New report suggests Canadian households are turning to 'creative solutions' to get into housing market

More than 20 per cent of Canadians would consider purchasing a home with a family member in order to break into the housing market, according to a new report by Re/Max.

The Leger report, which was commissioned on behalf of Re/Max, suggests that non-traditional home-ownership models are becoming increasingly more common in larger Canadian cities thanks to “the high cost of living, high interest rates and the price of housing.”

The report, which looked at residents in 22 Canadian cities, found that 48 per cent would consider buying a home using an alternative model. About 22 per cent of those respondents said they would buy under a rent-to-own scenario. About 21 per cent said they would consider co-ownership with a family member that isn’t a spouse or partner, and 17 per cent of respondents said they would consider purchasing a house intending to rent out a part of the home to a tenant.

- Download our app to get local alerts on your device

- Get the latest local updates right to your inbox

“In London, Brampton and Mississauga, homebuyers are increasingly searching for properties with secondary suites to accommodate intergenerational households,” the report read.

In London, the report notes, parents are purchasing homes with their children to operate as an “intergenerational family unit” and assist with child care.

“By contrast, in Mississauga and Brampton, which are experiencing an expanding immigrant population, secondary suites are intended to accommodate extended family members or to generate rental income to support the costs of growing extended families,” the report continued.

The survey indicates that about 13 per cent of respondents who are current homeowners bought a home in a non-traditional way.

According to data from the Toronto Regional Real Estate Board (TRREB), the average selling price of a Toronto home across all property types peaked at $1,334,062 in February 2022 before dropping to a low of $1,037,542 later in the year. With the exception of a surge in activity last spring, prices have remained relatively unchanged in the region.

“With high interest rates plateauing, and potentially lowering in the latter half of 2024, now may be a good time to consider getting into the market, especially for those who have been taking a ‘wait-and-see’ approach,” Benjamin Tal, deputy chief economist for CIBC World Markets Inc., said in a statement accompanying the survey.

“Despite some interest rate reprieve in 2024, Canada is still dealing with an affordability crisis due to lack of inventory and increasing demand, which will persist until the country addresses the problem adequately. Considering this, creative solutions like co-ownership may be an option for many Canadian homebuyers looking to achieve the dream of home ownership.”

Chris Alexander, president of Re/Max Canada, noted that “creativity in the home-buying process” may be a workaround but cannot be considered a “solution” to the country’s affordability crisis.

“Like modern, innovative homebuyers, our governments must be more strategic and visionary in how we can use existing lands and real estate to drive our housing supply to allow for a greater diversity of housing for all Canadians,” Alexander said in a written statement.

The online survey of 1,522 Canadians, which was conducted using Leger’s online panel, was conducted between Jan. 19 and Jan. 20. Online surveys cannot be assigned a margin of error as they do not contain a random sample.

CTVNews.ca Top Stories

Freeland previews omnibus budget bill, proposed capital gains tax change left out

Deputy Prime Minister and Finance Minister Chrystia Freeland will be tabling yet another omnibus bill to pass a sweeping range of measures promised in her April 16 federal budget, though left out of the legislation is the government's proposed capital gains tax change.

Man dies after suffering cardiac arrest while waiting in ER, widow wants investigation

When an ambulance took David Lippert to the hospital in March of 2023, the 68-year-old Kitchener, Ont., executive was hoping to find out why he was feeling weak and unable to walk. Some 24 hours later, he was found unresponsive in the ER.

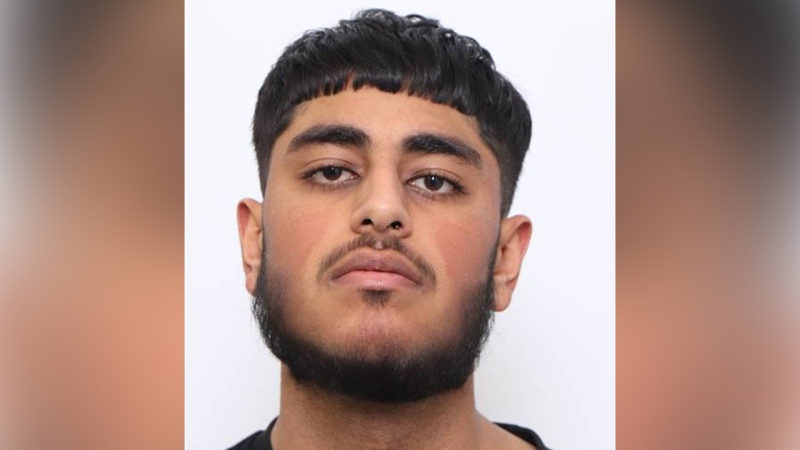

Baby, grandparents among 4 people killed in wrong-way police chase on Ontario's Hwy. 401

A police chase which started with a liquor store robbery in Bowmanville Monday night ended in tragedy some 20 minutes later when a suspect fleeing police entered Highway 401 in the wrong direction and caused a pileup which killed an infant and the child's grandparents, as well as the suspect, investigators say.

Air Canada walks back new seat selection policy change after backlash

Air Canada has paused a new seat selection fee for travellers booked on the lowest fares just days after implementing it.

McGill requests 'police assistance' over pro-Palestinian encampment

McGill University says it has 'requested police assistance' about the pro-Palestinian encampment on its lower field.

Judge raises threat of jail in hush money trial as he holds Trump in contempt, fines him US$9,000

Donald Trump was held in contempt of court Tuesday and fined US$9,000 for repeatedly violating a gag order that barred him from making public statements about witnesses, jurors and some others connected to his New York hush money case. And if he does it again, the judge warned, he could be jailed.

Court upholds Milwaukee police officer's firing for posting racist memes after Sterling Brown arrest

The Wisconsin Supreme Court ruled Tuesday that a former Milwaukee police officer was properly fired for posting racist memes related to the arrest of an NBA player that triggered a public outcry.

Video captures deadly wrong-way police chase on Highway 401 in Ontario

A new video has surfaced showing a vehicle being pursued by police in the wrong direction on Highway 401 moments prior to a fatal crash that killed four people, including an infant and their grandparents.

New cancer treatment approved, but not everyone thinks it's what's best for patients

A new cancer treatment recently approved in Canada promises to cut treatment time down to just minutes, but experts have differing opinions on whether it's what's best for patients.