Class action lawsuit alleges Ontario company that took $14M in investments was feeder fund for the 'crypto king'

A Chatham, Ont. mother is spearheading a class action lawsuit alleging a company that collected $14 million in investments from members of her community was actually a Ponzi scheme that fed nearly a third of its funds to Ontario’s self-described ‘crypto king’ Aiden Pleterski.

“It’s definitely been overwhelming,” Emily Hime, the 31-year-old mother, told CTV News Toronto in an interview earlier this month. “The financial stress of it all, it’s impacted my family life quite significantly.”

The class action, filed at the Ontario Superior Court of Justice in May, is representing 125 people who invested with Banknote Capital Inc. after a whistleblower from the company filed a complaint to the Ontario Securities Commission in early 2023 alleging the owner pocketed investments. The lawsuit is ultimately aiming to trace and preserve assets with the goal of redistributing money to investors.

Speaking out for the first time, the whistleblower – former Banknote employee Brock Tedford – told CTV News Toronto he believes his boss and close friend, Ryan Rumble, saw Pleterski “getting away” with allegedly exploiting investors and “decided to do the same thing.”

Pleterski – a 24-year-old from Whitby, Ont., who allegedly operated a $40 to $100 million Ponzi scheme – was pushed into bankruptcy a year ago. According to previous court documents, more than 98 per cent of the money he collected was never invested.

“I think he saw how quickly Aiden was getting away with it,” Tedford said of his boss.

HOW DID IT UNFOLD?

At the start, in the spring of 2021, Pleterski boasted six per cent earnings per week and offered investors a 70-30 per cent split on capital gains, a motion filed in court last month states.

Excited about the prospect of making quick profits, Rumble decided to create Banknote with two other directors in 2021 to operate as a “feeder fund” for Pleterski, sending him nearly $4 million, while engaging in his own trading with investor’s money, according to the court documents.

Those directors are named in the legal action, however the documents state that “various transfers of Banknote funds that are the focus of the injunction” were undertaken by Rumble without their knowledge.

"To state otherwise, Rumble was primarily responsible for the fraudulent conduct and investor / class member losses," court documents read.

Banknote Capital's Ryan Rumble (left) and self-described 'crypto king' Aiden Pleterski (right). To do so, he solicited investments from friends and family in the Chatham community.

Banknote Capital's Ryan Rumble (left) and self-described 'crypto king' Aiden Pleterski (right). To do so, he solicited investments from friends and family in the Chatham community.

“We live in a small town,” Hime said.

The mother said she was hesitant about Banknote at first, but caved, making a “very significant” investment, after friends and family raved about their returns.

FORMER WORKER’S SUSPICIONS ARISE

In early 2022, when Tedford was still new in his role as an analyst at Banknote, he said he flagged what he interpreted as an error to Rumble.

“My first week I texted Ryan, I said, ‘Hey man, I think you made an error on the website,’” Tedford recalled after making a nearly 10 per cent return on his personal investment in just a week. But Rumble said the returns were real.

“I trusted him more than anything,” Tedford said.

Tedford said his rose-coloured glasses started to fade after Rumble pitched the idea of opening an investment bank in Dubai, claiming Banknote was currently managing millions for celebrities.

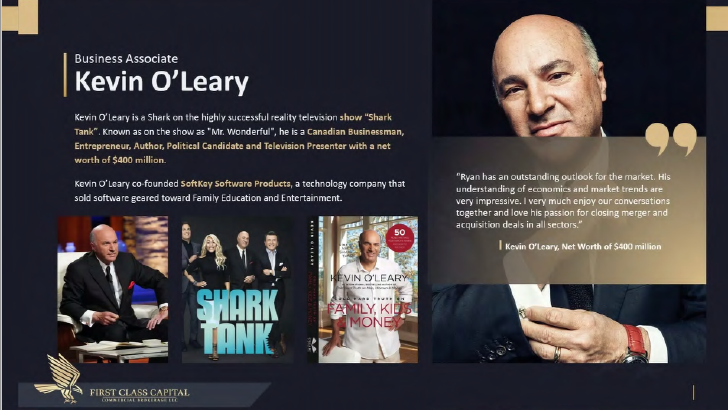

To bolster his point, Rumble procured letters of endorsement from Kevin O’Leary and Galen Weston Jr., Tedford said.

A procured endorsement from Kevin O'Leary on his investments with Ryan Rumble, included as exhibit in court documents.

A procured endorsement from Kevin O'Leary on his investments with Ryan Rumble, included as exhibit in court documents.

“At that point, I just started getting really suspicious,” the former employee said.

Fuelled by doubt, Tedford said he then asked for more responsibilities at the company as a way to collect evidence of alleged wrongdoing.

“I wanted to turn this in, but at that point I couldn’t just say, ‘Hey this was happening,’ so I pretty much had to go in and sit with this guy everyday for months,” he said.

