Former RCMP officer calls on Ontario to get to the bottom of $372M in suspicious casino transactions

A former RCMP officer is calling on the province to conduct a thorough investigation into the hundreds of millions of dollars worth of suspicious transactions flowing through Ontario’s casinos every year.

Despite measures taken in recent years to crack down on suspicious transactions, records show the dollar value of the suspicious transactions has actually increased risen to levels higher than those of before the pandemic.

“My guess is that in many of these cases when you’re seeing large sums of money like this, there are illicit funds,” Cal Chrustie, a former RCMP investigator that dealt with complex cases involving money laundering and transnational crime, said.

“The numbers are significant, but until you drill down to each transaction with an in-depth investigation, it’s very hard to tell,” he said.

Ontario regulators introduced new rules requiring casinos to maintain logs on anyone doing more than $3,000 worth of business in a single transaction, ascertain the source of funds, and watch for indicators of money laundering. If signs of laundering are detected, casinos refuse to take the money at all.

The rules came into effect at the beginning of 2022, a year when suspicious cash transactions rose to higher than pre-pandemic levels.

In 2019, there were $334 million in suspicious transactions, according to records provided through a freedom of information request. By 2022, that had risen by $38 million to $372 million — or by more than $1 million a day.

By comparison, B.C. regulators brought in similar rules to clamp down on the flow of suspicious cash after it became apparent they were being used in a transnational money laundering effort that washed drug money and invested it into the province’s real estate market.

Source: B.C. government, Ontario Lottery and Gaming Corporation

Source: B.C. government, Ontario Lottery and Gaming Corporation

Figures provided by the B.C. government show that suspicious cash was as high as $153 million in 2015 — but by last year, dropped to just $3 million.

Those rules inadvertently ensnared Toronto rapper Drake in 2018, when he visited the Parq Casino in downtown Vancouver, and was turned away.

Drake claimed he had been profiled. The casino later reported it couldn’t take cash like his thanks to new rules.

Ontario Premier Doug Ford said this week said he has confidence in the system.

“The OLG, if there is anything suspicious, they call the OPP in. They’ll do an investigation, like anything else,” Doug Ford told reporters. “I have all the confidence in the world in the OPP,” he said.

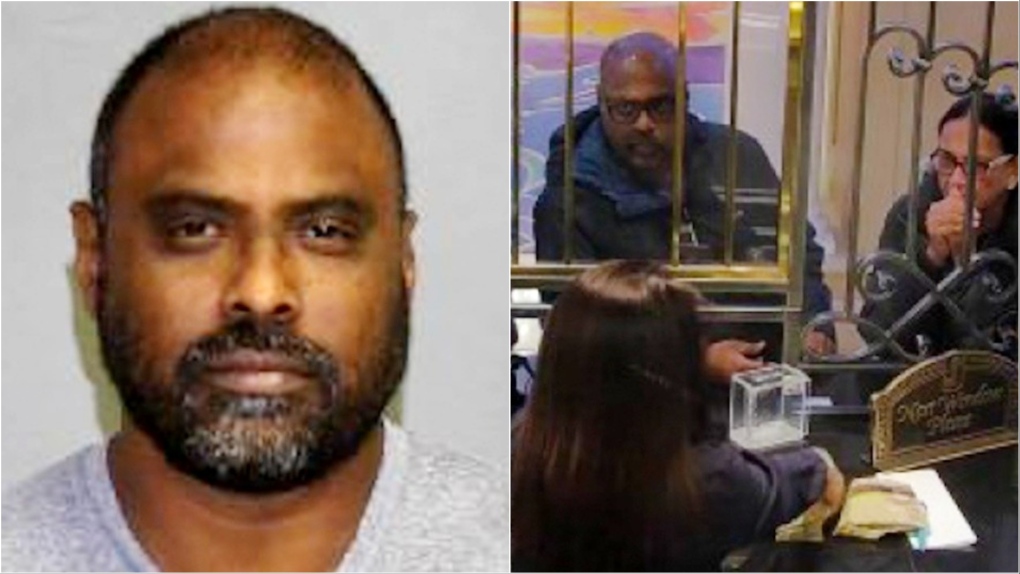

Last year in Ontario, the OPP zeroed in on millions in cash transactions by just one man, Branavan Kanapathipillai, including $824,000 cash at Pickering Casino. The casino took as much as $100,000 per transaction, court documents say, and the source of funds was left as “unclear” — something the AGCO is now investigating.

