TORONTO -- Canada's main stock index moved higher, helped by strength in the industrials and materials sectors, as the loonie took a hit amid U.S. President Donald Trump's trade complaints.

The S&P/TSX composite index was up 55.55 points to 16,258.24, after 90 minutes of trading.

In New York, the Dow Jones industrial average was down 8.76 points to 25,307.77. The S&P 500 index was up 2.74 points to 2,781.77 and the Nasdaq composite index was up 6.24 points to 7,651.75.

The Canadian dollar was trading at 76.90 cents US, down from Friday's average value of 77.15 cents US, after Trump continued his attacks on Canada and Prime Minister Justin Trudeau.

Trump complained on Sunday that he had been blindsided by Trudeau's criticism of his tariff threats at a summit-ending news conference.

In tweets, Trump insulted Trudeau as "dishonest" and "weak."

Other Trump advisers also attacked Trudeau in appearances on Sunday.

Trump trade adviser Peter Navarro said in an interview with Fox News on Sunday that "there's a special place in hell for any foreign leader that engages in bad faith diplomacy with President Donald J. Trump and then tries to stab him in the back on the way out the door."

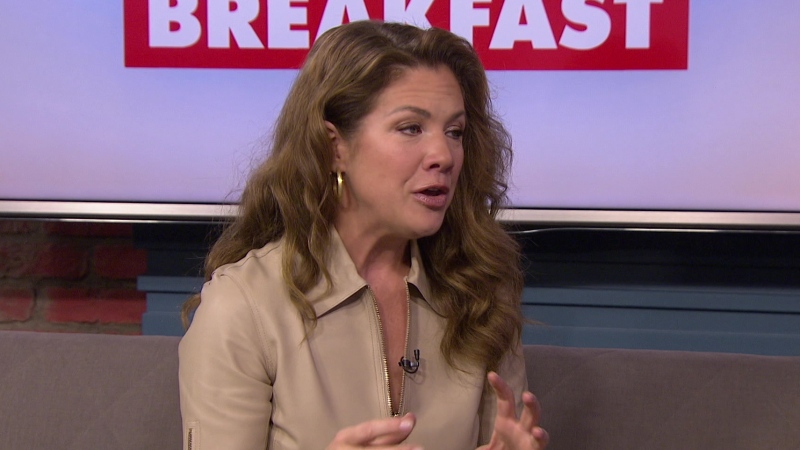

Shaun Osborne, chief FX strategist at Scotiabank, said the market's reaction to sell the Canadian dollar following Trump's latest tweets reflect a belief that a NAFTA deal is further away now.

"The whole tone of the bilateral rhetoric between Canada and the U.S. seems to have deteriorated quite significantly," he said.

The July crude contract was down two cents to US$65.72 per barrel and the July natural gas contract was up five cents to US$2.94 per mmBTU.

The August gold contract was up US$2.20 to US$1,304.90 an ounce and the July copper contract was down four cents to US$3.26 a pound.