TORONTO -- The Ontario government is proposing new measures aimed at better regulating debt settlement companies.

The draft rules would ban debt settlement firms from charging up-front fees and limit the amount of fees consumers are charged.

Debt settlement companies would be required to offer clear, transparent contracts and implement a 10-day cooling-off period.

The proposed regulations -- which have been posted for public comment -- are similar to ones introduced in other provinces such as Alberta, Manitoba and Nova Scotia.

More than 20 debt settlement companies currently operate in Ontario.

The governing Liberals say the Ontario Association of Credit Counselling Services receives over 100 complaints about debt settlement companies a month.

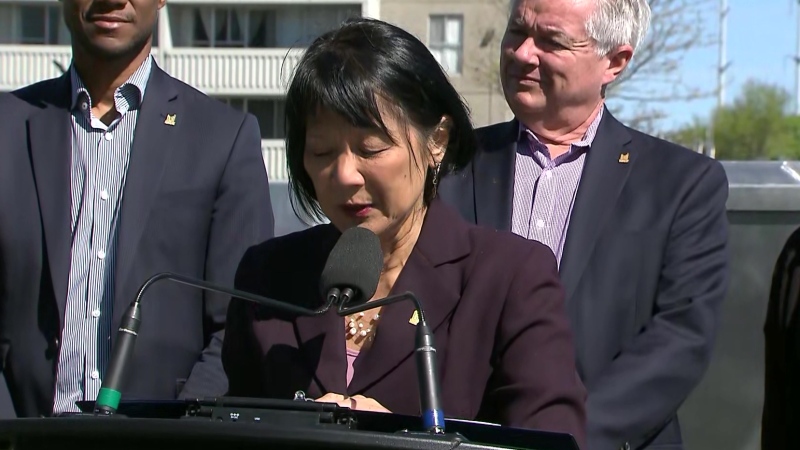

"There is evidence of harmful practices used by some debt settlement companies and that is why our government is taking steps to protect consumers," Consumer Services Minister Margarett Best said in a statement Friday.

"Consumers should know their rights before they sign contracts and they should not make any payments until they get results."