Ontario woman in 'shock' by $2,500 vacant home tax bill for condo she lives in

Mary Walker said she got a “bit of shock” when she opened up a piece of mail from the City of Toronto last month, informing her that she owed more than $2,500 in taxes for the “vacant” Scarborough condo where she currently resides.

She said she was hit with the unexpected tax bill after she failed to make her Vacant Home Tax declaration for 2023 and the city deemed her condo unoccupied.

“Obviously it is a bit of shock to get this kind of bill in the mail,” Walker told CP24.com on Thursday.

When Toronto’s Vacant Home Tax was first rolled out in 2022, she said she did go online and make the declaration.

“This year, I overlooked the fact that it said it was an annual thing,” Walker noted, adding that she didn’t see any reminders from the city in the mail this year.

She said the situation has caused unnecessary frustration for some homeowners, who now need to work with the city to resolve the situation.

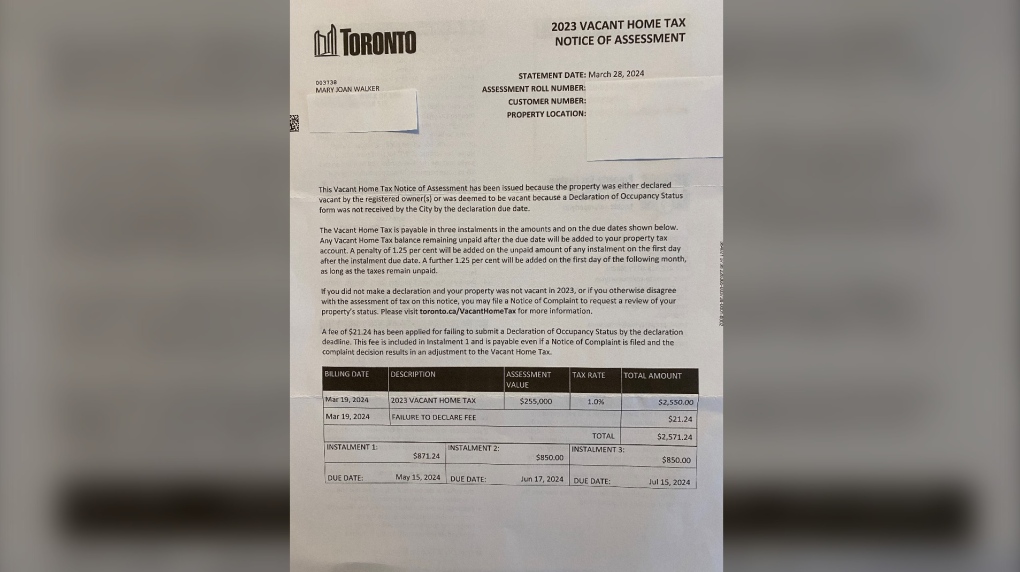

A Vacant Home Tax bill is seen above. (Mary Walker/ Submitted)

A Vacant Home Tax bill is seen above. (Mary Walker/ Submitted)

“It is just frustrating to try and sort this out with such a large, busy office,” said Walker, who has already filed a Notice of Complaint online. “I certainly don’t want to have to go down to city hall to speak to someone.”

Walker is one of many Toronto homeowners who now find themselves in a similar situation after failing to declare the occupancy status of their residence ahead of the deadline, which was initially set for Feb. 29 but later extended to March 15.

Lineups could be seen at the North York Civic Centre on Thursday morning as homeowners who failed to declare looked for more information about next steps.

Homeowners line up at the North York Civic Centre for more information about Vacant Home Tax bills after missing the deadline to declare. (Steven Lindy/ Submitted photo)

Homeowners line up at the North York Civic Centre for more information about Vacant Home Tax bills after missing the deadline to declare. (Steven Lindy/ Submitted photo)

The city’s Vacant Home Tax charges owners who leave their properties vacant for more than six months in a calendar year. For 2023, the taxation rate is one per cent, meaning that the tax for a property valued at $1 million is $10,000.

In the 2024 tax year, and every year after, the tax rate will be three per cent (i.e. $30,000 on a $1 million home).

While the vast majority of homeowners in the city will not be required to pay the tax as their homes are occupied, every homeowner who did not declare by the deadline is required to pay a $21.24 fee.

As of Wednesday, a spokesperson for the city said it had received more than 43,000 Notices of Complaint by owners claiming that their property was occupied in 2023.

"The City is receiving a high volume of Notice of Complaint filings through the portal and staff are prioritizing the processing of these complaints. Once their complaint is reviewed and the grounds of the complaint are found to be valid... then their property tax account will be adjusted and the Vacant Home Tax levy will not apply," Russell Baker, the manager of Media Relations and Issues Management for the City of Toronto, said in an email to CP24.

"In addition, the City will review the current process by which owners must submit an annual declaration of their property’s occupancy status and make improvements for the 2024 taxation year."

Homeowner ‘distressed’ by huge tax bill

Sophie Lem, a Riverdale resident, said she too was unaware that the declaration had to be made every year. Last month, she said she received a Vacant Home Tax bill for more than $12,000.

“I’m just furious, and I’m upset, and distressed at the same time,” she said, adding that it is obvious from the utility bills that the residence is occupied. “A good cross-reference is the water bill.”

Lem said she filed a complaint online and tried to contact her local councillor but has not heard back.

