TORONTO - Gold stocks helped take the Toronto stock market to a positive close Tuesday as investors nervous about the growing European debt crisis bid bullion prices to a fresh record high.

The S&P/TSX composite index closed up 54.33 points to 13,234.07 while the TSX Venture Exchange moved 6.66 points higher to 1,951.89.

The Canadian dollar rose 0.3 of a cent to 103.5 cents US. The currency had been as low as 102.31 cents earlier in the morning after increasing nervousness pushed traders to the safe haven status of the U.S. dollar.

Worries about the eurozone debt crisis spreading from small economies such as Greece to larger Eurozone economies grew as the premiums demanded by investors to lend to Italy and Spain started to soar. The spread between the yield on Italian 10-year bonds and the benchmark German ones hit 3.1 per cent earlier Tuesday, while Spain's rose to 3.42 per cent.

Spreads moderated somewhat and the euro bounced off early lows after Italian Premier Silvio Berlusconi said the government will bring forward the timetable it has for a raft of austerity measures so that the country can have a balanced budget by 2014.

Officials now say they want the measures passed by Sunday instead of sometime in August.

There was also a successful auction of new Italian government debt.

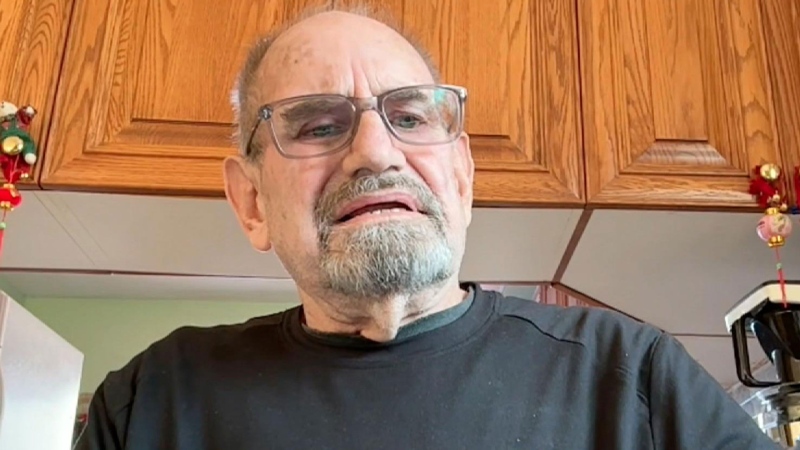

"There is so much fear in the marketplace right now, it's like Chicken Little's 'The sky is falling,"' said Irwin Michael, portfolio manager ABC Funds and president of I.A. Michael Investment Counsel Ltd.

He added that Europe has no choice but to bail out Greece "and do what they have to do with Italy and everyone else."

"They will do something: necessity is the mother of all inventions. The alternative is not so good."

Gold stocks advanced and bullion prices shook off declines while the August bullion contract in New York rose $13.10 to a record closing high of US$1,562.30 an ounce. Goldcorp Inc. (TSX:G) gained $2.03 to $50.86 and Barrick Gold Corp. (TSX:ABX) rose 99 cents to C$45.46.

Telecom stocks also helped push the TSX higher while Rogers Communications (TSX:RCI.B) rose 76 cents to $38.66 and BCE Inc. (TSX:BCE) climbed 37 cents to $38.12.

Oil prices moved into positive territory as strength in the greenback moderated and the August crude contract on the New York Mercantile Exchange moved up $2.28 to US$97.43 following two days of steep losses. The energy sector was flat as Suncor Energy (TSX:SU) lost 32 cents to C$37.98 and Imperial Oil (TSX:IMO) dropped 21 cents to $44.13.

A stronger greenback usually helps depress oil prices, which are denominated in U.S. dollars, as it makes items such as oil more expensive for holders of other currencies.

The base metals sector rose 0.39 per cent as metal prices recovered from early losses with the September copper contract ahead two cents at US$4.39 a pound. Teck Resources (TSX:TCK.B) fell 56 cents to C$49.21 while First Quantum (TSX:FM) lost $3.87 to $134.47.

Traders had initially reacted positively to the minutes of the most recent U.S. Federal Reserve meeting on interest rates that indicated the central bank may yet embark on another round of economic stimulus.

Besides eurozone worries, markets have also been buffeted by worries that the U.S. economy is stuck in a soft patch. Those concerns grew following last Friday's dismal employment report showing the economy created a paltry 18,000 jobs last month.

And with the U.S. Federal Reserve's latest stimulus program expiring at the end of June, investors were relieved to see an indication in the minutes that at least some central bank officials are thinking about another round.

"The minutes do note the continued view of some participants that it 'would be appropriate to provide additional monetary accommodation', if growth remains too slow to reduce unemployment," said CIBC World Markets senior economist Peter Buchanan.

"While the bar for (further stimulus) clearly remains high, the fact that further action is not being categorically ruled out could provide some support."

The Dow Jones industrial average closed down 58.88 points to 12,446.88.

The Nasdaq composite index lost 20.71 points to 2,781.91 while the S&P 500 index dipped 5.85 points to 1,313.64.

There was a negative reaction to the start of the second-quarter earnings season in the U.S.

Shares in aluminum giant Alcoa declined 20 cents to US$15.71 after it reported after the close Monday that net income totalled US$322 million, or 28 cents a share. Excluding one-time items of $38 million, or four cents a share, Alcoa earned 32 cents a share. Analysts, who generally exclude one-item items, expected Alcoa to earn 33 cents per share, according to FactSet.

Alcoa's revenue totalled $6.59 billion, beating expectations of US$6.28 billion and projected higher sales in 2011 across all its markets. However, its shares were down nine cents at US$15.82 in New York.

In other corporate news, shares in Alimentation Couche-Tard (TSX:ATD.B) gained $1.76 to C$29.85 after the convenience store operator boosted its quarterly dividend by 25 per cent. The company's quarterly profit surged 19 per cent to $64 million. Couche-Tard had $4.84 billion in revenues for the quarter, up nearly 21 per cent from a year-ago.

Quebec gas company Gaz Metro has signed a definitive agreement to purchase Central Vermont Public Service Corp. (NYSE:CV), clearing the way for a US$702-million merger. The deal, if approved by shareholders and regulators, clears the way to merge CVPS with Green Mountain Power, Vermont's second largest electric utility.