Sodhi is adamant he didn't know his coverage had changed and is shocked he still owes more than $50,000 for the stolen truck.

You should never ignore any correspondence from your insurance company and always double check your policy at renewal time for changes in case you need to find coverage somewhere else.

CTVNews.ca Top Stories

'A beautiful soul': Funeral held for baby boy killed in wrong-way crash on Highway 401

A funeral was held on Wednesday for a three-month-old boy who died after being involved in a wrong-way crash on Highway 401 in Whitby last week.

'Sophisticated' cyberattacks detected on B.C. government networks, premier says

There has been a "sophisticated" cybersecurity breach detected on B.C. government networks, Premier David Eby confirmed Wednesday evening.

Police handcuff man trying to enter Drake's Toronto mansion

Toronto police say a man was taken into custody outside Drake's Bridle Path mansion Wednesday afternoon after he tried to gain access to the residence.

Biden says he will stop sending bombs and artillery shells to Israel if they launch major invasion of Rafah

U.S. President Joe Biden said for the first time Wednesday he would halt shipments of American weapons to Israel, which he acknowledged have been used to kill civilians in Gaza, if Prime Minister Benjamin Netanyahu orders a major invasion of the city of Rafah.

Rookie goalie Arturs Silovs to start for Canucks in Game 1 vs. Oilers

Rookie goalie Arturs Silovs will start in net for the Canucks as Vancouver kicks off a second-round series against the Edmonton Oilers Wednesday night.

Nijjar murder suspect says he had Canadian study permit in immigration firm's video

One of the Indian nationals accused of murdering British Columbia Sikh activist Hardeep Singh Nijjar says in a social media video that he received a Canadian study permit with the help of an Indian immigration consultancy.

Pfizer agrees to settle more than 10K lawsuits over Zantac cancer risk: Bloomberg News

Pfizer has agreed to settle more than 10,000 lawsuits about cancer risks related to the now discontinued heartburn drug Zantac, Bloomberg News reported on Wednesday, citing people familiar with the deal.

Quebec premier defends new museum on Quebecois nation after Indigenous criticism

Quebec Premier Francois Legault is defending his comments about a new history museum after he was accused by a prominent First Nations group of trying to erase their history.

U.S. presidential candidate RFK Jr. had a brain worm, has recovered, campaign says

Independent U.S. presidential candidate Robert F. Kennedy Jr. had a parasite in his brain more than a decade ago, but has fully recovered, his campaign said, after the New York Times reported about the ailment.