‘A PONZI SCHEME’

In early 2022, Banknote stopped accepting new investments due to “cash flow problems.” According to court documents, the problems stemmed from a failure on Pleterski’s part to return funds.

At this point, Banknote became a “Ponzi scheme,” court records allege.

Ryan Rumble stands beside a blue Lamborghini. Court documents allege he purchased a 2019 Lamborghini Uras luxury SUV on December 20, 2021(Supplied). “During the second phase of Banknote’s lifespan, it appears to be insolvent and to be a form of a Ponzi scheme where new client money was being used in part to pay client redemption demands and to engage in other forms of trading that resulted in further losses,” according to court documents. The allegations against Banknote and Rumble have not been proven in court.

Ryan Rumble stands beside a blue Lamborghini. Court documents allege he purchased a 2019 Lamborghini Uras luxury SUV on December 20, 2021(Supplied). “During the second phase of Banknote’s lifespan, it appears to be insolvent and to be a form of a Ponzi scheme where new client money was being used in part to pay client redemption demands and to engage in other forms of trading that resulted in further losses,” according to court documents. The allegations against Banknote and Rumble have not been proven in court.

Norman Groot, a fraud recovery lawyer representing the class action, said, “In effect, this is a Ponzi scheme feeding another Ponzi scheme.”

‘IT’S IMPACTED ME’

By January 2023, Tedford said he had accumulated enough evidence to support his claim. He then filed a whistleblower complaint containing more than 400 files with the Ontario Securities Commission (OSC), alleging Rumble was transferring investors’ funds to his personal bank account.

An OSC spokesperson told CTV News Toronto they were unable to confirm or comment on the existence, status or nature of Tedford’s complaint in order to “protect the integrity” of the commission’s investigations and “ensure the complaint process is not used to affect the market.”

With the whistleblower complaint pending, Groot filed a motion on Tuesday to further extend a court injunction granted in May, which would not only freeze Banknote’s assets, but Rumble’s too.

If passed, the motion would also include unaccounted cash. The court documents state that days before the lawsuit launched, Banknote sent a wire transfer worth more than $212,000 of the over $295,000 in a company Scotiabank account to Dubai. Rumble also transferred money to his sister in the form of a private mortgage and “accidentally” sent his father $100,000 that he said was meant for Pleterski, according to a court examination.

“What we’re trying to do now is retrieve, or trace, and have returned funds that left either Banknote’s accounts or funds that investors transferred to Ryan Rumble personally,” Groot said.

At the centre of this tangled web, Groot said there’s a simple golden rule: “Don't invest in what you don't understand.”

“Do your due diligence, don't be emotionally caught up in some sort of private hysteria,” he said.

But in the wake of the Banknote debacle, an undeniable imprint remains with Hime.

“I would say in every way it’s impacted me … emotionally, mentally, physically,” Hime said. “It’s definitely been overwhelming.”

Rumble has not responded to repeated interview requests from CTV News Toronto.

CTVNews.ca Top Stories

'She will not be missed': Trump on Freeland's departure from cabinet

As Canadians watched a day of considerable political turmoil for Prime Minister Justin Trudeau and his government given the sudden departure of Chrystia Freeland on Monday, it appears that U.S. president-elect Donald Trump was also watching it unfold.

BREAKING Canadian government to make border security announcement today: sources

The federal government will make an announcement on new border security measures after question today, CTV News has learned.

Canada's inflation rate down a tick to 1.9% in November

Inflation edged down slightly to 1.9 per cent in November as price growth continued to stabilize in Canada.

The Canada Post strike is over, but it will take time to get back to normal, says spokesperson

Canada Post workers are back on the job after a gruelling four-week strike that halted deliveries across the county, but it could take time before operations are back to normal.

Transit riders work together to rescue scared cat from underneath TTC streetcar

A group of TTC riders banded together to rescue a woman's cat from underneath a streetcar in downtown Toronto, saving one of its nine lives.

Trudeau considering his options as leader after Freeland quits cabinet, sources say

Chrystia Freeland, Canada's finance minister, said in an explosive letter published Monday morning that she will quit cabinet. Here's what happened on Monday, Dec. 16.

Teacher and a teenage student killed in a shooting at a Christian school in Wisconsin

A 15-year-old student killed a teacher and another teenager with a handgun Monday at a Christian school in Wisconsin, terrifying classmates including a second grader who made the 911 call that sent dozens of police officers rushing to the small school just a week before its Christmas break.

A bomb killed a Russian general in Moscow. A Ukrainian official says secret service was behind it

A senior Russian general was killed Tuesday by a bomb hidden in a scooter outside his apartment building in Moscow, a day after Ukraine’s security service leveled criminal charges against him. A Ukrainian official said the service carried out the attack.

Tom Cruise gets a top U.S navy honour for boosting the military with his screen roles

Tom Cruise was awarded the U.S. navy's top civilian honour on Tuesday for 'outstanding contributions to the Navy and the Marine Corps' with 'Top Gun' and other films.