'I feel horrible': Ontario man denied theft coverage owes $55,000 for stolen truck

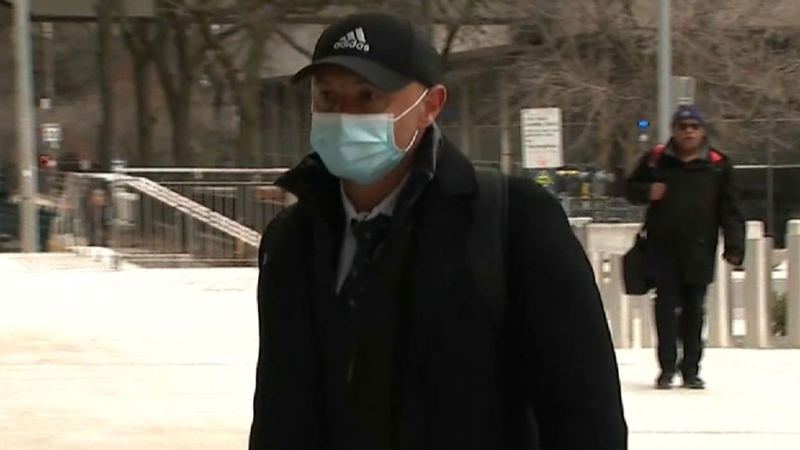

An Ontario man said he was shocked when his truck was stolen not once but twice, and the second time it was taken he was surprised to discover he was no longer covered for theft.

"I feel horrible. Had I known that the insurance company had canceled the comprehensive coverage I would have gone to another company," said Roger Sodhi of Toronto.

- Download our app to get local alerts on your device

- Get the latest local updates right to your inbox

Sodhi said when his 2021 Ram 1500 truck was stolen in February of 2022 police found the pick-up badly damaged in Montreal and his insurance company agreed to tow it back and repair the damages that happened during the theft.

Then, the same truck was stolen again in September.

"It got stolen again a second time. I guess they really wanted it bad, it must be in high demand these Rams” said Sodhi.

The second time Sodhi's truck was stolen his insurance company advised him he was no longer covered for theft as collision and comprehensive coverage had been dropped when his policy renewed in April after the truck had been stolen the first time.

Sodhi is with Desjardins Insurance which said it assured him he was informed by letter and on the phone that changes had been made to his policy.

"The insurance company apparently sent a notice to me that they had canceled it (comprehensive coverage) but I never got anything," said Sodhi.

Sodhi said he still has a loan on the truck and owes the bank $54,350.

“It’s painful to be paying for something you don't even have," said Sodhi.

CTV News Toronto reached out to Desjardins Insurance about Sodhi’s case and a spokesperson said, “Due to privacy reasons, we can’t discuss details of an insured’s policy. However, I can confirm that in a registered letter dated April 7, 2022, the client was informed of the decision and reason to remove certain coverages from his policy at renewal. Unfortunately, since the claim for vehicle theft was made months after on September 28, 2022, no coverage was applicable.”

The Insurance Bureau of Canada (IBC) said that insurance companies can modify coverages and make changes to a client’s policy but they must make sure the customer is made aware of the changes.

“Insurance companies have to give written notice to a policy holder when they make these type of changes," said Anne Marie Thomas, Director, Consumer and Industry Relations with IBC.

Thomas said it’s important to always pay close attention to any correspondence received from your insurance company, especially if it comes in the form of a registered letter.

“If a letter comes registered that means the insurance company is wanting to make sure that you get the information and they want proof you have received it," said Thomas.

Sodhi is adamant he didn't know his coverage had changed and is shocked he still owes more than $50,000 for the stolen truck.

You should never ignore any correspondence from your insurance company and always double check your policy at renewal time for changes in case you need to find coverage somewhere else.

CTVNews.ca Top Stories

Pearson gold heist suspect arrested after flying into Toronto from India

Another suspect is in custody in connection with the gold heist at Toronto Pearson International Airport last year, police say.

Justin and Hailey Bieber are expecting their first child together

Hailey and Justin Bieber are going to be parents. The couple announced the news on Thursday on Instagram, both sharing a video that showcases Hailey Bieber's growing belly.

From outer space? Sask. farmers baffled after discovering strange wreckage in field

A family of fifth generation farmers from Ituna, Sask. are trying to find answers after discovering several strange objects lying on their land.

B.C. man used Bobcat as 'weapon' while chasing away homeless people, judge says

A B.C. man has been convicted of assault with a weapon after using a skid-steer Bobcat to chase two homeless people from his lawn, injuring one of them in the process.

Debate on abortion rights erupts on Parliament Hill, Poilievre vows he won't legislate

A Conservative government led by Pierre Poilievre would not legislate on, nor use the notwithstanding clause, on abortion, his office says, as anti-abortion protesters gather on Parliament Hill.

Ontario family receives massive hospital bill as part of LTC law, refuses to pay

A southwestern Ontario woman has received an $8,400 bill from a hospital in Windsor, Ont., after she refused to put her mother in a nursing home she hated -- and she says she has no intention of paying it.

Miss Teen USA steps down just days after Miss USA's resignation

Miss Teen USA resigned Wednesday, sending further shock waves through the pageant community just days after Miss USA said she would relinquish her crown.

'Nobody should be getting away with murder': Grieving mother speaks out after son killed in North Preston, N.S.

A grieving mother is speaking out after her 36-year-old son was shot and killed in North Preston, N.S., Wednesday night.

Toronto-area dessert shop featured by Keith Lee forced to move after zoning complaint

A small Ajax dessert shop that recently received a glowing review from celebrity food critic Keith Lee is being forced to move after a zoning complaint was made following the social media influencer’s visit last month.