Canadian banks need to do more to protect customers: Citizen’s group

About 90 per cent of Canadians bank online and while there are many benefits, there are dangers too as criminals use more elaborate scams to trick Canadians.

A group which advocates for corporate responsibility feels banks need to do more to protect their customers.

“The banks are essentially saying sorry you weren't careful enough, and we weren't careful enough either, but you are going to take the losses and we are going to keep the profits," said Duff Conacher, with Democracy Watch.

Democracy Watch is a national non-profit, non-partisan organization that advocates for improved corporate responsibility for Canadians.

Canadians have already lost $283 million to various frauds this year and $531 million last year according to the Canadian Anti-Fraud Centre.

Many of the scams involve getting into bank accounts and draining away funds through e-transfers, tricking customers into moving money into different accounts or saying they need help catching a bank employee involved in theft.

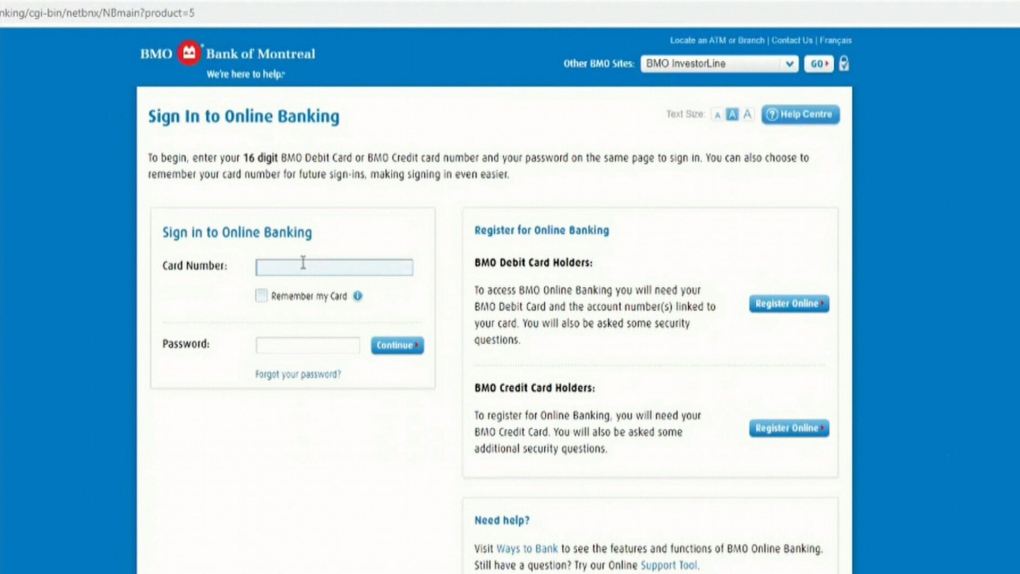

Bruna Capretta of Hamilton recently Googled her bank to do some online banking, but she was directed to a fake website. Criminals drained $3,000 from her account and her bank refused to reimburse her the money.

“You’re made to feel like it’s your fault. Like you’re the criminal” said Capretta.

In many cases if the customer loses money they may not get it back if they did not follow the rules of their banking agreements to the letter.

Every major Canadian bank says on its website they guarantee to reimburse you for unauthorized digital transactions "provided you have kept your account details secure” or “so long as you fulfill your responsibility.”

Conacher said by using this type of language in banking agreements customers can be blamed if they lose money to a scam.

“The banks can easily say in any case it's your fault, it's not our fault at all, even though it might have been a hack into the banks system in some cases,” said Conacher.

An Ontario woman who planned to do some online banking during a lunch break said she was shocked to find out she was scammed out of $3,000. (CTV News Toronto)

Conacher said banks should have anti-fraud systems in place to stop scams, but they don't and he feels if banks allowed customers to set their own limits it could prevent fraudulent transactions.

An Ontario woman who planned to do some online banking during a lunch break said she was shocked to find out she was scammed out of $3,000. (CTV News Toronto)

Conacher said banks should have anti-fraud systems in place to stop scams, but they don't and he feels if banks allowed customers to set their own limits it could prevent fraudulent transactions.

Conacher said customers could set up limits with the bank so they would be notified to approve a transaction if it was over a certain amount such as $1,000.

“Then these transactions would be stopped if they are above a certain dollar value and everyone would be protected," said Conacher.

Until changes are made customers will have to be extremely cautious banking online to make sure they aren't scammed, because if they are, their funds may not be returned.

The Canadian Bankers Association said on its website that banks are working hard to prevent fraud, identity theft and are investing in improving cyber security systems.

The association also said customers must also do their part to learn about fraud and protect themselves.

CTVNews.ca Top Stories

Fall sitting bookended by Liberal byelection losses ends with Trudeau government in tumult

The House of Commons adjourned on Tuesday, bringing an end to an unstable fall sitting that has been bookended by Liberal byelection losses. The conclusion of the fall sitting comes as Prime Minister Justin Trudeau's minority government is in turmoil.

2 B.C. police officers charged with sexual assault

Two officers with a Vancouver Island police department have been charged with the sexual assault of a "vulnerable" woman, authorities announced Tuesday.

Canadian government announces new border security plan amid Donald Trump tariff threats

The federal government has laid out a five-pillared approach to boosting border security, though it doesn't include specifics about where and how the $1.3-billion funding package earmarked in the fall economic statement will be allocated.

B.C. teacher disciplined for refusing to let student use bathroom

A teacher who refused to let a student use the bathroom in a B.C. school has been disciplined by the province's professional regulator.

Most Canadians have heard about Freeland's resignation from Trudeau cabinet, new poll finds

The majority of Canadians heard about Chrystia Freeland's surprise resignation from Prime Minister Justin Trudeau's cabinet, according to a new poll from Abacus Data released Tuesday.

Police chief says motive for Wisconsin school shooting was a 'combination of factors'

Investigators on Tuesday are focused on trying to determine a motive in a Wisconsin school shooting that left a teacher and a student dead and two other children in critical condition.

After investigating Jan. 6, House GOP sides with Trump and goes after Liz Cheney

Wrapping up their own investigation on the Jan. 6 2021 Capitol attack, House Republicans have concluded it's former GOP Rep. Liz Cheney who should be prosecuted for probing what happened when then-President Donald Trump sent his mob of supporters as Congress was certifying the 2020 election.

Wine may be good for the heart, new study says, but experts aren’t convinced

Drinking a small amount of wine each day may protect the heart, according to a new study of Spanish people following the plant-based Mediterranean diet, which typically includes drinking a small glass of wine with dinner.

The Canada Post strike is over, but it will take time to get back to normal, says spokesperson

Canada Post workers are back on the job after a gruelling four-week strike that halted deliveries across the country, but it could take time before operations are back to normal.