Toronto homeowners have until Thursday to declare status of property to avoid steep fines

A real estate sign is displayed in front of a house in the Riverdale area of Toronto on Wednesday, September 29, 2021.Housing industry observers say Ontario's surprise move to increase the tax paid by foreign home buyers to 25 per cent is a last-minute cash grab ahead of the federal government banning such buyers next year.THE CANADIAN PRESS/Evan Buhler

A real estate sign is displayed in front of a house in the Riverdale area of Toronto on Wednesday, September 29, 2021.Housing industry observers say Ontario's surprise move to increase the tax paid by foreign home buyers to 25 per cent is a last-minute cash grab ahead of the federal government banning such buyers next year.THE CANADIAN PRESS/Evan Buhler

A new tax on vacant homes is set to take effect in Toronto and homeowners have until this Thursday to declare the status of their properties.

Toronto’s City Council introduced the Vacant Home Tax in a bid to increase housing supply by discouraging homeowners from leaving their properties unoccupied. It went into force last year, making 2022 the first payable year the tax will be levied on vacant homes for one per cent of a property’s Current Value Assessment (CVA).

Lived-in homes won’t be taxed, but all Toronto residential property owners must submit a declaration of their properties’ status by Feb 2 – and those who don’t submit the paperwork could find their homes deemed vacant and pay the price.

POSSIBLE FINES

Penelope Graham, director of content at Ratehub.ca, said homeowners should strive to meet the Feb. 2 deadline in order to avoid steep fines, which range between $250 for failing to submit a declaration to $10,000 for making a false declaration.

“From the homeowners’ perspective, I think awareness is really important because the city is being quite stringent in terms of the fines if you don't comply,” she said in a Monday phone interview with BNNBloomberg.ca.

People who don’t submit a declaration could also be taxed the full portion of the Vacant Home Tax.

Interest will be applied to overdue tax amounts at a rate of 1.25 per cent on the first day after default, and again each month as long as there are unpaid amounts. Toronto said unpaid amounts will be added to property taxes upon default of payment.

WHO IS AFFECTED

Toronto defines a property as vacant if it was not used as a principal residence for the owner or other occupants, or was unoccupied for six months or more during the previous calendar year.

Graham said real estate investors with units sitting empty will likely be among those affected by the tax.

She also advised that home buyers and sellers pay close attention to their closing dates when it comes to the tax.

The seller must complete the tax declaration if the sale closes between Jan. 1 and Feb. 2, and the purchaser must submit a declaration the following year for any closing dates from Feb. 3 until Dec. 31.

However, Toronto said “any unpaid taxes will become the purchaser’s responsibility” and the Vacant Home Tax will form a lien on a property.

EXEMPTIONS

Some vacant homes are exempt from the tax. Those situations include:

- Death of a homeowner

- Principal resident is in a care facility like a hospital or long-term care home

- Court order preventing occupancy

- Owner lives outside the Greater Toronto Area but requires the vacant home for occupation-related residency for at least six months of the year

- Repairs and renovations

- Transfer of legal ownership

Paperwork is required to qualify for an exemption to the tax, and Graham said people with exemptions or those who might fall through the cracks should stay on top of communication with municipal officials.

“It’s really important to be communicating with the city and ensuring you're getting ahead of it,” she said.

HOW TO DECLARE

Homeowners can submit their declaration for the tax online. There is also a paper option, but Graham noted that the city must receive copies by the Feb. 2 deadline.

Toronto said it will issue notices to owners in March and April and payments for the tax will be due on May 1.

WHAT IS THE GOAL

Toronto is the latest Canadian jurisdiction to introduce a tax on vacant homes as the country struggles with a widespread housing shortage.

Vancouver was the first to introduce a tax on vacant homes and said in November it had generated $115.3 million for affordable housing initiatives and renter supports since 2017.

The federal government has also introduced an “Underused Housing Tax” that mostly applies to non-resident homeowners, while other Canadian cities are also considering the measure.