On the bill, Lem said, she is told to make her first payment of more than $4,000 by May 15.

“I don’t know what to do,” she said.

Ward 12 Coun. Josh Matlow urged residents in this situation not to pay the bill while the city works to resolve the issue.

“You are going to receive an updated notice to inform you about the next steps. If you do have utility bills, proof that you live there, certainly send it in but I do know that they mayor and city staff are working this out because there is a recognition that this is not done well,” he told CP24 on Thursday.

Implementation a ‘mess’

Matlow called the declaration process “flawed,” “clumsy,” and unfairly “punitive.”

“This is just a demonstration of an idea that had merit but has not been implemented well,” he said.

“The Vacant Home Tax is being used by cities as a tool to identify where there are investment properties that are just sitting around, sitting vacant that really should be used as homes in the midst of a housing affordability crisis. So it is a useful tool.”

But he said the implementation of it has been “a mess.”

“It is our job to guide and direct city staff to come up with a process that is fair, understandable, reasonable, and isn’t punitive when somebody simply didn’t know to do something.”

He said people faced with unexpected tax bills for “thousands and thousands of dollars” are “understandably upset.”

Matlow added that conversations are underway about how the city can better identify properties that are vacant.

“There should be a way to identify, for example, through the utility bill… where if you are using electricity and water that should suggest that someone is living there,” he said.

“We need to have a process that doesn’t depend on people every single year having to either remember or be prompted to make a declaration.”

In 2022, there were 2,336 property owners who declared their residential units vacant, while 44,902 other properties were initially deemed vacant by the city because no declaration was made. Late declarations received through a complaints process eventually reduced the number of homes deemed vacant to 17,437.

Speaking at an unreleated event in Toronto on Thursday, Mayor Olivia Chow apologized for the rollout of the program and vowed to "clean up the mess."

"By the time I arrived here, the system was already set," Chow told reporters. "It is not acceptable the way we rolled out this program. It is very new."

She said the fact that notices went out in only one language is also problematic.

"I promise you that I will clean this up so that next round, people will not have to line up or have to get a bill that is shocking," she said. "This year we are asking Torontonians, we are asking for forgiveness."

City Council Speaker Frances Nunziata called on the city to reverse the late charge imposed on homeowners who missed the deadline.

"The City’s outreach efforts failed to effectively reach vulnerable populations such as seniors and those with limited English proficiency, resulting in undue financial burdens and emotional distress among affected homeowners. With the commencement of tax bill mailouts on April 2, my office has been inundated with pleas for assistance from distressed residents facing unexpected tax liabilities," Nunziata said in a written statemnet sent on Thursday.

"I condemn the imposition of a $21.24 late declaration charge, considering the circumstances. Given the unprecedented economic challenges facing Toronto residents, compounded by soaring costs of living, it is unjust to burden homeowners with additional financial penalties for a failure in communication on the part of the City."

In a subsequent statement issued Thursday evening, city spokesperson Russell Baker said the late fee will be immediately waived for anyone who states that they completed the declaration before the March 15 deadline.

“Furthermore, given the challenges experienced with this year’s process, the Budget Chief and Mayor will be bringing forward direction to Toronto City Council to seek authority to waive the $21.24 late fee for everyone impacted this calendar year,” he said.

With files from CTV Toronto’s Phil Tsekouras

CTVNews.ca Top Stories

5 rescued after avalanche triggered north of Whistler, B.C. RCMP say

Emergency crews and heli-skiing staff helped rescue five people who were caught up in a backcountry avalanche north of Whistler, B.C., on Monday morning.

Quebec fugitive killed in Mexican resort town, RCMP say

RCMP are confirming that a fugitive, Mathieu Belanger, wanted by Quebec provincial police has died in Mexico, in what local media are calling a murder.

Bill Clinton hospitalized with a fever but in good spirits, spokesperson says

Former President Bill Clinton was admitted Monday to Georgetown University Medical Center in Washington after developing a fever.

Trump again calls to buy Greenland after eyeing Canada and the Panama Canal

First it was Canada, then the Panama Canal. Now, Donald Trump again wants Greenland. The president-elect is renewing unsuccessful calls he made during his first term for the U.S. to buy Greenland from Denmark, adding to the list of allied countries with which he's picking fights even before taking office.

UN investigative team says Syria's new authorities 'very receptive' to probe of Assad war crimes

The U.N. organization assisting in investigating the most serious crimes in Syria said Monday the country’s new authorities were “very receptive” to its request for cooperation during a just-concluded visit to Damascus, and it is preparing to deploy.

Pioneering Métis human rights advocate Muriel Stanley Venne dies at 87

Muriel Stanley Venne, a trail-blazing Métis woman known for her Indigenous rights advocacy, has died at 87.

King Charles ends royal warrants for Ben & Jerry's owner Unilever and Cadbury chocolatiers

King Charles III has ended royal warrants for Cadbury and Unilever, which owns brands including Marmite and Ben & Jerry’s, in a blow to the household names.

Man faces murder charges in death of woman who was lit on fire in New York City subway

A man is facing murder charges in New York City for allegedly setting a woman on fire inside a subway train and then watching her die after she was engulfed in flames, police said Monday.

Canada regulator sues Rogers for alleged misleading claims about data offering

Canada's antitrust regulator said on Monday it was suing Rogers Communications Inc, for allegedly misleading consumers about offering unlimited data under some phone plans.