More than $4 million in suspicious casino buy-ins allegedly traced to one man

Just one man racked up millions of dollars in suspicious transactions at several Toronto-area casinos, CTV News Toronto has learned.

Branavan Kanapathipillai's more than $4 million deposits and withdrawals over several years raised flags at various casinos, but it wasn't until last fall that a nearly $100,000 cash buy-in was seized in Niagara Falls, court documents obtained by CTV News Toronto say.

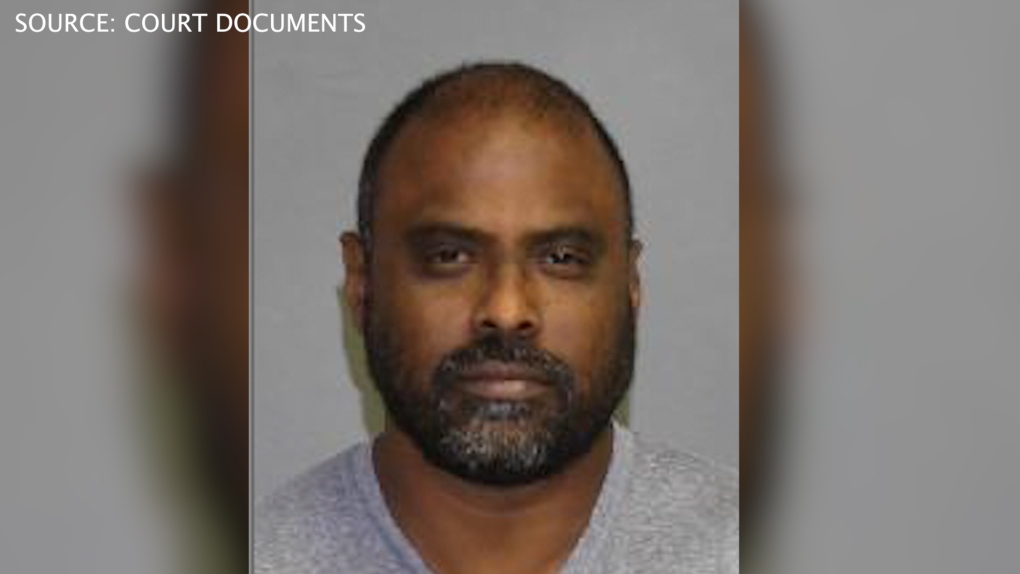

Branavan Kanapathipillai seen in a mug shot (Credit: Court documents).

Branavan Kanapathipillai seen in a mug shot (Credit: Court documents).

His buy-ins were a significant portion of the total suspicious transactions reported across Ontario gaming facilities, which roared back from a pandemic low of $116 million to $372 million last year, records show.

Kanapathapillai’s apparent ease in depositing and withdrawing millions over the span of years shows that while casinos are reporting the transactions, those reports aren’t being acted on fast enough, said retired RCMP money laundering specialist Garry Clement.

“It’s a terrible thing to say, but it’s open season for individuals like this,” Clement said in an interview this week, saying that casinos need to do more than file reports — they must also take steps to keep the individual out.

“These seem pretty obvious. There’s more to this than just gambling,” he said.

Kanapathipillai is not charged with any crime in relation to these transactions, and his lawyer told CTV News he plans to contest the application in a Newmarket courthouse to seize his money.

“Mr. Kanapathipillai wants to help the police. He has been cooperating with their investigation and will continue to do so in the civil forfeiture process. He is looking forward to his day in court which he fully expects will result in the return of his lawfully obtained money,” wrote James Foy in a letter to CTV News.

The nearly $100,000 buy-in at Fallsview Casino was flagged by the cashier as a suspicious transaction. Kanapathipillai claimed he was gambling with the proceeds of a third mortgage.

The OPP instead seized the cash, the documents say, alleging he was in league with a loan shark. Officers alleged in court that Kanapathipillai had multiple drivers licenses, bank accounts, and aliases, and a two-decade history of fraud and other convictions.

An affidavit filed in court indicated that the $100,000 may have been the tip of the iceberg, mapping hundreds of transaction reports at casinos or banks connected to him in the past 12 years adding up to $11 million.

Among them was a $182,000 deposit at Fallsview Casino in 2015. In 2016, Kanapathipillai presented $80,000 at Casino Rama, separated into eight bundles worth $10,000 each, the documents say.