Toronto said revenue from its tax will go towards affordable housing, with a goal to discourage vacant rental units at a time when Canadian renters face the tightest market since 2001, according to a report from the Canada Mortgage and Housing Corporation (CMHC).

Some data from Vancouver suggests the tax nudged some vacant homes back onto the market, with the city reporting that the number of unoccupied properties decreased by 36 per cent between 2017 and 2021.

It remains to be seen how the tax will play out in Toronto, but Graham said it presents an opportunity to understand true number of vacant properties and potentially expand housing supply amid a “crucial shortage” that’s also contributing to the steep cost of real estate.

“Any opportunity to get more data on the true status of the housing market is going to be beneficial,” she said. “Hopefully we'll see some positive benefits … and actually see some of these units returning to either the rental or the ownership market.”

CTVNews.ca Top Stories

B.C. tenants evicted for landlord's use after refusing large rent increase to take over neighbouring suite

Ashley Dickey and her mother rented part of the same Coquitlam duplex in three different decades under three different landlords.

MPP Sarah Jama asked to leave Ontario legislature for wearing keffiyeh

MPP Sarah Jama was asked to leave the Legislative Assembly of Ontario by House Speaker Ted Arnott on Thursday for wearing a keffiyeh, a garment which has been banned at Queen’s Park.

Mountain guide dies after falling into a crevasse in Banff National Park

A man who fell into a crevasse while leading a backcountry ski group deep in the Canadian Rockies has died.

Expert warns of food consumption habits amid rising prices

A new survey by Dalhousie University's Agri-Food Analytics Lab asked Canadians about their food consumption habits amid rising prices.

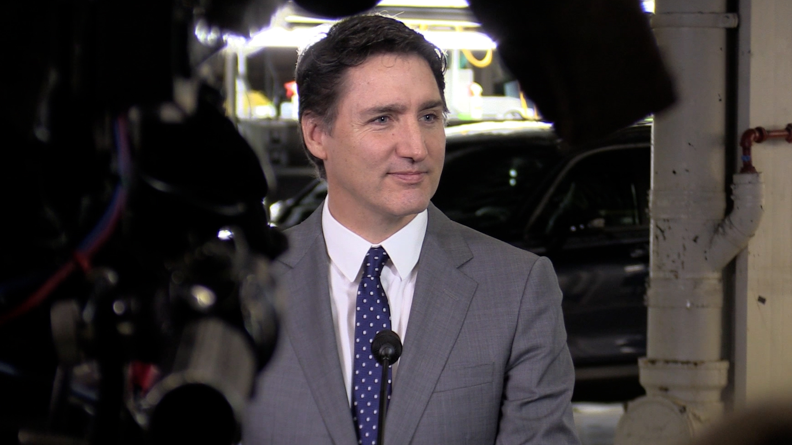

Here's why provinces aren't following Saskatchewan's lead on the carbon tax home heating fight

After Prime Minister Justin Trudeau said the federal government would still send Canada Carbon Rebate cheques to Saskatchewan residents, despite Saskatchewan Premier Scott Moe's decision to stop collecting the carbon tax on natural gas or home heating, questions were raised about whether other provinces would follow suit. CTV News reached out across the country and here's what we found out.

Montreal actress calls Weinstein ruling 'discouraging' but not surprising

A Montreal actress, who has previously detailed incidents she had with disgraced Hollywood producer Harvey Weinstein, says a New York Court of Appeals decision overturning his 2020 rape conviction is 'discouraging' but not surprising.

Charlie Woods, son of Tiger, shoots 81 in U.S. Open qualifier

Charlie Woods failed to advance in a U.S. Open local qualifying event Thursday, shooting a 9-over 81 at Legacy Golf & Tennis Club.

Caleb Williams, Jayden Daniels and Drake Maye make it four NFL drafts with quarterbacks going 1-3

Caleb Williams is heading to the Windy City, aiming to become the franchise quarterback Chicago has sought for decades.

Improve balance and build core strength with this exercise

When it comes to cardiovascular fitness, you may tend to focus on activities that move you forward, such as walking, running and cycling.