Ontario man suffers cardiac arrest in Florida. This is why insurance won't cover his $620,000 hospital bill

An Ontario man who wanted to spend time with his family in Florida was hospitalized after suffering a cardiac arrest at the airport as he was about to fly back to Canada.

Despite having travel insurance, an investigation found he was not considered stable enough to travel and has been stuck with a hospital bill of $620,011.

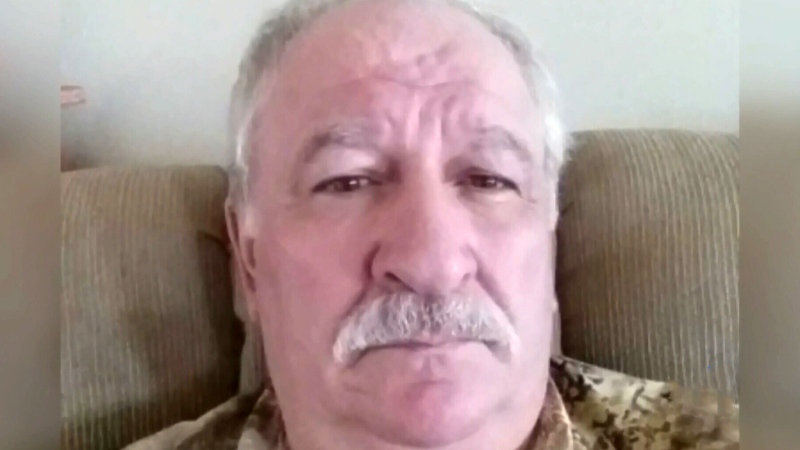

Despite the massive bill, the medical care Richard Bishop received saved his life.

“I’m recovering. I had 10 broken ribs but I’m recovering. I’m good,” said Bishop, a resident of Tecumseh, near Windsor, Ont.

The 73-year-old told CTV News Toronto that on the last day of his trip, while he was at the Orlando airport, he suffered a cardiac arrest and it took 14 minutes of CPR to revive him.

Bishop and his wife, Alina, have group travel insurance and checked to make sure they had coverage before they left Canada. When Richard was hospitalized, he needed a defibrillator.

As far as they were concerned, all their bills were covered.

“I provided them with all the phone numbers to his cardiologist, the doctors and physicians,” Alina said.

The total hospital bill came to $620,011 and that’s when the Bishops found out they were not covered, due to Bishop having pre-existing conditions related to his heart.

“They told me they are not going to pay for the hospitalization because the cardiologist said my husband wasn’t stable to travel,” said Alina.

The family said if they would have known sooner that the hospital bill wouldn’t have been paid, they would’ve taken an emergency flight home to have Richard’s health addressed in Canada.

“After you get an $80,000 defibrillator they said, ‘Oh, we’re not paying,” Bishop said.

When CTV News Toronto reached out to GreenShield, Bishop’s insurance company, a spokesperson said due to privacy concerns, they couldn’t get into specific details.

However, the company did tell CTV News: “As a not-for-profit health and benefits company, GreenShield is committed to our social mission of advancing better health for all. As such, the care of its members is its first priority. Given this individual claim contains private personal health information, we cannot provide specific details. We can confirm all claim decisions involve multiple levels of review with both internal claim examiners and external medical experts,” the statement read.

Martin Firestone, president of Travel Secure Inc., a travel insurance company, told CTV News Toronto a change in medication, a doctor’s visit or pending medical tests are all enough to void an insurance claim.

“Just to think you have travel insurance is not enough. It’s just not enough in this time. You have to be careful to see that you do have coverage,” said Firestone, who was not involved in Bishop's case.

The Bishops said they aren’t sure how they will pay the huge hospital bill.

“I feel terrible. The fact that we had no guidance from them while I was flat on my back in the hospital,” said Bishop.

Firestone also told CTV News that in most cases if someone owes a hospital bill in the U.S. a large sum, like $600,000, you can often negotiate it to a lower amount, especially if you tell the hospital your claim was denied. You could possibly pay hundreds of thousands of dollars less.

CTVNews.ca Top Stories

CRTC posts independent report on Rogers outage, says company made necessary changes

An independent report into the 2022 Rogers outage says the company lacked several protections and redundancies that could have either prevented the outage or ended it sooner.

Ottawa woman, cancer survivor, 49, wins $70 million, plans to help community

An Ottawa woman, who has survived cancer and has overcome addiction, has won $70 million with Lotto Max.

Church must pay $104 million to victims of historical abuse in Newfoundland

The Roman Catholic Church has been ordered to pay settlements totalling $104 million to 292 survivors of historical abuse in Newfoundland and Labrador, including those at the now infamous Mount Cashel orphanage in St. John's.

Eight-year-old boy pulled from water covered in blood after bite at Montreal beach

An eight-year-old boy from Los Angeles had his vacation to Montreal include a dramatic moment when a creature swimming underwater bit him causing a bloody scene at Jean Dore beach.

Earth's core has slowed so much it's moving backward, scientists confirm. Here's what it could mean

Deep inside Earth is a solid metal ball that rotates independently of our spinning planet, like a top whirling around inside a bigger top, shrouded in mystery.

Democrats start moving to Harris as Biden digs in

Amid the ongoing fallout from U.S. President Joe Biden’s debate performance, talk in many top Democratic circles has already moved to who Kamala Harris’ running mate would be.

Montreal Liberal MP Anthony Housefather named to new antisemitism adviser role

Liberal MP Anthony Housefather says he is 'looking forward to making a real difference' as the government's new special adviser on Jewish community relations and antisemitism.

Canada continues Copa run against Venezuela

History is at stake for both Venezuela and Canada when they meet on Friday in Arlington, Texas, in the second Copa America quarter-final.

Ronaldo starts for Portugal as Kolo Muani and Camavinga come in for France in Euro quarter

Portugal captain Cristiano Ronaldo started for a fifth straight match at the European Championship in the quarterfinals against France, for which Randal Kolo Muani and Eduardo Camavinga were promoted from the bench.