Ontario income credits people need to know about before filing their taxes

While the deadline to file your taxes gets closer, there are some personal tax credits people in Ontario may qualify for.

“Today is the best time to start putting all your papers together, and that way, you’ll be sure you don’t forget anything,” H&R Block tax specialist, Yannick Lemay, told CTV News Toronto.

“Often what we see in practice is that the credits that get forgotten are those that people need to search for slips, they need to search for receipts.”

Lemay brought up Ontario’s Staycation Tax Credit as an example. Through this credit, Ontarians who have stayed in a hotel or rented a cottage in the province can claim 20 per cent of eligible accommodation expenses between Jan. 1 and Dec. 31, 2022.

“We are excluding costs for food, entertainment, gas, and all extra expenses, but anything that goes for accommodation for travel, you can claim,” he said, noting Ontarians who want to apply for this credit should have all of their receipts. “It’s up to $1,000 [for an individual], and it’s a 20 per cent rate credit, so that means Ontarians can get up to $200 back.”

Families and couples can claim up to $2,000 and get a maximum credit of $400.

“Now is the time to get those receipts,” Lemay said. “But there are other credits that have changed, improved, or are new credits, for which you don’t necessarily have to provide an additional receipt.”

Lemay pointed to the Ontario Seniors Care at Home Tax Credit, which can help low to moderate-income seniors with eligible medical expenses.

Seniors who are 70 years and older can write off up to 25 per cent of their medical expenses, and can claim up to $6,000 for a maximum of $1,500 in return.

The credit is refundable and anyone earning up to $65,000 annually can qualify, though the amount of credit is on a sliding scale based on income level.

There is also the Childcare Access and Relief from Expenses (CARE) tax credit, which helps families with a household income of $150,000 or less. Eligible families may be able to claim up to 75 per cent of child care expenses, including child care centres and camps.

While there are personal income tax credits, Lemay says there are also deductions that Ontarians will want to keep in mind.

Anyone who has moved to be closer to work or school might be able to claim their moving expenses, he said.

“Sometimes people think they don’t move far enough to be able to deduct moving expenses, but the criteria is 40 kilometres,” Lemay said.

According to the federal government, if your new home is at least 40 kilometres closer to your new job than your previous home was, you can be eligible for the moving expenses deduction.

Lemay also noted those who have investments outside of their registered accounts – like their Tax Free Savings Account (TFSA) or Registered Retirement Savings Plan (RRSP) – can deduct management fees.

“If you’re paying management fees to your financial institution to manage your money – your investments – those fees are deductible, and they don’t come with a tax slip,” Lemay said. “Sometimes you have to look at the bank statement to find the fees.”

May 1 is the deadline for most Canadians to file their tax returns, with June 15 being the deadline for those who are self-employed.

CTVNews.ca Top Stories

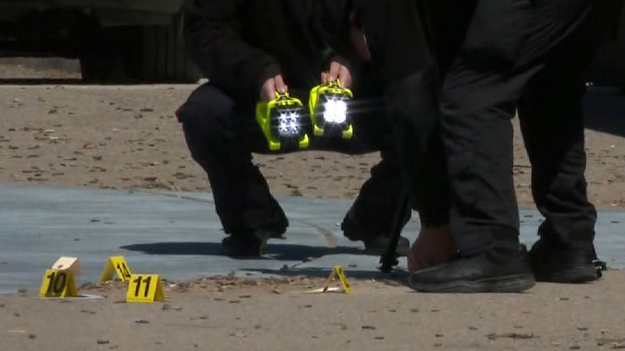

From outer space? Sask. farmers baffled after discovering strange wreckage in field

A family of fifth generation farmers from Ituna, Sask. are trying to find answers after discovering several strange objects lying on their land.

Broadcaster and commentator Rex Murphy dead at 77: National Post

The National Post is reporting that Rex Murphy, the pundit and columnist who hosted a national call-in radio show for decades, has died.

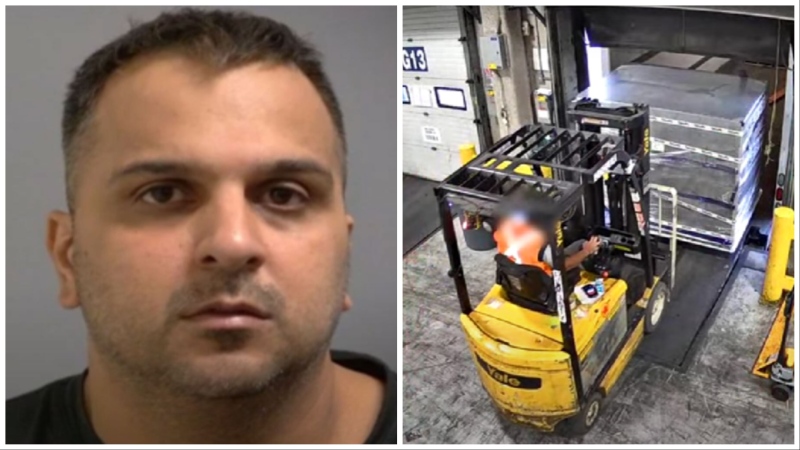

Pearson gold heist suspect arrested after flying into Toronto from India

Another suspect is in custody in connection with the gold heist at Toronto Pearson International Airport last year, police say.

Millions of cyberattacks per hour as B.C. government investigates multiple breaches

Careful attention to government statements and legislation is required to get a handle on the level of risk British Columbians’ information is under, as investigators probe multiple breaches under a continued barrage of attacks.

Ontario family receives massive hospital bill as part of LTC law, refuses to pay

A southwestern Ontario woman has received an $8,400 bill from a hospital in Windsor, Ont., after she refused to put her mother in a nursing home she hated -- and she says she has no intention of paying it.

Debate on abortion rights erupts on Parliament Hill, Poilievre vows he won't legislate

A Conservative government led by Pierre Poilievre would not legislate on, nor use the notwithstanding clause, on abortion, his office says, as anti-abortion protesters gather on Parliament Hill.

Justin and Hailey Bieber are expecting their first child together

Hailey and Justin Bieber are going to be parents. The couple announced the news on Thursday on Instagram, both sharing a video that showcases Hailey Bieber's growing belly.

Here are the ultraprocessed foods you most need to avoid, according to a 30-year study

Studies have shown that ultraprocessed foods can have a detrimental impact on health. But 30 years of research show they don’t all have the same impact.

New 'Lord of the Rings' film coming in 2026

The Oscar-winning team behind the nearly US$6 billion blockbuster 'Lord of the Rings' and 'The Hobbit' trilogies is reuniting to produce two new films.