Toronto semi pushes $2 million as 'bully offers' dominate red-hot market

Homes across the country posted eye popping gains in real estate over the past year, with the area around Toronto leading the pack, according to statistics published by a national association of realtors.

And that is translating on the ground into bare-knuckle fights on the ground for scarce properties, with bully offers becoming the norm, say realtors who themselves are astonished at how prices have gone through the roof.

“We bought one house three years ago for $1.2 million. We sold the house last week for $1.71. In three years the value of increase of this house is substantial,” said Nicola St. John of Bosley Real Estate.

The home, a two-story semi-detached home in the Pocket neighbourhood in Toronto’s East End, received three bully offers and sold after a day on the market for $210,000 above asking. Bully offers are buyers coming in well before an offer date with attempts to buy before competitors.

It’s not the only one: a nearby semi-detached on Logan Avenue sold for $550,000 over asking this week, just $50,000 shy of $2 million.

“It’s crazy. That’s an enormous amount of money,” said St. John, pointing to one factor: a dearth of listings that leave desperate buyers scamblng.

“There’s nothing on the market. It’s the lowest inventory in the city since 2013. It’s been a long time since there’s been so little for sale.”

Analysts say Toronto and area’s surge is pulling up averages all across the country.

“It’s definitely dominated by Toronto,” said Shaun Cathcart of the Canadian Real Estate Association. “A big part of this is a return into the city and a big comeback in the condo market,” he said.

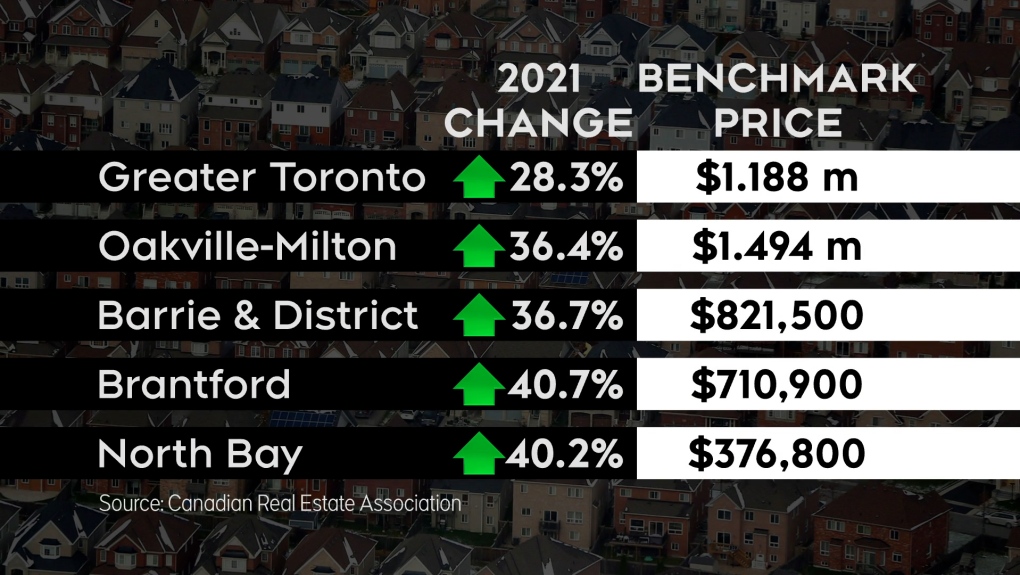

According to the CREA, prices in Greater Toronto soared 28.2 per cent in the last 12 months to a benchmark price of $1.18 million.

Surrounding areas grew even more. Oakville and Barrie for example jumped more than 36 per cent in prices. Brantford and North Bay surged more than 40 per cent.

“This year is head and shoulders above anything else. One of the main reasons for that that doesn’t get discussed enough is that COVID-19 is causing a lot of people to pull up stakes and move around who in a non-COVID world may have been in their forever home for the next 30 or 40 years. And a lot of those people are playing with major equity,” Cathcart said.

Getting a mortgage with a modest down payment at today’s rates with the Pocket home’s selling price would cost about $7,500 a month — a sign the people buying have a lot in the bank.

The price surge is great for homeowners but for those who don’t own property it’s a major factor in a punishing housing crisis.

The Toronto Region Board of Trade has proposed to change zoning rules to allow more smaller less expensive properties — something that could allow buyers to purchase condos or townhouses in a much greater proportion of the city.

CTVNews.ca Top Stories

Canadian gov't proposes new foreign influence registry as part of wide-spanning new bill

Prime Minister Justin Trudeau's government is proposing a suite of new measures and law changes aimed at countering foreign interference in Canada, amid extensive scrutiny over past meddling attempts and an ever-evolving threat landscape.

Boeing Starliner capsule's first crewed test flight postponed

The long-awaited first crewed test flight of Boeing's new Starliner space capsule was called off for at least 24 hours over a technical issue that launch teams were unable to resolve in time for the planned Monday night lift-off.

Teacher charged in historical sexual assault of Calgary teenage girl

Calgary police have charged a teacher with the alleged sexual assault of a teenage girl more than 20 years ago.

Winnipeg man admits to killing four women, argues he's not criminally responsible

Defence lawyers of Jeremy Skibicki have admitted in court the accused killed four Indigenous women, but argues he is not criminally responsible for the deaths by way of mental disorder – this latest development has triggered a judge-alone trial rather than a jury trial.

Man banned from owning animals after fatal Calgary dog attack

The owner of three Calgary dogs that got loose and mauled a woman to death in 2022 has been ordered to pay a $15,000 fine within one year and banned from owning any animal for 15 years.

East-end Ottawa family dealing with massive rat infestation

Residents in Ottawa’s Elmridge Gardens complex are dealing with a rat infestation that just won’t go away. Now, after doing everything they can to try to fix the issue, they are pleading with the city to step in and help.

Mediterranean staple may lower your risk of death from dementia, study finds

A daily spoonful of olive oil could lower your risk of dying from dementia, according to a new study by Harvard scientists.

An El Nino-less summer is coming. Here's what that could mean for Canada

As Canadians brace themselves for summer temperatures, forecasters say a weakening El Nino cycle doesn’t mean relief from the heat.

Newfoundland and Labrador latest province to tighten rules on Airbnbs

Newfoundland and Labrador is the latest jurisdiction to bring in stricter rules for short-term rentals, with a coming set of regulations that will force operators to register with the provincial government.