Ontario aims to balance budget in 2025 despite largest spending plan in province's history

The Ontario government says it is on track to balancing the budget by 2025 despite having the largest spending plan in the province’s history.

The 186-page budget, titled “Building A Strong Ontario,” puts a heavy emphasis on support for industry, offering tax relief to manufacturers and small businesses while pledging millions towards expanding surgeries at private clinics.

It also appears to follow through on the Doug Ford government’s promise to show “restraint” during “uncertain times.”

- Download our app to get local alerts on your device

- Get the latest local updates right to your inbox

Under the spending plan, released Thursday afternoon, Ontario’s deficit has dropped drastically to about $2.2 billion for this fiscal year, which is about $17.7 billion that was forecasted in the 2022 budget.

The government is projecting a deficit of $1.3 billion in 2023-2024 and a small surplus of $200 million in 2024-2025.

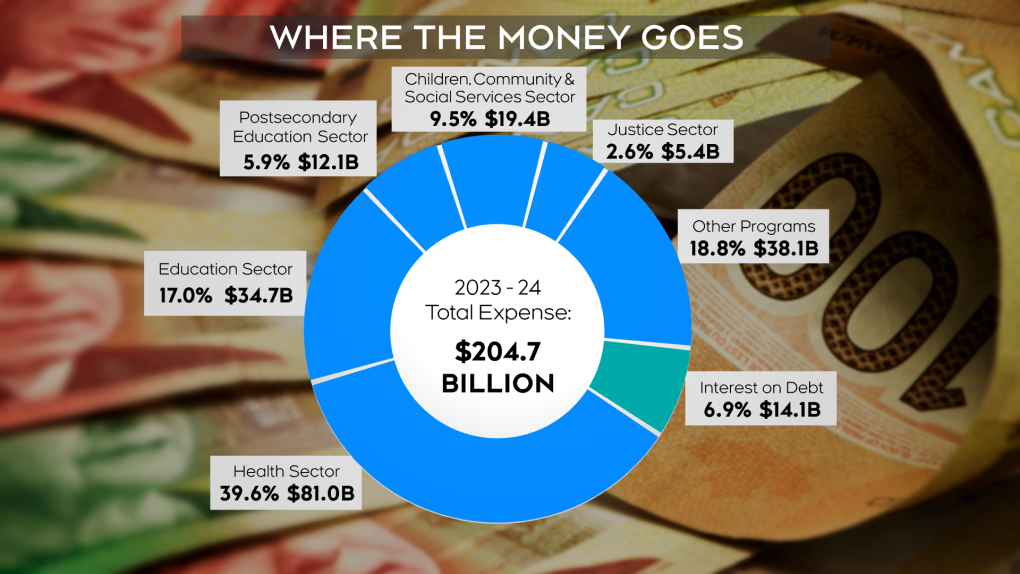

The $204.7-billion budget is the largest in the province’s history, surpassing last year’s spending by more than $6 billion, but officials say this is the result of higher than projected inflation and a more resilient economy.

Included in the fiscal plan is about $81 billion for health care, $34.7 billion for education and $38.1 billion in “other programs.”

Interest on debt is the province’s fourth biggest expenditure at $14.5 billion.

No money has been earmarked towards the building of new hospitals and roadway infrastructure after the government committed $4 billion to highways last year. Instead, the government is investing an additional $72 million in 2023-2024 to make more surgeries available at community surgical and diagnostic centres.

This tracks with the Ford government’s plan to reduce surgical backlogs by investing in private clinics and allowing them to perform more OHIP-covered surgeries.

This chart shows how the Ontario government is spending the $204.7 billion it has allocated for 2023.

This chart shows how the Ontario government is spending the $204.7 billion it has allocated for 2023.

The government is also investing just over $41 million to hire health-care workers. According to the government, the money will be used to hire up to 200 hospital medical supervisors to train newly graduated nurses and retain 100 mid-to-late career nurses. It will also help at least 50 internationally trained physicians get licensed.

The government is also spending $200 million in 2023-2024 to “address immediate health care shortages.”

Meanwhile, there is an additional $425 million, spread over three years, being earmarked for mental health and addiction services. This is on top of an additional $9.6 million to support the care of first responders experiencing mental health disorders.

In total, Ontario’s 10-year capital plan includes about $27.9 billion for highways, $70.5 billion for transit, more than $48 billion for hospital infrastructure, and $22 billion for education.

KEEPING COSTS DOWN

The government said it will expand the Guaranteed Annual Income System (GAINS) program starting in July 2024. Officials said the changes would see 100,000 additional seniors be eligible for the program—a 50 per cent increase in recipients.

The current private income threshold stand at about $2,000 for single seniors and $4,000 for senior couples. The government would not say how the threshold would be changed or how much this will cost.

They did, however, say the benefit would also be adjusted annually to inflation.

The province doubled GAINS in their November 2022 fall economic statement for 12 months starting in January 2023, increasing maximum payments to $166 per month for single seniors and $332 per month for couples.

When asked by reporters why the government chose not to provide further relief for families in the 2023 budget, Finance Minister Peter Bethlenfalvy touted commitments made in previous budgets, stressing that the PCs “didn’t wait until today” to provide aide to Ontarians.

“There's a range of things that we've been doing in the past and we can continue to do,” he said. “It’s not just one thing.”

The government reiterated their gas tax and fuel tax credit, which was previously extended until December 2023, will save households about $195 on average since the program was put in place in July 2022. The elimination of licence plate renewal fees resulted in savings for drivers of about $1.1 billion, the budget said.

