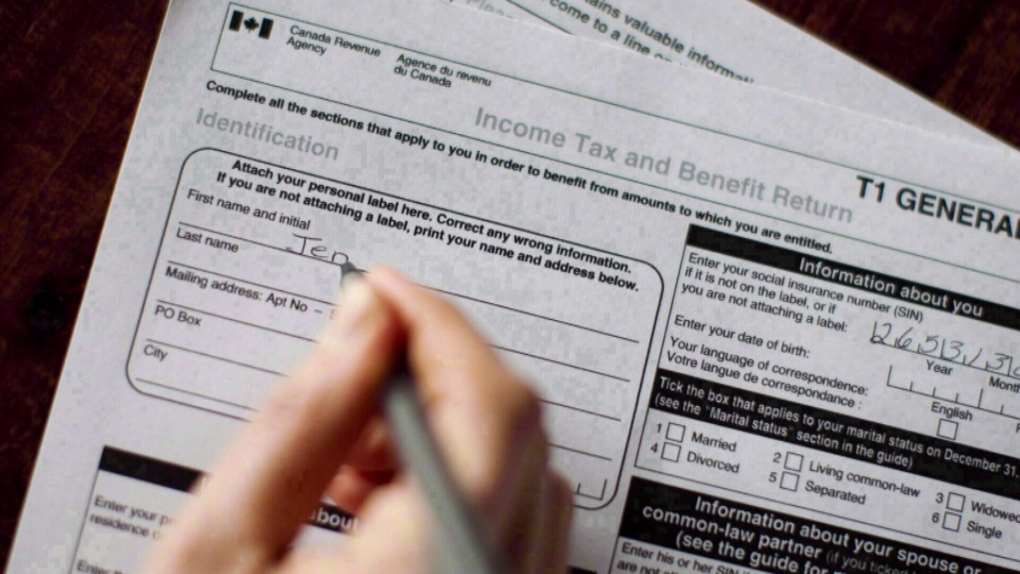

Ontario income credits people need to know about before filing their taxes

While the deadline to file your taxes gets closer, there are some personal tax credits people in Ontario may qualify for.

“Today is the best time to start putting all your papers together, and that way, you’ll be sure you don’t forget anything,” H&R Block tax specialist, Yannick Lemay, told CTV News Toronto.

“Often what we see in practice is that the credits that get forgotten are those that people need to search for slips, they need to search for receipts.”

Lemay brought up Ontario’s Staycation Tax Credit as an example. Through this credit, Ontarians who have stayed in a hotel or rented a cottage in the province can claim 20 per cent of eligible accommodation expenses between Jan. 1 and Dec. 31, 2022.

“We are excluding costs for food, entertainment, gas, and all extra expenses, but anything that goes for accommodation for travel, you can claim,” he said, noting Ontarians who want to apply for this credit should have all of their receipts. “It’s up to $1,000 [for an individual], and it’s a 20 per cent rate credit, so that means Ontarians can get up to $200 back.”

Families and couples can claim up to $2,000 and get a maximum credit of $400.

“Now is the time to get those receipts,” Lemay said. “But there are other credits that have changed, improved, or are new credits, for which you don’t necessarily have to provide an additional receipt.”

Lemay pointed to the Ontario Seniors Care at Home Tax Credit, which can help low to moderate-income seniors with eligible medical expenses.

Seniors who are 70 years and older can write off up to 25 per cent of their medical expenses, and can claim up to $6,000 for a maximum of $1,500 in return.

The credit is refundable and anyone earning up to $65,000 annually can qualify, though the amount of credit is on a sliding scale based on income level.

There is also the Childcare Access and Relief from Expenses (CARE) tax credit, which helps families with a household income of $150,000 or less. Eligible families may be able to claim up to 75 per cent of child care expenses, including child care centres and camps.

While there are personal income tax credits, Lemay says there are also deductions that Ontarians will want to keep in mind.

Anyone who has moved to be closer to work or school might be able to claim their moving expenses, he said.

“Sometimes people think they don’t move far enough to be able to deduct moving expenses, but the criteria is 40 kilometres,” Lemay said.

According to the federal government, if your new home is at least 40 kilometres closer to your new job than your previous home was, you can be eligible for the moving expenses deduction.

Lemay also noted those who have investments outside of their registered accounts – like their Tax Free Savings Account (TFSA) or Registered Retirement Savings Plan (RRSP) – can deduct management fees.

“If you’re paying management fees to your financial institution to manage your money – your investments – those fees are deductible, and they don’t come with a tax slip,” Lemay said. “Sometimes you have to look at the bank statement to find the fees.”

May 1 is the deadline for most Canadians to file their tax returns, with June 15 being the deadline for those who are self-employed.

CTVNews.ca Top Stories

BREAKING Alice Munro, Nobel literature winner revered as short story master, dead at 92

Nobel laureate Alice Munro, the Canadian literary giant who became one of the world's most esteemed contemporary authors and one of history's most honoured short story writers, has died at age 92.

Latest updates on air quality alerts, and when the smoke may reach Ontario and Quebec

Wildfires have led Environment Canada to issue air quality advisories for parts of B.C., Alberta, Manitoba, Saskatchewan and the Northwest Territories, as forecasters warn the smoke could drift farther east.

Are these Canada's best restaurants? Annual top 100 list revealed

The annual list of Canada's top restaurants in the country was just released and here are the places that made the 2024 cut.

Attack on prison van in France kills 2 officers, inmate escapes

Armed assailants killed two French prison officers and seriously wounded three others in an attack on a convoy in Normandy on Tuesday and an inmate escaped, officials said.

Maximum payout for LifeLabs class-action drops from $150 estimate to $7.86

Canadian LifeLabs customers who filed an application for a class-action settlement began receiving their payments this week, though at a much lower amount than initially expected.

Steal a car, lose your driver's licence for 10 years under new Ontario proposal

Repeat car thieves may face lengthy licence bans under proposed changes to Ontario’s Highway Traffic Act.

$1.6B parts plant for Honda electric vehicle batteries coming to Niagara Region

A Japanese company has announced it will build an approximately $1.6-billion plant in Ontario's Niagara Region that will make a key electric vehicle battery component as part of Honda's supply chain in the province.

B.C. brings in law on name changes on day that child killer's new identity revealed

The BC NDP have tabled legislation aimed at stopping people who have committed certain heinous acts from changing their names.

Manitoba premier to visit areas impacted by wildfire

Manitoba Premier Wab Kinew will get a close-up look at the devastation from a large wildfire burning in northern Manitoba Tuesday.