TORONTO -- The Canadian Black Chamber of Commerce is calling on the federal government to provide financial support for Black business owners affected by the COVID-19 pandemic that don’t qualify for current government loan programs.

The CBCC has requested $165 million in funding from Ottawa to create loan programs for businesses owners who currently don’t qualify for the Canadian Emergency Business Account (CEBA).

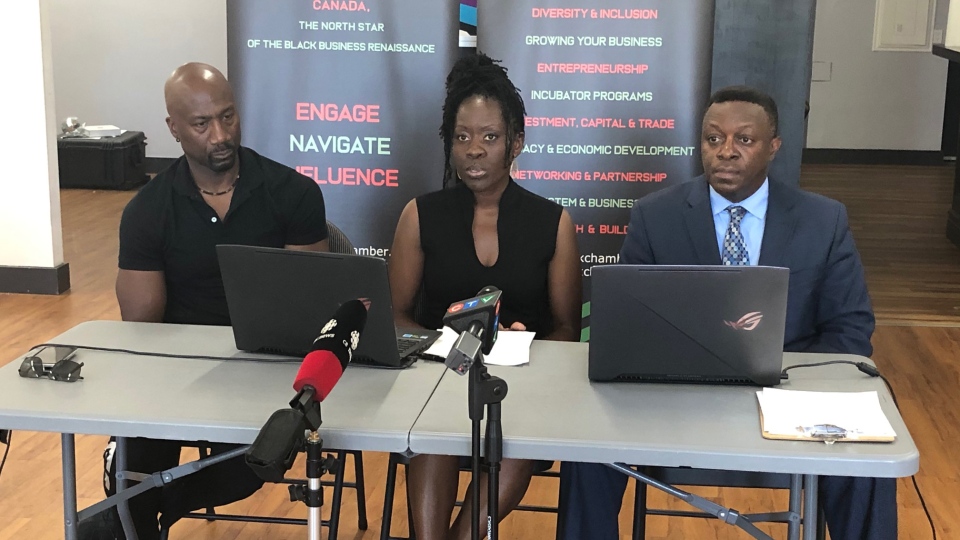

“Many Black business owners in the country have not been able to get any financing or any funding to support them,” Andria Barrett, the president of the Canadian Black Chamber of Commerce, said at a press conference on Tuesday. “We want COVID-19 funding for the Black business community.”

Under the government’s CEBA program, small and medium businesses can receive interest free loans of up to $40,000. In order to be eligible, businesses must have had a payroll between $20,000 and $1.5 million in 2019.

The chamber has identified more than 20,000 Black-owned businesses across the country and in a recent survey found that 70 per cent are not eligible for financial support under the CEBA program.

“A lot of companies across Canada are financing their companies off their credit cards and often paying themselves last, so we found there is a great plethora of companies, black and otherwise, that have basically found themselves in that space,” said Michael Forrest, Founder and Chairman of the Canadian Black Chamber of Commerce. “The bar has been set too high for them to qualify to begin with.”

As part of its proposal, the CBCC would create micro loans for business owners to apply for.

“We’re looking for a repayable grant, zero interest and two year term so that everyone has the same opportunity and chance,” Barrett said.

The chamber estimates its proposal could secure the survival of 6,000 businesses.

“The opportunity is to allow each company to apply for up to a maximum of $25,000 and in doing so we will be providing business coaching, mentoring, training development and things to make sure they can grow their business along the way,” Forrest said.

Business owners fear they may permanently close

The pandemic forced Chedwick Crieghtney to shutdown his virtual reality entertainment business in mid-March and worries that he may never open again.

“We have bank loans, we have landlords that are still clawing at our heals so financially we’ve really taken a toll,” Crieghtney said.

He opened VR Planet in Ajax two years ago and runs it with his two sons. When the pandemic hit, he says they applied for the financial support through the CEBA program, but learned they did not qualify because they did not meet the payroll requirements.

“We didn’t have a payroll, anything that we had we put right back into the business so it was mostly just sweat equity,” he said.

Crieghtney believes his business won’t survive the pandemic without government assistance.

“Without any kind of assistance we are forced to close this place in the next few months.”

The chamber formally made a funding request to the federal government on June 3 and is still waiting for a response.

CTV News Toronto reached out to the government for comment and did not yet receive a response.