Ontario university student loses $3K after clicking fake CIBC link

An Ontario university student lost $3,000 after clicking on a link that appeared to be a notice from CIBC to check her online banking.

Toronto student Elisha Manila said she clicked on a link in a text she received and thought it was taking her to her online bank account.

“They redirected me to a website that looked identical to CIBC’s online banking platform," said Manila.

But after she signed in, scammers were able to hack into her bank account and send themselves an e-transfer of $3,000.

"Next thing you know, one or two hours later I get an email from CIBC saying I successfully e-transferred these people $3,000,” said Manila, adding, “I was dumbfounded. I didn't think I would fall victim to one of these things."

For the past 20 years, October has been recognized as cyber security awareness month to educate the public on the dangers of online scams.

CTV News Toronto reached out to CIBC and a spokesperson said in a statement, “ We worked with our client to resolve this matter given the unique and extenuating circumstances involved. It is important to remember that impersonation scams are on the rise and can affect anyone.”

“We will never ask a client in a text or email message to click a link to confirm personal information, complete a transaction or resolve a security issue.”

“Clients have a role to play in recognizing scams and protecting themselves against them, including keeping personal or banking information safe and secure, and not sharing it with anyone. If you’re suspicious, contact your bank using the official phone number found on the back of your card or the website.”

Cybersecurity experts say there has been a 35 per cent increase in targeted attacks. Greg Young, vice president of Cybersecurity with Trend Micro, said, “if you're not expecting money from a source, it’s probably not real."

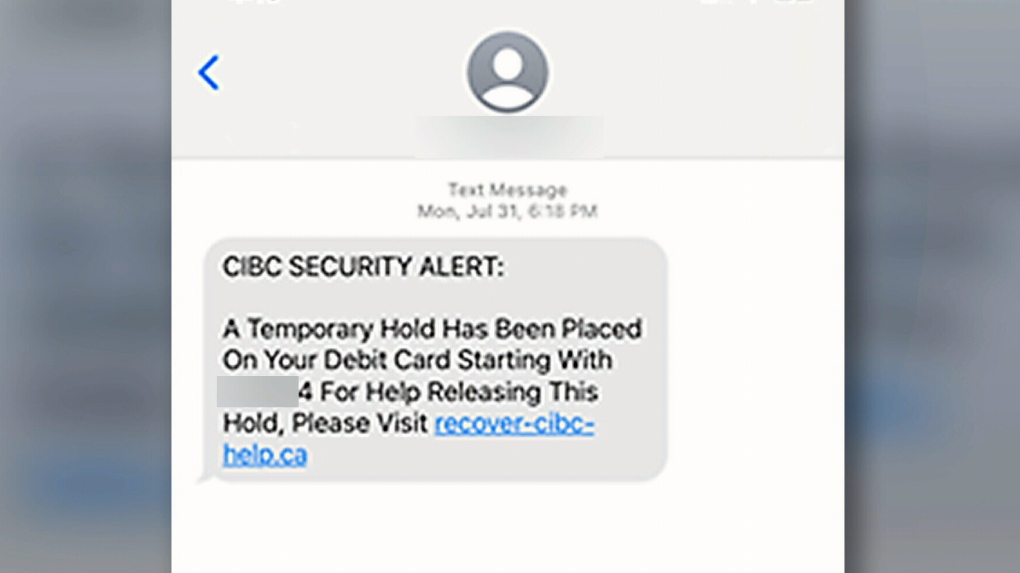

An image from a text message a CIBC banker received, which turned out to be a scam.

An image from a text message a CIBC banker received, which turned out to be a scam.

"They are going to get you to execute something, to react to something or click on something you normally wouldn't do, in order to capture your computer to get you to pay a ransom or get into your online banking," said Young.

To avoid so-called smishing (SMS messaging) and phishing (email) scams, CIBC said don't click on links from suspicious emails and text messages. When logging into online banking, ensure the URL address is correct and never share a one-time verification code.

After CTV News Toronto got involved, CIBC took another look at Manila's case and returned the $3,000 she lost to the scam.

Young said you should ignore emails and texts when you don't know the sender and don't click on attachments or links. Also get in the habit of being more suspicious because if you have a phone or a computer you will get scam messages.

CTVNews.ca Top Stories

Quebec fugitive killed in Mexican resort town, RCMP say

RCMP are confirming that a fugitive, Mathieu Belanger, wanted by Quebec provincial police has died in Mexico, in what local media are calling a murder.

Trump again calls to buy Greenland after eyeing Canada and the Panama Canal

First it was Canada, then the Panama Canal. Now, Donald Trump again wants Greenland. The president-elect is renewing unsuccessful calls he made during his first term for the U.S. to buy Greenland from Denmark, adding to the list of allied countries with which he's picking fights even before taking office.

Multiple OnlyFans accounts featured suspected child sex abuse, investigator reports

An experienced child exploitation investigator told Reuters he reported 26 accounts on the popular adults-only website OnlyFans to authorities, saying they appeared to contain sexual content featuring underage teen girls.

King Charles ends royal warrants for Ben & Jerry's owner Unilever and Cadbury chocolatiers

King Charles III has ended royal warrants for Cadbury and Unilever, which owns brands including Marmite and Ben & Jerry’s, in a blow to the household names.

'Serious safety issues': Edmonton building where security guard was killed evacuated

An apartment building where a security guard was killed earlier this month is being evacuated.

Santa Claus cleared for travel in Canadian airspace

Santa's sleigh has been cleared for travel in Canadian airspace, the federal government announced on Monday just ahead of the busy holiday season.

Ex-OpenAI engineer who raised legal concerns about the technology he helped build has died

Suchir Balaji, a former OpenAI engineer and whistleblower who helped train the artificial intelligence systems behind ChatGPT and later said he believed those practices violated copyright law, has died, according to his parents and San Francisco officials. He was 26.

U.S. House Ethics report finds evidence Matt Gaetz paid thousands for sex and drugs including paying a 17-year-old for sex in 2017

The U.S. House Ethics Committee found evidence that former Rep. Matt Gaetz paid tens of thousands of dollars to women for sex or drugs on at least 20 occasions, including paying a 17-year-old girl for sex in 2017, according to a final draft of the panel's report on the Florida Republican, obtained by CNN.

Young mammoth remains found nearly intact in Siberian permafrost

Researchers in Siberia are conducting tests on a juvenile mammoth whose remarkably well-preserved remains were discovered in thawing permafrost after more than 50,000 years.