More than half of GTA condo investors losing money on properties: report

A new report says for the first time ever, more than half of newly-completed condo investors in the Greater Toronto Area were losing money on their rental properties last year — and its authors expect the trend to persist.

The research from the Canadian Imperial Bank of Commerce and real estate research firm Urbanation says 48 per cent of leveraged condo investors who bought pre-construction units to rent out were cash flow positive in 2022.

- Download our app to get local alerts on your device

- Get the latest local updates right to your inbox

For the majority of investors, rent generated by newly-completed units was lower than mortgage costs, condo fees and property taxes.

CIBC and Urbanation feel this trend marks a "meaningful shift" that may signal a change in investor behaviour is on its way.

They say they expect the shift toward negative cash flow is expected to worsen in the years ahead as increasingly expensive new condos presold to investors in the past few years reach completion.

They add a reduction in interest rates and further growth in rents will lighten the impact on investors in the years ahead, but won’t be enough to stop their financial situations from getting worse.

This report by The Canadian Press was first published May 29, 2023.

CTVNews.ca Top Stories

B.C. tenants evicted for landlord's use after refusing large rent increase to take over neighbouring suite

Ashley Dickey and her mother rented part of the same Coquitlam duplex in three different decades under three different landlords.

MPP Sarah Jama asked to leave Ontario legislature for wearing keffiyeh

MPP Sarah Jama was asked to leave the Legislative Assembly of Ontario by House Speaker Ted Arnott on Thursday for wearing a keffiyeh, a garment which has been banned at Queen’s Park.

Mountain guide dies after falling into a crevasse in Banff National Park

A man who fell into a crevasse while leading a backcountry ski group deep in the Canadian Rockies has died.

Montreal actress calls Weinstein ruling 'discouraging' but not surprising

A Montreal actress, who has previously detailed incidents she had with disgraced Hollywood producer Harvey Weinstein, says a New York Court of Appeals decision overturning his 2020 rape conviction is 'discouraging' but not surprising.

Saskatchewan isn't remitting the carbon tax on home heating. Why isn't my province following suit?

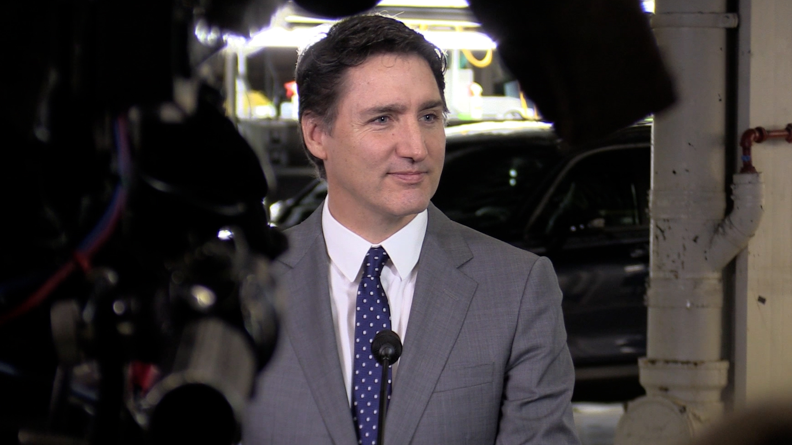

After Prime Minister Justin Trudeau said the federal government would still send Canada Carbon Rebate cheques to Saskatchewan residents, despite Saskatchewan Premier Scott Moe's decision to stop collecting the carbon tax on natural gas or home heating, questions were raised about whether other provinces would follow suit. CTV News reached out across the country and here's what we found out.

Expert warns of food consumption habits amid rising prices

A new survey by Dalhousie University's Agri-Food Analytics Lab asked Canadians about their food consumption habits amid rising prices.

Charlie Woods, son of Tiger, shoots 81 in U.S. Open qualifier

Charlie Woods failed to advance in a U.S. Open local qualifying event Thursday, shooting a 9-over 81 at Legacy Golf & Tennis Club.

Caleb Williams goes to the Bears with the No. 1 overall pick in the NFL draft

Caleb Williams is heading to the Windy City, aiming to become the franchise quarterback Chicago has sought for decades.

Body of Quebec man who died in Cuba found in Russia, family confirms

A Montreal-area family confirmed to CTV News that the body of their loved one who died while on vacation in Cuba is being repatriated to Canada after it was mistakenly sent to Russia.