After recent figures showed a 16 per cent drop in housing sales in November compared to the same time last year, Toronto realtors are strengthening their call to abolish the land transfer tax.

But several city councillors say the Municipal Land Transfer Tax now provides a source of revenue the city simply cannot afford to lose.

Ever since the land transfer tax took effect in 2008, the Toronto Real Estate Board has staunchly opposed the tax.

It’s charged on a graduated basis on all properties purchased in Toronto. The board says that the tax, in combination with the recent tightening of mortgage rules, is hurting the local economy.

TREB’s chief government and public affairs officer Von Palmer argues that as the housing market slows – due in part to the tax -- the city is losing millions in economic spinoffs.

He cites a 2009 study conducted by Altus Group Economic Consulting for The Canadian Real Estate Association that found that for each real estate transaction taken off the market in Canada, an average of $46,400 in economic spinoff is lost.

“Things like furniture, appliances, renovations – these are a whole host of industries that depend on real estate, over and beyond the financial services and the legal industry,” said Palmer.

Also at issue is the unreliability of the tax’s revenue stream. In a separate study released last October, the C.D. Howe Institute criticized the land transfer tax and said it is an unsteady source of revenue..

Palmer agrees. “It’s unreliable. We’re seeing the real estate market start to slow down,” he said. “They budgeted for the land transfer tax at the height of the real estate market, so when that revenue source starts to dry up every Torontonian will be affected because they’ll have to find that money from somewhere.”

So far, the tax has turned out to be lucrative and helped put millions of dollars into the City of Toronto’s coffers.

In 2011, the tax brought in roughly $320 million in revenue, representing roughly 3 per cent of the city’s operating budget for the year.

City budget committee chief Coun. Mike Del Grande agrees that the tax is an unstable revenue source. But Del Grande said that although he’d like to phase it out, the city now depends on it.

“It’s embedded that’s the problem, this tax is embedded and not in a good way, but in a bad way in terms of over reliance by the city,” he said.

Del Grande told CTVNews.ca that the total revenue from the tax this year is projected to be around $315 million. He said that council has put a similar amount in the budget for 2013, though he’s uncertain they’ll get it.

“It’s a cash cow when the economy’s good. When the economy’s not so good you’ll see the revenues go down,” he said. “The problem the city has is that it has a very large reliance for continued spending on those levels of taxation.

“I think a lot of councillors have come to realize—even supporters of the mayor-- that it’s too much money and there’s just no way of making it up,” he said.

“I looked at it and we just can’t seem to wean ourselves off of it because of the level of spending.”

Del Grande believes the city should be focusing on saving the land transfer tax revenues in a reserve fund rather than using it to cover the cost of daily operations.

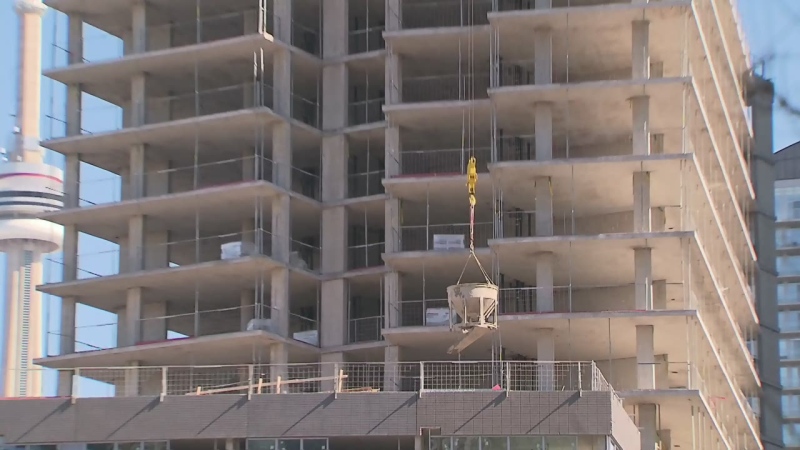

He’s also not entirely sold on the TREB’s argument that the slowdown in housing sales has had an effect on Toronto’s economy, especially given the numerous construction projects underway in the city.

According to the Del Grande, there are roughly $7.2 billion worth of new projects in line to be built, making the board’s claim “a little hard to swallow.”

Meanwhile Coun. Janet Davis, who represents the Beaches-East York ward, said that she doesn’t think the city faces a threat from decreasing land transfer tax revenues unless the city’s housing market completely collapses.

And because the city remains a desirable place to live, argues Davis, she doesn’t anticipate a market collapse.

“People want to live here and people will want to continue to live here,” she said. “We have much lower residential taxes. We have better services and transit. We have more cultural and recreational activities than many of the other GTA municipalities.”

Davis also said that because the city has always projected land transfer tax revenues very conservatively, it should be able to weather a slowdown in the housing market.

“Our staff have been very conservative in terms of their projections for the land transfer tax since we introduced it,” she said. “I anticipate that they will continue to project on the conservative side so that we don’t find ourselves in the position of receiving less revenue than anticipated.”

Davis said the land transfer tax has consistently earned surpluses, which the city should make use of.

“We can’t afford to throw away the land transfer tax and we can’t afford to not rely on it either. What we’re doing is some of both. Some of it is being used to support the overall budget and some of it is being identified for reserve. We have to meet our needs, as well as build for the future.”