Toronto semi pushes $2 million as 'bully offers' dominate red-hot market

Homes across the country posted eye popping gains in real estate over the past year, with the area around Toronto leading the pack, according to statistics published by a national association of realtors.

And that is translating on the ground into bare-knuckle fights on the ground for scarce properties, with bully offers becoming the norm, say realtors who themselves are astonished at how prices have gone through the roof.

“We bought one house three years ago for $1.2 million. We sold the house last week for $1.71. In three years the value of increase of this house is substantial,” said Nicola St. John of Bosley Real Estate.

The home, a two-story semi-detached home in the Pocket neighbourhood in Toronto’s East End, received three bully offers and sold after a day on the market for $210,000 above asking. Bully offers are buyers coming in well before an offer date with attempts to buy before competitors.

It’s not the only one: a nearby semi-detached on Logan Avenue sold for $550,000 over asking this week, just $50,000 shy of $2 million.

“It’s crazy. That’s an enormous amount of money,” said St. John, pointing to one factor: a dearth of listings that leave desperate buyers scamblng.

“There’s nothing on the market. It’s the lowest inventory in the city since 2013. It’s been a long time since there’s been so little for sale.”

Analysts say Toronto and area’s surge is pulling up averages all across the country.

“It’s definitely dominated by Toronto,” said Shaun Cathcart of the Canadian Real Estate Association. “A big part of this is a return into the city and a big comeback in the condo market,” he said.

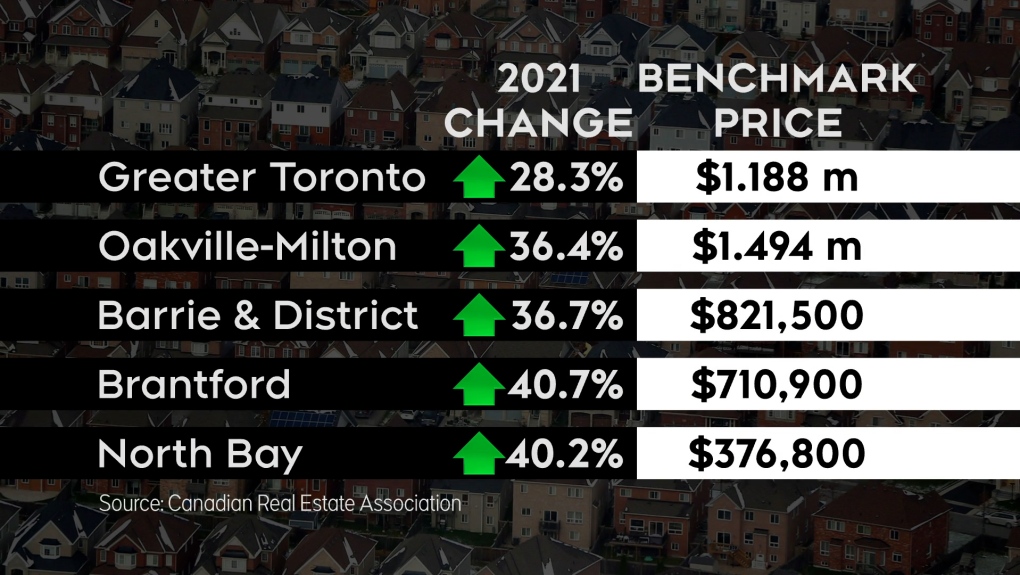

According to the CREA, prices in Greater Toronto soared 28.2 per cent in the last 12 months to a benchmark price of $1.18 million.

Surrounding areas grew even more. Oakville and Barrie for example jumped more than 36 per cent in prices. Brantford and North Bay surged more than 40 per cent.

“This year is head and shoulders above anything else. One of the main reasons for that that doesn’t get discussed enough is that COVID-19 is causing a lot of people to pull up stakes and move around who in a non-COVID world may have been in their forever home for the next 30 or 40 years. And a lot of those people are playing with major equity,” Cathcart said.

Getting a mortgage with a modest down payment at today’s rates with the Pocket home’s selling price would cost about $7,500 a month — a sign the people buying have a lot in the bank.

The price surge is great for homeowners but for those who don’t own property it’s a major factor in a punishing housing crisis.

The Toronto Region Board of Trade has proposed to change zoning rules to allow more smaller less expensive properties — something that could allow buyers to purchase condos or townhouses in a much greater proportion of the city.

CTVNews.ca Top Stories

Trump threatens to try to take back the Panama Canal. Panama's president balks at the suggestion

Donald Trump suggested Sunday that his new administration could try to regain control of the Panama Canal that the United States “foolishly” ceded to its Central American ally, contending that shippers are charged “ridiculous” fees to pass through the vital transportation channel linking the Atlantic and Pacific Oceans.

Wrongfully convicted N.B. man has mixed feelings since exoneration

Robert Mailman, 76, was exonerated on Jan. 4 of a 1983 murder for which he and his friend Walter Gillespie served lengthy prison terms.

opinion Christmas movies for people who don't like Christmas movies

The holidays can bring up a whole gamut of emotions, not just love and goodwill. So CTV film critic Richard Crouse offers up a list of Christmas movies for people who might not enjoy traditional Christmas movies.

Can the Governor General do what Pierre Poilievre is asking? This expert says no

A historically difficult week for Prime Minister Justin Trudeau and his Liberal government ended with a renewed push from Conservative Leader Pierre Poilievre to topple this government – this time in the form a letter to the Governor General.

New York City police apprehend suspect in the death of a woman found on fire in a subway car

New York City police announced Sunday they have in custody a “person of interest” in the early morning death of a woman who they believe may have fallen asleep on a stationary subway train before being intentionally lit on fire by a man she didn't know.

More than 7,000 Jeep SUVs recalled in Canada over camera display concern

A software issue potentially affecting the rearview camera display in select Jeep Wagoneer and Grand Cherokee models has prompted a recall of more than 7,000 vehicles.

'I'm still thinking pinch me': lost puppy reunited with family after five years

After almost five years of searching and never giving up hope, the Tuffin family received the best Christmas gift they could have hoped for: being reunited with their long-lost puppy.

10 hospitalized after suspected carbon monoxide poisoning in Ottawa's east end

The Ottawa Police Service says ten people were taken to hospital, with one of them in life-threatening condition, after being exposed to suspected carbon monoxide in the neighbourhood of Vanier on Sunday morning.

Pickup truck driver killed by police after driving through Texas mall and injuring 5

A pickup truck driver fleeing police careened through the doors of a JCPenney store in Texas and continued through a busy mall, injuring five people before he was fatally shot by officers, authorities said.