GTA home prices still forecast to rise 11 per cent in 2022 even with expected interest rate hikes: Royal LePage

A real estate sold sign is shown in a Toronto west end neighbourhood May 17, 2020. THE CANADIAN PRESS/Graeme Roy

A real estate sold sign is shown in a Toronto west end neighbourhood May 17, 2020. THE CANADIAN PRESS/Graeme Roy

Real estate brokerage Royal LePage says that the expected rise in interest rates in 2022 “may not be enough to offset the significant upward price pressure” on homes, especially in the Greater Toronto Area where it expects the cost of the average property to go up by double-digits once again.

The brokerage said that the aggregate price of a home in the Greater Toronto Area increased by 17.3 per cent in 2021 to $1,119,800 as demand continued to outpace supply.

It is forecasting that in 2022 prices in the GTA will rise by another 11 per cent, with the aggregate home price reaching $1,243,000 by the fourth quarter.

The forecasted price growth comes despite market expectations that the Bank of Canada could raise interest rates up to five times in 2022, significantly increasing the cost of borrowing.

“It isn't sustainable. The good news, if you could call it that, is we see all prices rising at about half the rate they did in 2021 in the months ahead so while home prices continue to be more expensive the rate at which they're getting more expensive is falling,” Royal LePage President and CEO Phil Soper told CP24 on Friday morning. “We will find things return to normal appreciation levels sometime in the future, my guess is by 2023 we will be back into single-digit increases, which is what we have come to expect in the city and across the country over the decades.”

The Bank of Canada’s overnight lending rate has been at its effective lower bound of 0.25 since early on in the COVID-19 pandemic but with inflation surging and employment numbers back to their pre-pandemic norms the central bank is expected to begin a cycle of rate hikes in the coming months.

Soper said that when that happens it will effectively make homes more expensive and “some people will get priced out of the market.”

But he said that it likely won’t be enough to tame rising housing prices, given the lack of supply.

“We’ve been building to this lack of supply for years unfortunately and it really came to a head during the pandemic when there was such hyper focus on our homes,” he said. “People were saving money. They were not travelling, they weren’t going out to restaurants and they redirected that money, a lot of it, into their living conditions.”

Royal LePage says that in 2021 the median price of a detached home in the Greater Toronto Area increased 22.4 per cent to $1,421,200 while the median price of a condominium increased 14.8 per cent to $665,400.

Soper, however, said that price growth in condos could outpace detached homes in 2022 due to the “growing gap” in prices, at least in the GTA.

CTVNews.ca Top Stories

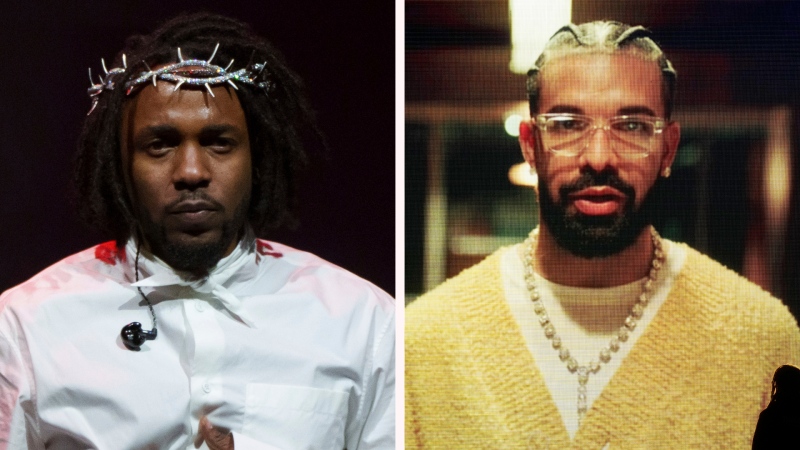

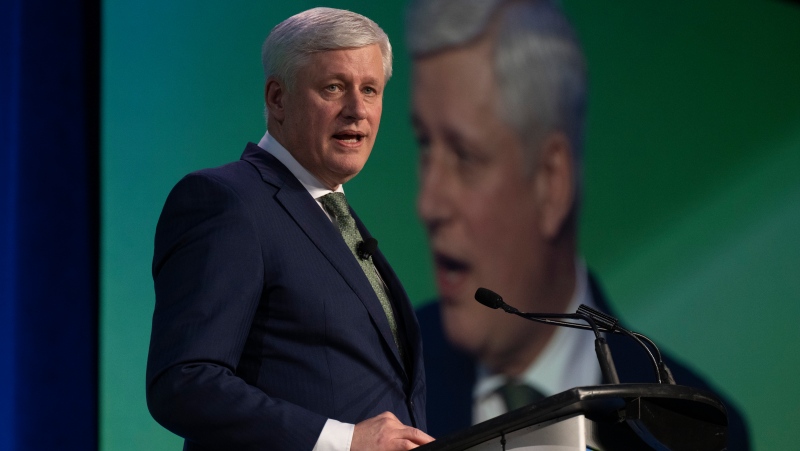

Canadian gov't proposes new foreign influence registry as part of wide-spanning new bill

Prime Minister Justin Trudeau's government is proposing a suite of new measures and law changes aimed at countering foreign interference in Canada, amid extensive scrutiny over past meddling attempts and an ever-evolving threat landscape.

Boeing Starliner capsule's first crewed test flight postponed

The long-awaited first crewed test flight of Boeing's new Starliner space capsule was called off for at least 24 hours over a technical issue that launch teams were unable to resolve in time for the planned Monday night lift-off.

Teacher charged in historical sexual assault of Calgary teenage girl

Calgary police have charged a teacher with the alleged sexual assault of a teenage girl more than 20 years ago.

Winnipeg man admits to killing four women, argues he's not criminally responsible

Defence lawyers of Jeremy Skibicki have admitted in court the accused killed four Indigenous women, but argues he is not criminally responsible for the deaths by way of mental disorder – this latest development has triggered a judge-alone trial rather than a jury trial.

Man banned from owning animals after fatal Calgary dog attack

The owner of three Calgary dogs that got loose and mauled a woman to death in 2022 has been ordered to pay a $15,000 fine within one year and banned from owning any animal for 15 years.

East-end Ottawa family dealing with massive rat infestation

Residents in Ottawa’s Elmridge Gardens complex are dealing with a rat infestation that just won’t go away. Now, after doing everything they can to try to fix the issue, they are pleading with the city to step in and help.

Mediterranean staple may lower your risk of death from dementia, study finds

A daily spoonful of olive oil could lower your risk of dying from dementia, according to a new study by Harvard scientists.

An El Nino-less summer is coming. Here's what that could mean for Canada

As Canadians brace themselves for summer temperatures, forecasters say a weakening El Nino cycle doesn’t mean relief from the heat.

Newfoundland and Labrador latest province to tighten rules on Airbnbs

Newfoundland and Labrador is the latest jurisdiction to bring in stricter rules for short-term rentals, with a coming set of regulations that will force operators to register with the provincial government.