Bethlenfalvy said that he supported his government’s decision not to extend or make permanent the province’s temporary sick-day program, calling it a “time limited, very targeted” approach to the pandemic.

“Now we're pivoting to grow this economy, to build good jobs, to get more infrastructure and to really have bigger paychecks for people.”

Ontario Finance Minister Peter Bethlenfalvy (left) and Premier Doug Ford arrive to table the provincial budget at the legislature at Queen's Park in Toronto on Thursday, March 23, 2023. THE CANADIAN PRESS/Frank Gunn

Ontario Finance Minister Peter Bethlenfalvy (left) and Premier Doug Ford arrive to table the provincial budget at the legislature at Queen's Park in Toronto on Thursday, March 23, 2023. THE CANADIAN PRESS/Frank Gunn

The PCs are also using the budget as an opportunity to call on the federal government to defer the Harmonized Sales Tax (HST) on all new large scale purpose-built rental projects in an effort to tackle the housing crisis in Ontario.

The province will also provide new money for supportive housing. The PCs have pledged to add an additional $202 million each year to the Homeless Prevention Program and Indigenous Supportive Housing Program.

Municipalities hoping to see money to offset the elimination of some development fees will be out of luck.

There is no new funding or plan in the 2023 budget to help cities who have been tasked with building hundreds of thousands of new units without the added revenue of those fees.

The Association of Municipalities of Ontario has previously said communities could be short about $5 billion as a result of Ford’s housing legislation.

In Toronto alone, the loss of development charges will cost at least $230 million.

The Ford government has promised to build 1.5 million homes across the province in the next decade. However, housing starts appear to be increasing at a slow pace

Housing starts, which measure new residential construction, also appear to be declining despite new measures put in place by the government, from 96,000 in 2022 to just over 80,000 projected for 2023.

It’s projected to reach just over 83,000 by 2026, although Bethlenfalvy stressed those are private sector forecasts.

“They reflect the economic environment…when interest rates go up, building slows down and there’s adjustments in the market,” he said.

“But clearly, we have a long term goal. And those numbers, which are private sector numbers, don't reflect some of the legislative rules and some of the actions this government is taking through things like Bill 23 and the housing supply action plan.”

The New Democratic Party Finance Critic, Catherine Fife, stressed the budget is “more of the same” and that isn’t working for Ontarians.

"I've never seen a government so gleefully celebrating mediocrity,” she said. “This budget isn't really worth the paper it's printed on."

MADE IN ONTARIO

The premier announced his Ontario Made Manufacturing Investment Tax Credit on Wednesday ahead of the budget, saying it will cost about $780 million over the next three years.

Canadian-controlled private corporations will now be eligible for a 10 per cent refundable tax credit of up to $2 million a year for buildings, machinery and equipment.

Officials have said the income tax credit would be re-evaluated after the three year time period.

The government has also said it would spend $224 million to build and upgrade training centres in Ontario.

An additional $25 million will spend over the next three years to enhance the province’s economic immigration program in order to attract more skilled workers to Ontario while a $75 million will be added to the Skills Development Fund over the next three years.

The government is also expanding the phase-out of its small business corporate income tax, which will provide about 5,500 small businesses with $265 million in relief from 2022-2023 to 2025-2026.

They will be extending the amount of taxable capital for the preferential rate to between $10 million and $50 million.

The government has also said it will be reviewing Ontario’s tax system, focusing on “modernized administration tools” that will help reduce further red tape. No further details were provided by officials about what this review would entail.

CTVNews.ca Top Stories

Trump threatens to try to take back the Panama Canal. Panama's president balks at the suggestion

Donald Trump suggested Sunday that his new administration could try to regain control of the Panama Canal that the United States “foolishly” ceded to its Central American ally, contending that shippers are charged “ridiculous” fees to pass through the vital transportation channel linking the Atlantic and Pacific Oceans.

Man handed 4th distracted driving charge for using cell phone on Hwy. 417 in Ottawa

An Ottawa driver was charged for using a cell phone behind the wheel on Sunday, the fourth time he has faced distracted driving charges.

Wrongfully convicted N.B. man has mixed feelings since exoneration

Robert Mailman, 76, was exonerated on Jan. 4 of a 1983 murder for which he and his friend Walter Gillespie served lengthy prison terms.

Can the Governor General do what Pierre Poilievre is asking? This expert says no

A historically difficult week for Prime Minister Justin Trudeau and his Liberal government ended with a renewed push from Conservative Leader Pierre Poilievre to topple this government – this time in the form a letter to the Governor General.

opinion Christmas movies for people who don't like Christmas movies

The holidays can bring up a whole gamut of emotions, not just love and goodwill. So CTV film critic Richard Crouse offers up a list of Christmas movies for people who might not enjoy traditional Christmas movies.

More than 7,000 Jeep SUVs recalled in Canada over camera display concern

A software issue potentially affecting the rearview camera display in select Jeep Wagoneer and Grand Cherokee models has prompted a recall of more than 7,000 vehicles.

'I'm still thinking pinch me': lost puppy reunited with family after five years

After almost five years of searching and never giving up hope, the Tuffin family received the best Christmas gift they could have hoped for: being reunited with their long-lost puppy.

10 hospitalized after carbon monoxide poisoning in Ottawa's east end

The Ottawa Police Service says ten people were taken to hospital, with one of them in life-threatening condition, after being exposed to carbon monoxide in the neighbourhood of Vanier on Sunday morning.

New York City police apprehend suspect in the death of a woman found on fire in a subway car

New York City police announced Sunday they have in custody a “person of interest” in the early morning death of a woman who they believe may have fallen asleep on a stationary subway train before being intentionally lit on fire by a man she didn't know.