Toronto rent prices rose 20 per cent over the last year

Toronto rent prices have risen by 20 per cent over the last year and are now approaching where they were prior to the onset of the COVID-19 pandemic.

A new report by Bullpen Research & Consulting and TorontoRentals.com has found that the average rent price in the city in May was $2,474, up from $2,035 at this time last year.

It marks the first year-over-year increase in rent prices since the start of the pandemic.

Previously, rent prices declined by 11 per cent annually in May 2021 and six per cent annually in May 2020 as many people left the city in search of more space.

But this past May saw the biggest monthly increase in rent prices since 2019, pushing up prices in most markets across the country.

Across the GTA as a whole, rent prices were up 17 per cent over the last year to $2,327 per month. That, however, is still marginally below the average price in May 2019 ($2,365).

Meanwhile, supply was also down across the board. The data suggests that listings on TorontoRentals.com have fallen 22 per cent since November, including 10 per cent since the peak of the resale housing market was reached in February.

“In a quest to fight off inflation, central banks across the world are increasing interest rates, and as a consequence, in the GTA, resale house prices are softening. In the short-term that is dissuading some would-be buyers from exiting the rental market, reducing rental supply,” the report notes. “This reduced supply coupled with increased demand via immigration, more students, and recent graduates moving out of their parents homes have contributed to the rapid rise in rental rates.”

It marks the first year-over-year increase in rent prices since the start of the pandemic.

Previously, rent prices declined by 11 per cent annually in May 2021 and six per cent annually in May 2020 as many people left the city in search of more space.

But this past May saw the biggest monthly increase in rent prices since 2019, pushing up prices in most markets across the country.

In the GTA as a whole, rent prices were up 17 per cent over the last year to $2,327 per month. That, however, is still marginally below the average price in May 2019 ($2,365).

Meanwhile, supply was also down across the board. The data suggests that listings on TorontoRentals.com have fallen 22 per cent since November, including 10 per cent since the peak of the resale housing market was reached in February.

“In a quest to fight off inflation, central banks across the world are increasing interest rates, and as a consequence, in the GTA, resale house prices are softening. In the short-term that is dissuading some would-be buyers from exiting the rental market, reducing rental supply,” the report notes. “This reduced supply coupled with increased demand via immigration, more students, and recent graduates moving out of their parents homes have contributed to the rapid rise in rental rates.”

The data suggests that a one-bedroom unit in Toronto is now listed for $2,133 per month on average. That equates to a 3.3 per cent increase over the last month and a 15.7 per cent increase over the last year.

- Have you recently bought a house? We want to hear from you

But the competition for larger two-bedroom units is more fierce, pushing the average listing price up more than five per cent over the last month and 21.5 per cent year-over-year to $3,002.=

The authors of the report also cited anecdotal evidence suggesting that “bidding wars, and tenants renting homes sight unseen” are becoming more common in the marketplace.

Speaking with reporters at Queen’s Park, Premier Doug Ford said that the answer to the rising cost of rent lies in “encouraging more developers to build more rental units.” But he acknowledged that it is a tough task in an inflationary environment that has pushed up the cost of borrowing and building.

“We are going to have a very, very aggressive plan going forward but we can’t do it alone. So we have to work with the federal government and the city and I am confident that if we can standardize the process, speed up the process, supply some of the land – be it municipally or provincial and federal – we can move forward,” he said. “But make no mistake about it, there are challenges. The interest rates are going up, inflation is going up so it is going to be a challenge.”

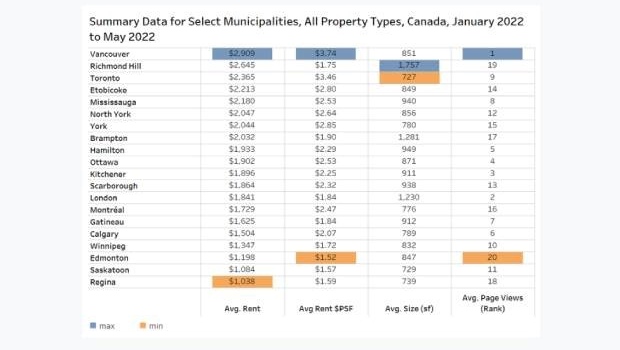

- Vancouver - $3.74 per square foot

- Toronto - $3.46 per square foot

- York Region - $2.85 per square foot

- Mississauga - $2.53 per square foot

- Ottawa - $2.53 per square foot

- Montreal - $2.47 per square foot

- Hamilton - $2.29 per square foot

- Kitchener - $2.25 per square foot

- Calgary - $2.07 per square foot

- Brampton - $1.90 per square foot

CTVNews.ca Top Stories

BREAKING Emergency crews responding to avalanche in Whistler, B.C., area

Paramedics and search crews have been dispatched to the scene of an avalanche that struck Monday in the Whistler, B.C., area.

Quebec fugitive killed in Mexican resort town, RCMP say

RCMP are confirming that a fugitive, Mathieu Belanger, wanted by Quebec provincial police has died in Mexico, in what local media are calling a murder.

Bill Clinton hospitalized with a fever but in good spirits, spokesperson says

Former President Bill Clinton was admitted Monday to Georgetown University Medical Center in Washington after developing a fever.

Trump again calls to buy Greenland after eyeing Canada and the Panama Canal

First it was Canada, then the Panama Canal. Now, Donald Trump again wants Greenland. The president-elect is renewing unsuccessful calls he made during his first term for the U.S. to buy Greenland from Denmark, adding to the list of allied countries with which he's picking fights even before taking office.

Pioneering Métis human rights advocate Muriel Stanley Venne dies at 87

Muriel Stanley Venne, a trail-blazing Métis woman known for her Indigenous rights advocacy, has died at 87.

King Charles ends royal warrants for Ben & Jerry's owner Unilever and Cadbury chocolatiers

King Charles III has ended royal warrants for Cadbury and Unilever, which owns brands including Marmite and Ben & Jerry’s, in a blow to the household names.

Man faces murder charges in death of woman who was lit on fire in New York City subway

A man is facing murder charges in New York City for allegedly setting a woman on fire inside a subway train and then watching her die after she was engulfed in flames, police said Monday.

Canada regulator sues Rogers for alleged misleading claims about data offering

Canada's antitrust regulator said on Monday it was suing Rogers Communications Inc, for allegedly misleading consumers about offering unlimited data under some phone plans.

Multiple OnlyFans accounts featured suspected child sex abuse, investigator reports

An experienced child exploitation investigator told Reuters he reported 26 accounts on the popular adults-only website OnlyFans to authorities, saying they appeared to contain sexual content featuring underage teen girls.