Ontario millennials need to save for over 20 years for down payment on a home: report

A real estate sign is displayed in front of a house in the Riverdale area of Toronto on Wednesday, September 29, 2021. THE CANADIAN PRESS/Evan Buhle

A real estate sign is displayed in front of a house in the Riverdale area of Toronto on Wednesday, September 29, 2021. THE CANADIAN PRESS/Evan Buhle

A new report shows house prices need to drop by more than $500,000 for millennials to be able to afford a home in Ontario.

Generation Squeeze, a charitable organization fighting for generational fairness in the country, recently released a 56-page reported called “Straddling the Gap 2022,” which looks at the disparity between home prices and earnings across the country.

The study analyzes what Canada’s “primary goal” should be for home prices by looking at the gap between earnings and average home prices from 1976 until 2021, which was the last year available to procure data from the Canadian Real Estate Association (CREA).

After analyzing CREA’s data and comparing it to Statistics Canada’s data for annual income, the report concludes prices should stall “for many years ahead – or even continue to fall moderately.”

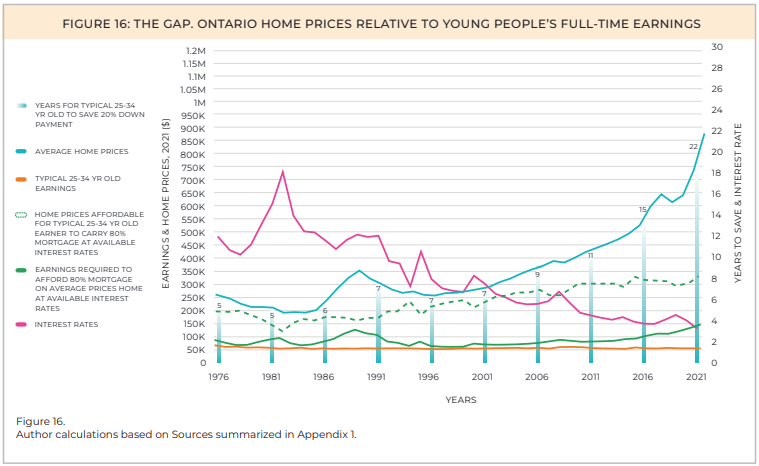

“The number of years of work required to save [for] a 20 [per cent] down payment on average priced homes has grown in alarming ways in many regions,” the report reads.

Across Ontario, average home prices were just shy of $900,000 last year.

Meanwhile, average income of Ontarians between the ages of 25 and 34 years has stayed nearly the same for decades, lingering at an average of roughly $50,000 a year. According to the latest data from StatsCan, the yearly income was $50,800 in 2020.

In order for millennials to buy a home in the province, the report says average home prices need to drop by $530,000, more than 60 per cent of the market value last year, for them to afford a mortgage that covers 80 per cent of the value.

Or, Ontario millennials will need to be earning $137,000 a year, which is roughly $85,000 more than what they are currently making on average.

A graph of Ontario's home prices relative to 25-to-34-year-olds full-time earnings. (Generation Squeeze)

A graph of Ontario's home prices relative to 25-to-34-year-olds full-time earnings. (Generation Squeeze)

“It takes 22 years of full-time work for the typical young person to save a 20 [per cent] down payment on an average priced home,” the report reads, which they say is 17 years longer than when “today’s aging population” were their age. The report did not clarify what age groups fall under this definition.

