Here's how to improve or build your credit score if you have none

Your credit score is one of the most important qualifiers you have, signaling to financial institutions the likelihood of you repaying borrowed money.

Canadian credit scores range between 300 and 900 and if you’ve been late paying your bills, you could have a low credit score. Some people with no credit history could actually have no score at all.

The good news is that if you don’t have a credit history or you have a low credit score due to past financial problems, you can work to make it better.

If you’ve been thinking of buying a home, a car or taking out a loan and your credit score is below 600, it can be hard to qualify with many lenders.

“A bad credit history can also make it difficult to rent an apartment, go to college or even get a job,” Lisa Gill of Consumer Reports told CTV News Toronto on Wednesday.

Part of the problem is that if you want to build up your credit, you need to get credit. So, how can you get credit if you have bad credit?

An important first step is to open a bank account, take out several small loans and pay them back, making on-time monthly payments.

Over time, this should improve your score.

Next, you might want to consider applying for what's known as a secured credit card, which means that you've backed the card with cash. Secured credit cards can help build or rebuild your credit score since the payments are included in your credit report.

You could also ask a family member with good credit to add you to their credit card account, but just make sure you have a good relationship with that person because if you miss or are late with a payment, it can hurt both your scores.

Once you establish a credit score you'll want to continually try to improve it. To do that you should try to pay off all outstanding collections, fix any errors you find in your credit history and try to reduce balances on your credit cards.

If you always pay your bills on time, you can avoid collections in the future.

“Once you pay off any debt in collections, many credit-scoring systems won’t heavily weigh them when your score is calculated,” Gill said.

If there is an error on your credit file you can dispute it by sending a certified letter with evidence to Equifax and TransUnion.

Equifax also now allows you to check your credit score for free and you can access your file in just a few steps on their website.

Also, watch out for any company that promises it can fix your credit score fast for a fee. You don't have to pay to improve your score — it can only be done over time by having good financial habits and sticking to them.

CTVNews.ca Top Stories

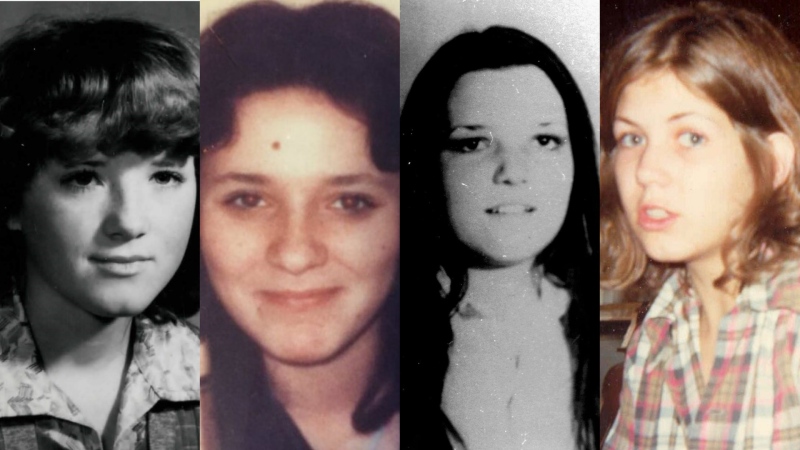

Serial sexual offender linked to unsolved 1970s homicides of four Calgary girls, women

An investigation into unsolved historical homicides from the 1970s has linked the deaths of two girls and two young women in and around Calgary to a now-deceased serial offender.

Woman with liver failure rejected for a transplant after medical review highlights alcohol use

For nearly three months, Amanda Huska has been in an Ontario hospital, part of it on life support, because of severe liver failure. Her history of alcohol use is getting in the way of her only potential treatment: a liver transplant.

$500K-worth of elvers seized at Toronto airport

Fishery and border service officers seized more than 100 kilograms of unauthorized elvers at the Toronto Pearson International Airport on Wednesday.

Wildfires are dampening against cool, rainy weather, but there's plenty left to contain

An opportune system of cool, wet weather Friday is dampening the spread of wildfires across Western Canada, but there's still plenty of work for responders and residents alike.

Dabney Coleman, actor who specialized in curmudgeons, dies at 92

Dabney Coleman, the mustachioed character actor who specialized in smarmy villains like the chauvinist boss in '9 to 5' and the nasty TV director in 'Tootsie,' has died. He was 92.

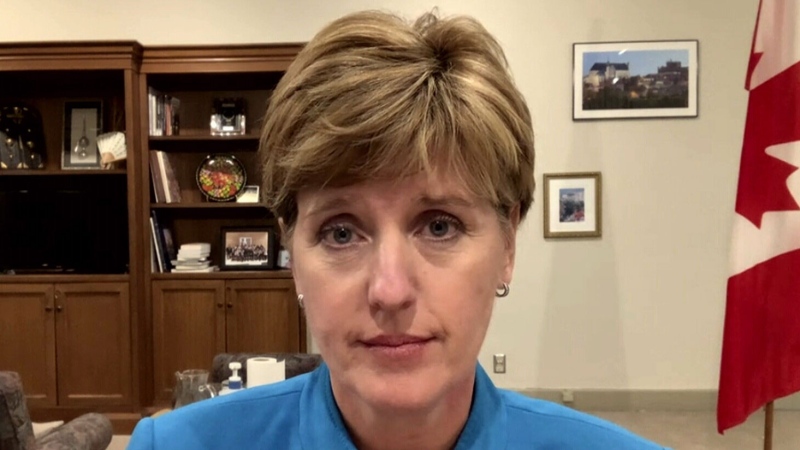

Information commissioner faces $700K funding shortfall, says system is 'overwhelmed'

Canada's information commissioner says her office is facing a $700,000 funding shortfall that could impact its ability to investigate complaints about government transparency and accountability.

Backlash over NFL player Harrison Butker's commencement speech has reached a new level

The NFL is distancing itself from controversial comments by Kansas City Chiefs kicker Harrison Butker during a recent commencement address.

Craig Berube named as next head coach of Toronto Maple Leafs

The Toronto Maple Leafs have named Craig Berube as their new head coach.

B.C. man 'attacked suddenly' by adult grizzly near Alberta boundary: RCMP

A B.C. man is recovering from multiple injuries after he was "attacked suddenly" by an adult grizzly bear near Elkford Thursday afternoon.