Authorities seized nearly $100,000 that Kanapathipillai used to buy chips at Fallsview Casino, though he intends to fight it at civil forfeiture, saying the money is legitimately obtained.

“Mr. Kanapathipillai wants to help the police. He has been cooperating with their investigation and will continue to do so in the civil forfeiture process. He is looking forward to his day in court which he fully expects will result in the return of his lawfully obtained money,” his lawyer told CTV News Toronto in a statement.

Peter German, a former RCMP deputy commissioner, wrote a report on B.C. casinos called “Dirty Money”, which contained recommendations that, when enacted, were one reason the number of suspicious transactions plummeted.

German said he couldn’t make any conclusions based on the raw figures from Ontario, but said much could be gained by a big-picture look at the funds.

“One really has to look carefully at the numbers to determine how they were created,” German said in an interview.

“You can have over-reporting and you can have underreporting. You have to assess the quality of the transactions. It’s important that the regulator is following up,” he said.

Chrustie said potential money laundering has to be looked as more than just a financial crime because the ill-gotten gains could be used to empower criminals, often drug traffickers, or other agencies that are threats to national security.

He said it’s not good enough to simply rely on the police to receive suspicious transaction reports and wash your hands after that.

“That’s what we saw in B.C. There was a straw man mentality. Everybody’s going to send the suspicious transactions, and we would receive them all, and people like myself were overwhelmed by the volume, didn’t look at 99 per cent of those transactions,” he said.

“On paper, it looks great, but in reality, it’s not."

CTVNews.ca Top Stories

Fall sitting bookended by Liberal byelection losses ends with Trudeau government in tumult

The House of Commons adjourned on Tuesday, bringing an end to an unstable fall sitting that has been bookended by Liberal byelection losses. The conclusion of the fall sitting comes as Prime Minister Justin Trudeau's minority government is in turmoil.

2 B.C. police officers charged with sexual assault

Two officers with a Vancouver Island police department have been charged with the sexual assault of a "vulnerable" woman, authorities announced Tuesday.

Canadian government announces new border security plan amid Donald Trump tariff threats

The federal government has laid out a five-pillared approach to boosting border security, though it doesn't include specifics about where and how the $1.3-billion funding package earmarked in the fall economic statement will be allocated.

B.C. teacher disciplined for refusing to let student use bathroom

A teacher who refused to let a student use the bathroom in a B.C. school has been disciplined by the province's professional regulator.

Most Canadians have heard about Freeland's resignation from Trudeau cabinet, new poll finds

The majority of Canadians heard about Chrystia Freeland's surprise resignation from Prime Minister Justin Trudeau's cabinet, according to a new poll from Abacus Data released Tuesday.

Police chief says motive for Wisconsin school shooting was a 'combination of factors'

Investigators on Tuesday are focused on trying to determine a motive in a Wisconsin school shooting that left a teacher and a student dead and two other children in critical condition.

After investigating Jan. 6, House GOP sides with Trump and goes after Liz Cheney

Wrapping up their own investigation on the Jan. 6 2021 Capitol attack, House Republicans have concluded it's former GOP Rep. Liz Cheney who should be prosecuted for probing what happened when then-President Donald Trump sent his mob of supporters as Congress was certifying the 2020 election.

Wine may be good for the heart, new study says, but experts aren’t convinced

Drinking a small amount of wine each day may protect the heart, according to a new study of Spanish people following the plant-based Mediterranean diet, which typically includes drinking a small glass of wine with dinner.

The Canada Post strike is over, but it will take time to get back to normal, says spokesperson

Canada Post workers are back on the job after a gruelling four-week strike that halted deliveries across the country, but it could take time before operations are back to normal.