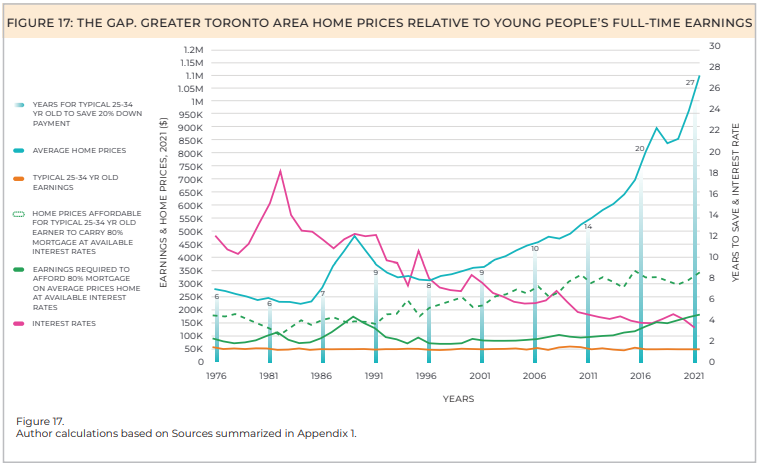

The lack of affordability in the Greater Toronto Area (GTA) is even steeper.

Those who have their sights set on owning a home in the GTA will have to save for an average of 27 years to make the same downpayment on an average-priced home. That is 10 years longer compared to the average amount of time across Canada.

Average annual incomes have remained at around $50,000 in the region, with StatsCan revealing 25 to 34-year-olds in the GTA raked in an average of $51,600 in 2020.

Meanwhile, average home prices in the region have soared to $1.1 million.

According to the report, these prices will have to fall by more than $750,000 for this age group to afford a mortgage that covers 80 per cent of the home’s value at current interest rates.

A graph of the GTA's home prices relative to 25-to-34-year-olds full-time earnings. (Generation Squeeze)

A graph of the GTA's home prices relative to 25-to-34-year-olds full-time earnings. (Generation Squeeze)

“Or typical full-time earnings would need to increase to $172,000/year – more than triple current levels,” the report notes.

Rent is also steep for those who cannot afford to buy, as the report notes it costs $20,148 a year for a two-bedroom apartment in the GTA in 2021.

With how much millennials make a year on average, rent takes up about 40 per cent of their income.

House prices in the GTA, however, are expected to drop slightly next year.

According to Re/Max Canada’s housing market outlook for 2023, prices are expected to fall by nearly 12 per cent to an average of just over $1 million.

CTVNews.ca Top Stories

Police arrest 3 Indian nationals in killing of B.C. Sikh activist Hardeep Singh Nijjar

Three people have been arrested and charged in the killing of B.C. Sikh activist Hardeep Singh Nijjar – as authorities continue investigating potential connections to the Indian government.

Five areas Canada's foreign interference commissioner says needs more investigation

Commissioner Marie-Josee Hogue released her interim report examining foreign election interference on Friday. Here are five elements of the issue that Hogue says she needs to further probe before she can make conclusions or recommendations.

Police officer hit by driver of fleeing vehicle in Toronto

York Regional Police say they are continuing to search for a suspect in an auto theft investigation who was captured on video running over a police officer in Toronto last month.

Why your airfare may be getting more expensive

Skyrocketing airfare prices are linked to heightened competition and rising food and fuel, according to the CAA.

TD worst-case scenario more likely after drug money laundering allegations: analyst

TD Bank Group could be hit with more severe penalties than previously expected, says a banking analyst after a report that the investigation it faces in the U.S. is tied to laundering illicit fentanyl profits.

New weight-loss drug Wegovy not a 'magic bullet,' doctor warns

As Wegovy becomes available to Canadians starting Monday, a medical expert is cautioning patients wanting to use the drug to lose weight that no medication is a ''magic bullet,' and the new medication is meant particularly for people who meet certain criteria related to obesity and weight.

Drew Carey is never quitting 'The Price Is Right'

Drew Carey took over as host of 'The Price Is Right' and hopes he’s there for life. 'I'm not going anywhere,' he told 'Entertainment Tonight' of the job he took over from longtime host Bob Barker in 2007.

Funeral today for broadcasting legend and voice of 'Hockey Night in Canada' Bob Cole

A funeral is being held today for hockey broadcasting legend Bob Cole in his hometown of St. John's, N.L.

Foreign meddling 'did not affect' overall federal election results: inquiry report

Foreign interference by China did not affect the overall results of the 2019 and 2021 general elections won by Justin Trudeau's Liberals, a federal commission of inquiry has found.