At One Toronto Gaming, which operates Casino Woodbine, Pickering Casino Resort, Great Blue Heron Casino and Hotel, and Casino Ajax, their anti-money laundering unit had documented 120 transactions totalling more than $3 million in 2021 and 2022.

On July 1, 2022, Pickering Casino reported $824,000 in 10 transactions, with the source of cash unclear, and with more than 100 transactions that were “not related to any significant gaming activity. The majority of his transactions were casino gaming chip purchases and redemptions,” the affidavit says.

“Records obtained from a production order relating to Kanapathipillai’s TD Bank accounts indicate a history of Kanapathipillai depositing a large amount into his account and then making multiple cash withdraws via both the teller and the ABM,” the affidavit says.

"His withdrawal and financial transaction patterns were consistent with money laundering techniques that I have observed as an investigator," wrote Det. Constable Vic Jetvic in the affidavit.

Suspicious transactions on the rise

Figures released to CTV News Toronto through a Freedom of Information request show the number of suspicious transactions plummeted from $334 million in 2019 to $134 million in 2020, as the pandemic shuttered casinos.

In 2021, the total suspicious transactions fell still further, to $116 million. But as the pandemic waned and casinos reopened, the suspicious transaction totals roared back to an even higher figure: $372 million.

Those figures are a sign that the casinos are logging suspicious buy-ins, which is a tool that can be used by law enforcement for investigations, said Tony Bitonti of Ontario Lottery and Gaming (OLG).

And three new casinos were opened in 2022, which may also be adding to the total of suspicious transaction reports: Cascades Casino North Bay, Playtime Casino Wasage Beach and Pickering Casino Resort.

“Given the rigour of anti-money laundering controls, these new gaming sites would result in an increase in the number of reports generated under the anti-money laundering compliance program,” Bitonti said.

“OLG supports law enforcement efforts as needed and collaborates with federal and provincial regulators on a shared commitment to integrity and anti-money laundering,” he said.

Clement said the figures may show a problem similar in scale to what British Columbia had, with bags of cash laundered in government-licensed casinos, taking money from the province’s illicit drug market and putting it into real property that a government report found inflated housing prices in the province.

“Ontario needed to do the same thing. A real deep dive into how serious the problem is here in Ontario. I can tell you from personal experience that Vancouver pales in comparison to what’s going on in Ontario,” he said.

CTVNews.ca Top Stories

WATCH LIVE Canadian government announces new border security plan amid Donald Trump tariff threats

The federal government has laid out a five-pillared approach to boosting border security, though it doesn't include specifics about where and how the $1.3-billion funding package earmarked in the fall economic statement will be allocated.

Fall sitting bookended by Liberal byelection losses ends with Trudeau government in tumult

The House of Commons adjourned on Tuesday, bringing an end to an unstable fall sitting that has been bookended by Liberal byelection losses. The conclusion of the fall sitting comes as Prime Minister Justin Trudeau's minority government is in turmoil.

Prosecutors charge suspect with killing UnitedHealthcare CEO as an act of terrorism

The man accused of killing UnitedHealthcare's CEO has been charged with murder as an act of terrorism, prosecutors said Tuesday as they worked to bring him to a New York court from from a Pennsylvania jail.

W5 Investigates How a convicted con artist may have exploited Airbnb's ID checks in rental scams

In part two of a W5 investigation into landlord scams, correspondent Jon Woodward looks at how hosts on Airbnb may be kept in the dark about their guests' true identities – a situation that a prolific Canadian con artist appears to have taken advantage of.

Alcohol is not good for us. 5 tips to stay safe(r) if you drink

The holidays and New Year’s Eve are fast approaching, and for many, that means alcohol-infused festivities and gatherings to navigate.

The world's busiest flight routes for 2024 revealed

If you think planes have got fuller and the skies busier over the past year, you’d be right — especially if you live in either Hong Kong or Taipei.

Sex-ed group deemed 'inappropriate' by Tory government returns to N.B. schools

A sexual-education group whose presentations were deemed "clearly inappropriate" by the previous New Brunswick Progressive Conservative government has been cleared to return to the province's schools.

Suspect in Gilgo Beach serial killings is charged in the death of a seventh woman

The New York architect facing murder charges in a string of deaths known as the Gilgo Beach killings was charged on Tuesday in the death of a seventh woman.

Number of family doctors in Canada now growing at a slower pace: report

Canada is facing a growing crisis in its health-care system as the rate at which family doctors are growing has slowed, according to a recent report.