How to claim Ontario's staycation tax credit on your tax return

Those who vacationed in Ontario in 2022 can claim eligible travel expenses through the staycation tax credit. THE CANADIAN PRESS/Frank Gunn

Those who vacationed in Ontario in 2022 can claim eligible travel expenses through the staycation tax credit. THE CANADIAN PRESS/Frank Gunn

People in Ontario who vacationed in the province last year can claim the trip on their upcoming tax returns, and here’s how to do it.

Introduced as a temporary, refundable personal income tax credit for 2022, the Ontario Staycation Tax Credit can be used by families and individuals who went on a leisurely trip somewhere within the province.

Through this credit, Ontarians can claim 20 per cent of their eligible accommodation expenses between Jan. 1 and Dec. 31, 2022.

“If you travelled for work, that wouldn’t count,” H&R Block tax specialist, Yannick Lemay, previously told CTV News Toronto. “We are excluding costs for food, entertainment, gas, and all extra expenses, but anything that goes for accommodation for travel, you can claim.”

Those who are looking to apply for this credit should have the receipts from their accommodation stays, Lemay noted.

“It’s up to $1,000 [for an individual], and it’s a 20 per cent rate credit, so that means Ontarians can get up to $200 back.”

Families and couples can claim up to $2,000 and get a maximum credit of $400.

HOW CAN I CLAIM THE STAYCATION TAX CREDIT?

When it's time to file your Income Tax and Benefit Return for last year, keep your eyes peeled for form ON479, which lists all of the refundable tax credits Ontarians can specifically claim.

"Many Ontario credits are calculated on this form, and then the total of credits calculated on this form goes onto the T1 returns on your federal tax return. It goes on line 47900," Lemay told CTV News Toronto Friday.

Ontario’s staycation tax credit can be found underneath the Ontario childcare access and relief from expenses (CARE) tax credit.

SO WHAT ELIGIBLE EXPENSES CAN I CLAIM?

Ontarians who stayed at a short-term accommodation for less than a month in province can claim the expenses through the credit – so long as it is a hotel, motel, resort, lodge, bed-and-breakfast, cottage, campground or vacation rental property.

The accommodation must have either been paid by you, or your spouse, partner, or eligible child.

All of the receipts from the eligible expenses must have the location, the date of stay, the name of who purchased the accommodations, and the cost. It should also have the amount of taxes you paid on the stay.

If all these conditions are met, Ontarians can claim the accommodation of one trip or multiple trips, and can be expensed up to $1,000 as an individual or $2,000 as a family.

WHAT CAN’T I CLAIM?

Vacations on boats, trains, or “other vehicles that can be self-propelled,” the province says, aren’t included with the tax credit. Timeshare agreements are also generally not included.

As for travel expenses, Ontarians cannot claim car rentals, fuel, flights, groceries, parking, or tickets purchased to visit location attractions. If the trip was also for school or work, it also cannot be claimed through the staycation tax credit.

Lastly, if the expenses were reimbursed – either by a friend or an employer – the stay cannot be claimed.

May 1 is the deadline for most Canadians to file their tax returns, with June 15 being the deadline for those who are self-employed.

CTVNews.ca Top Stories

Indian envoy warns of 'big red line,' days after charges laid in Nijjar case

India's envoy to Canada insists relations between the two countries are positive overall, despite what he describes as 'a lot of noise.'

Stormy Daniels describes meeting Trump during occasionally graphic testimony in hush money trial

With Donald Trump sitting just feet away, Stormy Daniels testified Tuesday at the former president's hush money trial about a sexual encounter the porn actor says they had in 2006 that resulted in her being paid to keep silent during the presidential race 10 years later.

U.S. paused bomb shipment to Israel to signal concerns over Rafah invasion, official says

The U.S. paused a shipment of bombs to Israel last week over concerns that Israel was approaching a decision on launching a full-scale assault on the southern Gaza city of Rafah against the wishes of the U.S.

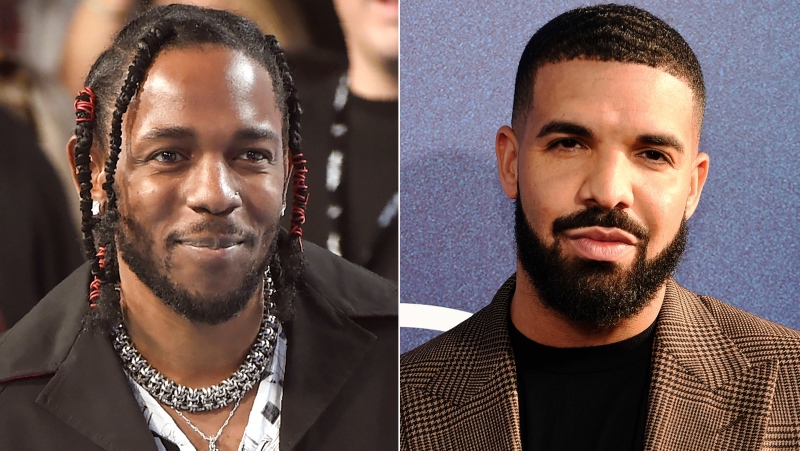

Former homicide detective explains how police will investigate shooting outside Drake's Bridle Path mansion

Footage from dozens of security cameras in the area of Drake’s Bridle Path mansion could be the key to identifying the suspect responsible for shooting and seriously injuring a security guard outside the rapper’s sprawling home early Tuesday morning, a former Toronto homicide detective says.

Northern Ont. woman makes 'eggstraordinary' find

A chicken farmer near Mattawa made an 'eggstraordinary' find Friday morning when she discovered one of her hens laid an egg close to three times the size of an average large chicken egg.

Susan Buckner, who played spirited cheerleader Patty Simcox in 'Grease,' dead at 72

Susan Buckner, best known for playing peppy Rydell High School cheerleader Patty Simcox in the 1978 classic movie musical 'Grease,' has died. She was 72.

Jeremy Skibicki has 'uphill battle' to prove he's not criminally responsible in Winnipeg killings: legal analysts

Accused killer Jeremy Skibicki could have a challenging time convincing a judge that he is not criminally responsible for the deaths of four Indigenous women, a legal analyst says.

Bye-bye bag fee: Calgary repeals single-use bylaw

A Calgary bylaw requiring businesses to charge a minimum bag fee and only provide single-use items when requested has officially been tossed.

Alcohol believed to be a factor in boating incident after 2 men die: N.S. RCMP

Two Nova Scotia men are dead after a boat they were travelling in sank in the Annapolis River in Granville Centre, N.S., on Monday.