A Richmond Hill woman's retirement fund took a big hit after she claims her investment advisor tricked her into investing nearly $200,000 overseas.

Rosemary Skinner says she met her investment advisor, Daniel Lipovetsky, more than 10 years ago when she opened an account with a large investment firm. At some point, Skinner says Lipovetsky started his own company, Investica Asset and Risk Management, and was asked to invest her money with him.

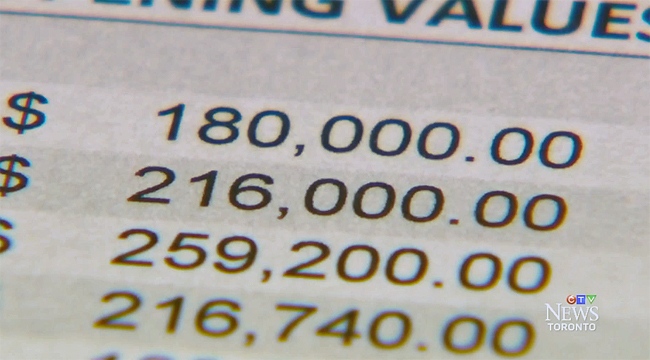

Skinner says she was told she could turn her life savings of $180,000 into more than $500,000 in 11 years by investing her money in Aruba.

"He said it had to do with the government there," said Skinner, who admits she’s not investment savvy and was "naïve" at the time.

Skinner, who is currently unemployed, says her money and Lipovetsky have since disappeared.

"His phone was disconnected. I checked his website, the company has disappeared," she said. "I don't even know if he's still in Canada."

CTV Toronto was unable to contact a Lipovetsky, or a representative of the Vaughan-based company.

According to the Mutual Fund Dealers Association of Canada, Lipovetsky faced disciplinary action in 2013 for conflict of interest and serious misconduct. He was fined $80,000 and was banned from selling securities.

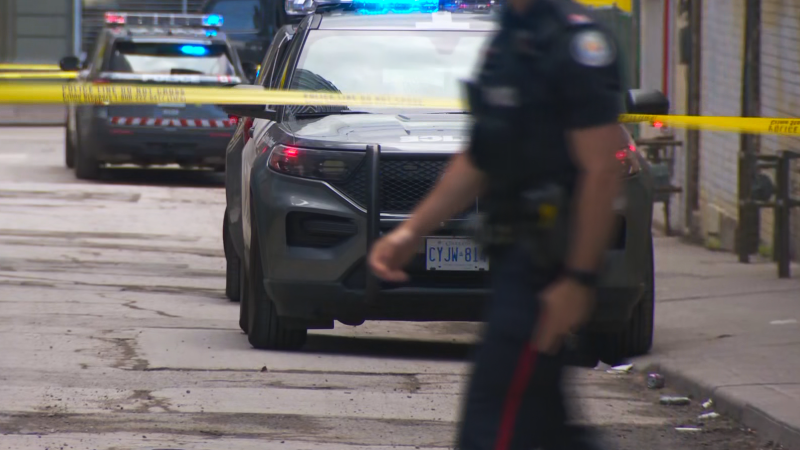

The York Regional Police's fraud unit has also launched an investigation into Skinner's case.

Skinner believes there are other victims.

"I'm not the only one," she said. "There are five or six other people who went to the police."

Signs of investment fraud include:

- A promise of huge profits with no risk

- Hot tips or insider information

- Pressure to invest quickly

- Poor documentation and statements

- Unusual investments out of the country

With a report from CTV Toronto's Pat Foran