Ontario business owner warns others about 'cheque washing' scam after $10K stolen

An Ontario man said a cheque he sent the Canada Revenue Agency (CRA) worth more than $10,000 for his maple syrup company was stolen in the mail.

“Since this has happened it's been a bit of a nightmare for us,” said Jordan Ender of Innisfil, Ont.

Ender runs a small family business making organic maple syrup and earlier this year he had to settle his tax bill with the CRA and sent the agency a cheque for $10,800.

"I realized that the cheque was intercepted in the mail at some point and altered and deposited into another account," said Ender, adding, “the cheque was deposited, withdrawn and the account closed at the same time, under what appears to be a fake name.”

This new scam is called "cheque washing" where criminals steal cheques from the mail and alter names and amounts.

Ender thought his bank would reimburse the funds, but when he contacted Royal Bank of Canada (RBC) he was told he had missed an important deadline on reporting the fraud.

"The answer the bank came back with is this cheque was spotted in 54 days and you have to notify us within 45 days," said Ender.

Ender said losing the money could cost him his business and said he still owes the CRA for his outstanding tax bill.

“$10,800 was a lot of money for us on top of that we have $1,500 in penalties from CRA for non-payment,” said Ender.

Jordan Ender's owns a small business in Ontario called Sakura Syrup. CTV News reached out to RBC and a spokesperson said, “We recognize that any time a client is impacted by fraud or scams, it can be a difficult and stressful situation for them. While we cannot comment on the specifics of this situation due to client privacy, we can advise that we take this matter seriously and are communicating with our client directly to resolve their concerns.”

Jordan Ender's owns a small business in Ontario called Sakura Syrup. CTV News reached out to RBC and a spokesperson said, “We recognize that any time a client is impacted by fraud or scams, it can be a difficult and stressful situation for them. While we cannot comment on the specifics of this situation due to client privacy, we can advise that we take this matter seriously and are communicating with our client directly to resolve their concerns.”

“We encourage clients to speak to us if they believe they have been impacted by fraud or scams as we review each instance on a case-by-case basis. Clients should contact us by calling the number on the back of their client card or by reaching out to their local branch.”

CTV News also reached out to Canada Post and a spokesperson said, “Canadians across the country rely on Canada Post for the safe delivery of their mail. It’s a responsibility we take very seriously. Unfortunately, our Customer Service and Security and Investigation teams weren’t made aware of this situation in order to look further into this incident.”

“Customers who believe that mail has been lost or stolen, or if fraud is involved, should contact their local police service and our Customer Service Department online at canadapost.ca/support or by telephone at 1-866-607-6301 (TTY: 1-800-267-2797). Customers concerned about identity fraud should contact the Canadian Anti-Fraud Centre at 1-888-495-8501.”

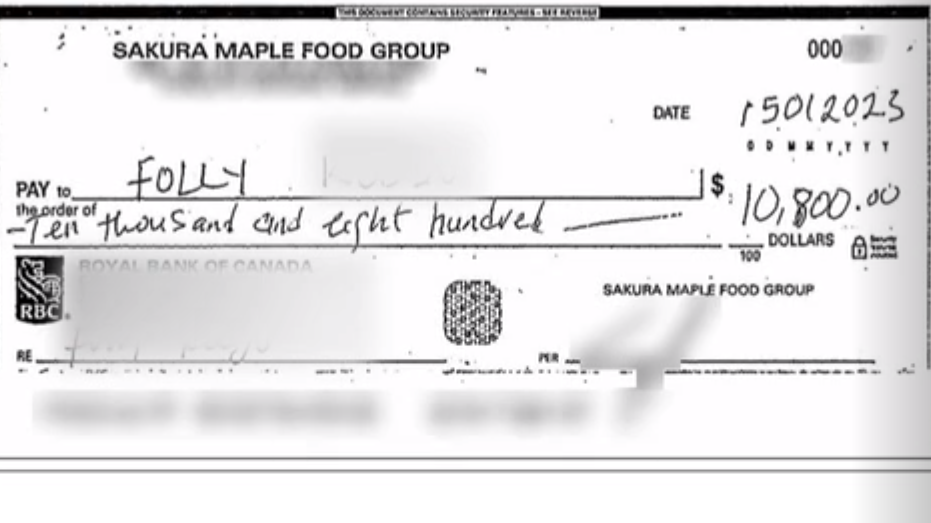

A stolen cheque Jordan Ender said he sent the Canadian Revenue Agency. “When it comes to sending money, we recommend using MoneyGram, money orders, money transfers, etc. rather than sending cash through the mail. We recommend when sending cheques with large amounts, to bring them to the post office and sending them using one of our traceable products as opposed to regular mail.”

A stolen cheque Jordan Ender said he sent the Canadian Revenue Agency. “When it comes to sending money, we recommend using MoneyGram, money orders, money transfers, etc. rather than sending cash through the mail. We recommend when sending cheques with large amounts, to bring them to the post office and sending them using one of our traceable products as opposed to regular mail.”

After CTV News contacted RBC, Ender said the bank apologized to him and as a goodwill gesture agreed to return the $10,800 to his bank account, which was great news for him.

“This has been a big relief for my wife and my whole family. It's been a big relief for all of us," said Ender.

The use of paper cheques has been declining for decades, but cheque fraud is on the rise. In the United States the Financial Crimes Enforcement Network found cheque fraud cases almost doubled to 680,000 cases in 2022 from 350,000 cases in 2021.

It’s advisable to always monitor your bank accounts and report any suspicious activity to your bank right away.

CTVNews.ca Top Stories

DEVELOPING Driver rams New Year's revellers in New Orleans, killing 10; FBI doesn't believe he acted alone

A driver armed wrought carnage on New Orleans' famed French Quarter early on New Year's Day, killing 10 people as he rammed a pickup truck into a crowd before being shot to death by police, authorities said.

Watch The next big thing in AI in 2025, according to one tech analyst

Artificial intelligence isn't done disrupting our lives and compromising online safety, tech analyst Carmi Levy says.

Missing hiker with arrest warrant found after friends delay police report: B.C. RCMP

Mounties in British Columbia are warning the public to be honest after a missing hiker's friends delayed reporting her disappearance to police.

Parts of the U.K. are flooded by heavy rain as wild weather continues to disrupt New Year's events

Parts of the United Kingdom were flooded Wednesday as heavy rains and powerful winds continued to disrupt New Year’s celebrations.

Gypsy Rose Blanchard gives birth to her first baby

Gypsy Rose Blanchard, who became infamous due to her role in the killing of her abusive mother, has given birth to her first child.

Manhunt underway in Sask. after inmate escapes federal prison

Police are seeking the public's assistance in locating an inmate who escaped from the Saskatchewan Penitentiary in Prince Albert.

Financial changes in Canada you should know about this year

There are a few changes in federal policies that could affect Canadians' finances in the new year.

A fireworks explosion in the Honolulu area has killed 3 people and injured at least 20

A New Year’s Eve fireworks explosion in a Honolulu-area neighborhood killed at least three people and critically injured 20 others , authorities said.

Here are some of the new laws and rules coming into effect in Canada in 2025

From boosting child and disability benefits to increasing protections for workers, here’s a look at new measures coming into effect in 2025.