Ontario income credits people need to know about before filing their taxes

While the deadline to file your taxes gets closer, there are some personal tax credits people in Ontario may qualify for.

“Today is the best time to start putting all your papers together, and that way, you’ll be sure you don’t forget anything,” H&R Block tax specialist, Yannick Lemay, told CTV News Toronto.

“Often what we see in practice is that the credits that get forgotten are those that people need to search for slips, they need to search for receipts.”

Lemay brought up Ontario’s Staycation Tax Credit as an example. Through this credit, Ontarians who have stayed in a hotel or rented a cottage in the province can claim 20 per cent of eligible accommodation expenses between Jan. 1 and Dec. 31, 2022.

“We are excluding costs for food, entertainment, gas, and all extra expenses, but anything that goes for accommodation for travel, you can claim,” he said, noting Ontarians who want to apply for this credit should have all of their receipts. “It’s up to $1,000 [for an individual], and it’s a 20 per cent rate credit, so that means Ontarians can get up to $200 back.”

Families and couples can claim up to $2,000 and get a maximum credit of $400.

“Now is the time to get those receipts,” Lemay said. “But there are other credits that have changed, improved, or are new credits, for which you don’t necessarily have to provide an additional receipt.”

Lemay pointed to the Ontario Seniors Care at Home Tax Credit, which can help low to moderate-income seniors with eligible medical expenses.

Seniors who are 70 years and older can write off up to 25 per cent of their medical expenses, and can claim up to $6,000 for a maximum of $1,500 in return.

The credit is refundable and anyone earning up to $65,000 annually can qualify, though the amount of credit is on a sliding scale based on income level.

There is also the Childcare Access and Relief from Expenses (CARE) tax credit, which helps families with a household income of $150,000 or less. Eligible families may be able to claim up to 75 per cent of child care expenses, including child care centres and camps.

While there are personal income tax credits, Lemay says there are also deductions that Ontarians will want to keep in mind.

Anyone who has moved to be closer to work or school might be able to claim their moving expenses, he said.

“Sometimes people think they don’t move far enough to be able to deduct moving expenses, but the criteria is 40 kilometres,” Lemay said.

According to the federal government, if your new home is at least 40 kilometres closer to your new job than your previous home was, you can be eligible for the moving expenses deduction.

Lemay also noted those who have investments outside of their registered accounts – like their Tax Free Savings Account (TFSA) or Registered Retirement Savings Plan (RRSP) – can deduct management fees.

“If you’re paying management fees to your financial institution to manage your money – your investments – those fees are deductible, and they don’t come with a tax slip,” Lemay said. “Sometimes you have to look at the bank statement to find the fees.”

May 1 is the deadline for most Canadians to file their tax returns, with June 15 being the deadline for those who are self-employed.

CTVNews.ca Top Stories

A healthy lifestyle can mitigate genetic risk for early death by 62%, study suggests

Even if your genetics put you at greater risk for early death, a healthy lifestyle could help you significantly combat it, according to a new study.

When you have a moment's notice to evacuate, what do you take?

Knowing what to have at home, or take with you for an evacuation, can be useful and even life-saving.

B.C. brings in law on name changes on day that child killer's new identity revealed

The BC NDP have tabled legislation aimed at stopping people who have committed certain heinous acts from changing their names.

No, a best-selling American writing duo didn't pen a Galen Weston romance novel

You would be forgiven for thinking Christina Lauren's latest romance novel stars a hunky reimagining of Loblaw chairman Galen G. Weston.

Avs forward Valeri Nichushkin suspended at least six months

Colorado Avalanche forward Valeri Nichushkin was suspended for at least six months without pay and placed in Stage 3 of the league's player assistance program.

Ellen DeGeneres addresses the 'hurtful' end of her talk show in new stand-up set

Ellen DeGeneres is reflecting on how her talk show came to an end in her newest Netflix special, 'Ellen's Last Stand ... Up Tour.'

Sunchips, Munchies recalled by Frito Lay Canada for possible salmonella contamination

Frito Lay Canada is recalling two of its most popular snacks due to a possible risk of salmonella contamination.

Western University researchers unlock potential 'cure' for ALS

New research out of London, Ont.'s Western University is shedding light on a potential cure for ALS, in which the targeting of the interaction between two proteins can halt or fully reverse the disease's progression.

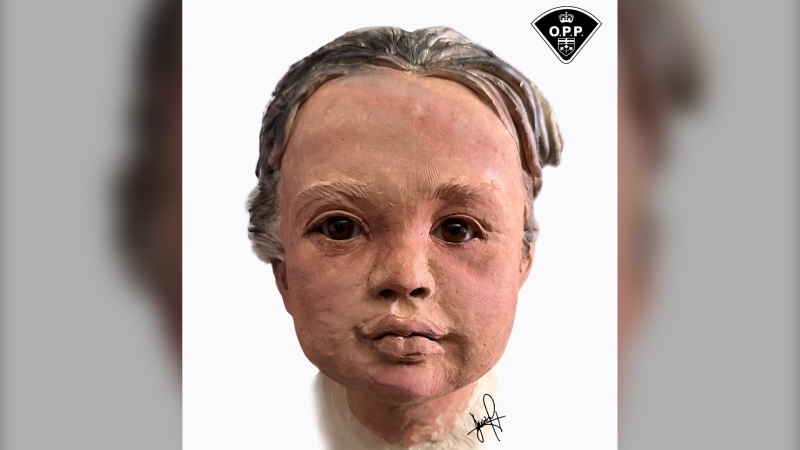

Police release 3D images of young child found in an Ontario river two years ago

Police have released a three-dimensional image of a young child whose remains were discovered in the Grand River in Dunnville, Ont. almost two years ago.